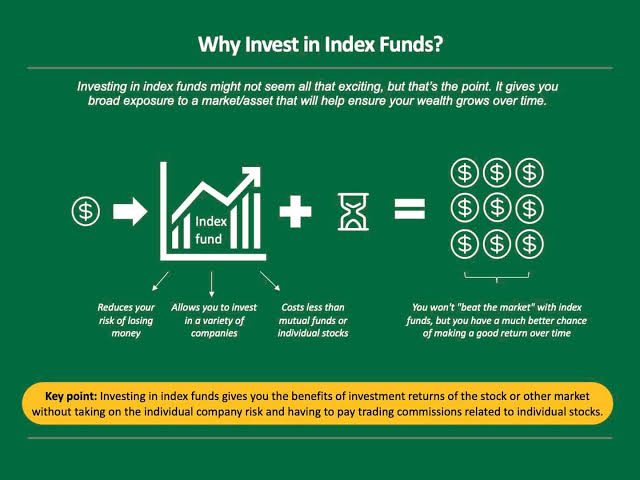

Boring yet brilliant – that’s index funds in a nutshell. You know, while everyone’s chasing the next big crypto moonshot or obsessing over meme stocks, most folks end up losing their shirts. Here’s a shocker: According to a study by Dalbar, the average investor underperforms the market by a whopping 5% annually due to emotional decisions and poor timing. But what if I told you that index funds could be your ticket to steady growth without the stomach-churning stress? In this chat, we’re diving into why using index funds effectively isn’t just smart – it’s like having a reliable old friend who’s always got your back in the wild world of investments. Stick around, and you’ll walk away with practical tips to build wealth effortlessly.

My First Tango with the Stock Market – And the Lesson That Stuck

Picture this: Back in my early twenties, I thought I was the next Warren Buffett. I’d pore over stock charts, convinced I could pick winners like picking apples at a farm stand. One day, I dumped a chunk of my savings into a hot tech stock, all based on a tip from a buddy. Spoiler alert: It tanked harder than a lead balloon. And that’s when it hit me – I’m no stock-picking genius. Fast forward to when I discovered index funds; it was like switching from a bumpy rollercoaster to a smooth cruise. My personal anecdote? After shifting to a simple S&P 500 index fund, my portfolio grew steadily over five years, beating my previous attempts hands down.

This isn’t just my story; it’s a common thread in effective investing. Index funds track a broad market index, like the S&P 500, which means you’re owning a slice of hundreds of companies without the hassle of choosing each one. It’s human nature to think we can outsmart the market, but as I learned the hard way, that hubris often leads to costly mistakes. In my opinion, based on years of watching friends chase trends, index funds offer a grounded approach – they’re not flashy, but they deliver. Think of it as planting a diverse garden instead of betting on a single exotic flower; one frost won’t wipe you out.

Index Funds vs. Active Trading: A Hollywood Blockbuster Face-Off

Ever watched The Wolf of Wall Street and thought, «That could be me»? Yeah, me too, until reality set in. It’s like comparing a blockbuster action flick to a reliable documentary – one’s all glitz and drama, the other tells the truth without the explosions. Historically, active fund managers, who try to beat the market, often fall short. Data from S&P Dow Jones Indices shows that over 15 years, about 88% of large-cap funds underperformed their benchmarks. On the flip side, index funds quietly shine with their low fees and diversification, much like how Netflix originals keep delivering without the big-budget hype.

Let’s get cultural for a sec – in the U.S., we love our underdog stories, right? But in investing, the underdog is often the steady index fund, not the flashy stock picker. A piece of cake comparison: Active trading is like trying to hit the jackpot in Vegas, full of excitement but slim odds, whereas index funds are more like a steady 9-to-5 job that pays the bills over time. The truth is, for the average Joe, passive investing through index funds reduces risk and maximizes returns in the long run. Don’t believe me? Imagine a conversation with a skeptical reader: «But what about that one stock that went to the moon?» I’d say, «Sure, but for every moonshot, there are a dozen crashes – index funds keep you diversified and sane.»

A Quick Reality Check on Fees

One often overlooked perk: Fees can eat your lunch. A table to break it down simply:

| Aspect | Index Funds | Active Funds |

|---|---|---|

| Average Expense Ratio | 0.2% or less | 0.5% to 1% or more |

| Tax Efficiency | High (less trading) | Lower (more frequent buys/sells) |

| Long-Term Performance | Matches market averages | Often lags behind |

See? It’s not rocket science; lower costs mean more in your pocket over time.

The Illusion of Control – And How Index Funds Save the Day with a Chuckle

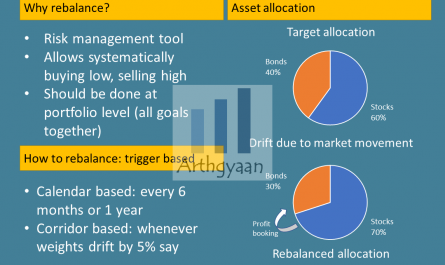

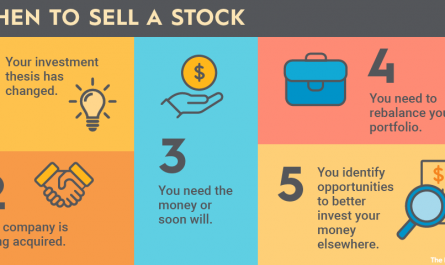

Here’s a problem that’ll make you smirk: So many investors think they need to «beat the market» to succeed, like it’s a personal challenge. But chasing hot stocks is about as reliable as predicting weather with a magic eight ball. Irony alert – in a world obsessed with control, index funds let you relax and let the market do the work. For instance, during market dips, I’ve seen folks panic-sell, only to miss the rebound. My solution? Embrace the «set it and forget it» mentality of long-term index fund investing. It’s like owning a slow-cooker instead of a fancy gourmet kitchen; you get great results without the constant fuss.

To make this real, try a mini experiment: Grab your investment statement and compare your returns to a broad index like the Dow Jones over the past year. Surprised? Most are. And just like that meme of the dog in a burning room saying «This is fine,» ignoring the chaos can actually work in your favor with index funds. They promote diversification in investments automatically, spreading your bets across sectors without you lifting a finger. In my book, that’s not lazy – it’s smart, especially when life’s already hectic.

Wrapping this up with a twist: Turns out, the so-called «boring» path of index funds might just be the exciting one for your wallet in the long haul. So, why not take action right now? Open a brokerage account and plunk some cash into a low-cost index fund – it’s easier than ordering pizza online. And here’s a thought to chew on: If index funds can build wealth steadily, what hidden gems in your financial life are you overlooking? Drop a comment and let’s discuss; I’m all ears. Y’know, because in investments, sharing stories beats going it alone.