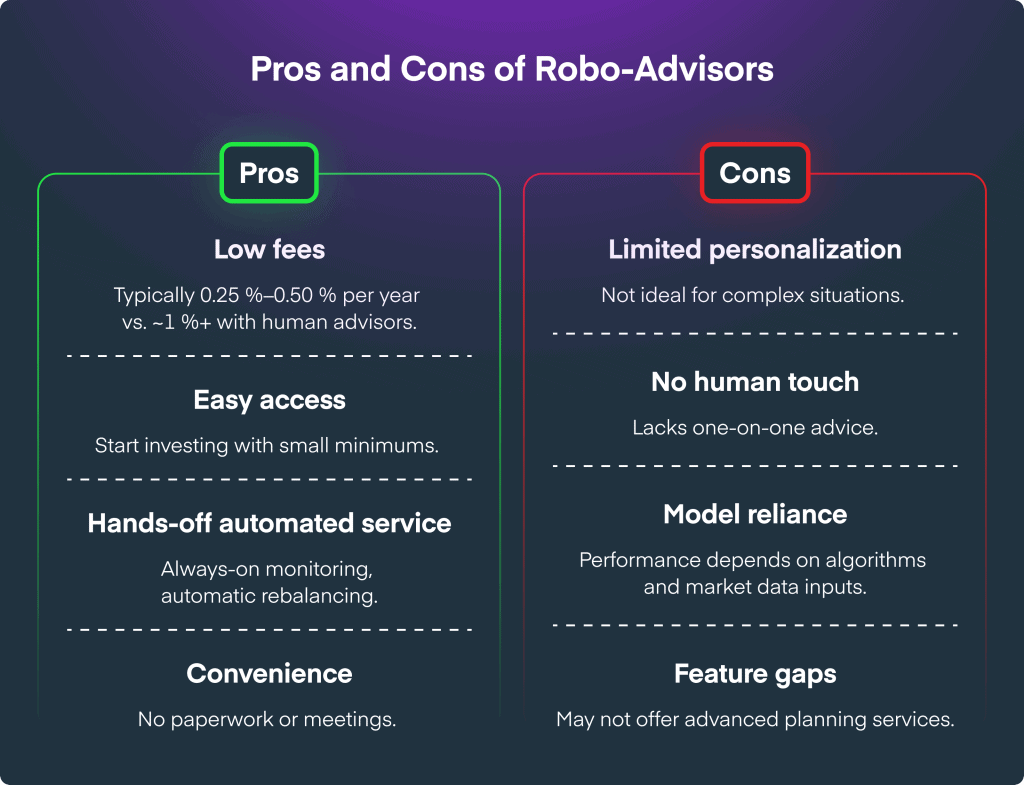

Whispers of wealth, those sneaky digital helpers. Yeah, you heard me—robo-advisors aren’t the magic bullets everyone claims, especially in the wild world of investments. Here’s the kicker: while they promise to simplify your portfolio and boost returns with algorithms smarter than your average fortune cookie, mishandling them can turn your nest egg into a cracked shell. Think about it—over 50% of millennial investors use robo-advisors, per a recent survey, yet many end up chasing losses because they forget the human touch. But stick with me, and you’ll learn how to wield these tools wisely, turning potential pitfalls into steady growth and peace of mind. No fluff, just real talk on navigating investments without the headache.

My Bumpy Ride with Robo-Bots: A Personal Tale

Okay, picture this: a few years back, I was that guy glued to my screen, thinking **robo-advisors** were the answer to effortless investing. Fresh out of a dead-end job, I dumped cash into an automated platform, lured by promises of diversification and low fees. It felt like handing the keys to a self-driving car—easy, right? But oh boy, was I wrong. During a market dip that hit like a plot twist in «The Big Short,» my portfolio took a nosedive because I didn’t tweak the settings for my risk tolerance. And that’s when it hit me—relying solely on algorithms without a second glance is like trusting a GPS in a storm without checking the map yourself.

This anecdote isn’t just venting; it’s a grounded opinion from someone who’s been there. In the U.S., where I hail from, we’ve got this cultural obsession with tech shortcuts, almost like it’s in our DNA—think Silicon Valley vibes. But here’s the lesson: **wise use of robo-advisors** means blending their efficiency with your personal insights. For instance, I started reviewing my investments quarterly, which turned things around. It’s not about ditching the bots; it’s about that human oversight, making sure your strategy aligns with life goals, not just numbers. And remember, as they say across the pond in a British twist, «Don’t put all your eggs in one basket»—adapt that to investments, and you’re golden.

Robo-Advisors Through the Ages: A Quirky Historical Mashup

Ever wonder how **automated investing** stacks up against the old-school ways? Let’s dive into a comparison that’s anything but dry. Back in the 1920s, during the Roaring Twenties, human advisors were the stars, guiding folks through stock market highs with gut feelings and ticker tape. Fast forward to today, and robo-advisors are like the cool, data-crunching sidekicks from «Moneyball»—using stats to outsmart the game. But here’s the unexpected analogy: it’s as if we’re pitting a vintage vinyl record against a streaming service. The old method has charm and intuition, while the new one offers speed and personalization, yet both can skip if not maintained.

In contrast, consider how cultures handle financial advice. In Japan, there’s a tradition of long-term thinking in investments, much like robo-advisors’ set-it-and-forget-it approach, but with a human mentor overseeing. A simple table might help clarify:

| Aspect | Historical Human Advisors | Modern Robo-Advisors |

|---|---|---|

| Personal Touch | High, with tailored conversations | Low, algorithm-driven |

| Cost | Expensive, often 1-2% of assets | Affordable, under 0.5% |

| Risks | Bias from emotions | Over-reliance on data glitches |

This setup shows that **using robo-advisors wisely** isn’t about choosing one over the other; it’s about the hybrid model. Imagine a conversation with a skeptical reader: «Sure, bots are cheap, but what if the market tanks?» I’d say, «Exactly— that’s why you monitor and adjust, blending tech with your own savvy.» It’s this historical evolution that underscores the need for balance, especially in volatile investments like stocks or ETFs.

The Hilarious Hazards of Robo-Mishaps and Smart Fixes

Alright, let’s get real with a dash of irony: picturing your **robo-advisor** as a well-meaning robot from «Wall-E,» scooping up investments without a clue about your coffee addiction or that dream vacation. The problem? Folks dive in thinking it’s a piece of cake, only to face fees eating into returns or mismatched asset allocations that leave them scratching their heads. Like, «Yikes, my portfolio’s more rollercoaster than a Disney ride.» But here’s the twist—we can fix this with a mini experiment for you.

Try this: Grab your investment app and run a simulation for a month, tweaking risk levels based on your actual life—say, if you’re nearing retirement, dial it back. 1. Start by assessing your current holdings. 2. Compare them to your goals. 3. Adjust the robo-settings accordingly. See? It’s that straightforward, yet so often overlooked. By exposing these hiccups with a light-hearted jab, we uncover the truth: **wise use of robo-advisors** demands active participation, turning potential blunders into wins. And just like in pop culture, à la «The Wolf of Wall Street,» it’s not about wild gambles; it’s the calculated moves that pay off.

In wrapping this up, here’s a fresh perspective: what if treating **robo-advisors** as your co-pilot, not the captain, is the real key to investment success? It’s about empowerment, not abdication. So, take action right now—log into your account and double-check those allocations based on today’s insights. And one last question to ponder: If machines can crunch numbers, what uniquely human edge will you bring to your financial future? Share your thoughts in the comments; let’s keep the conversation going. After all, investments aren’t just about money—they’re about your story.