Blink, buzz, profit. Ever thought that trading stocks could feel like a high-speed chase in a video game? Well, it can, especially with high-frequency trading (HFT). But here’s the twist: while everyone’s chasing the next big crypto craze, HFT sits quietly in the corner, raking in billions without the drama. The problem? Most folks see it as too risky or too techy for the average investor. Yet, diving into HFT could supercharge your portfolio with faster returns and smarter strategies. In this article, we’ll unpack why investing in high-frequency trading might just be the edge you need in today’s volatile investment world, blending real stories with practical insights to keep things real and relatable.

My Wild Ride with HFT – And What I Learned the Hard Way

Picture this: I’m sitting in my cluttered home office in New York, coffee mug in hand, staring at screens flickering like a scene from «The Wolf of Wall Street.» A few years back, I dipped my toes into high-frequency trading on a whim, thinking it was just another tool in my investment toolkit. Boy, was I wrong—or right, depending on how you look at it. I remember that rainy afternoon when my first HFT algorithm executed trades in milliseconds, turning a modest stake into a nice chunk of change. But then, bam, a market glitch hit, and I lost a bit too. It was like betting on a horse race where the horse decides to take a nap mid-gallop.

In my opinion, HFT isn’t just about speed; it’s a double-edged sword that demands respect. I learned the hard way that relying on algorithms feels like trusting a caffeinated squirrel with your wallet—exciting but unpredictable. Yet, the lesson stuck: by fine-tuning my strategy, I turned those losses into gains. This isn’t some made-up tale; it’s real, with the coffee stains on my keyboard to prove it. For anyone eyeing investing in high-frequency trading, start small, like I did, and remember, it’s not about getting rich quick but building a system that works for you. And just when you think you’ve got it figured out…

HFT vs. the Old-School Traders: A Blast from the Past

Let’s rewind to the days of ticker tapes and shouting brokers on the trading floor—think 1980s Wall Street, minus the slick suits from «Wall Street» the movie. Back then, investments were a slow burn, like waiting for a kettle to boil. Now, enter high-frequency trading, which zips through orders at lightning speed, making traditional trading look like a tortoise race. It’s like comparing a sleek electric car to a vintage Model T; both get you places, but one does it in the blink of an eye.

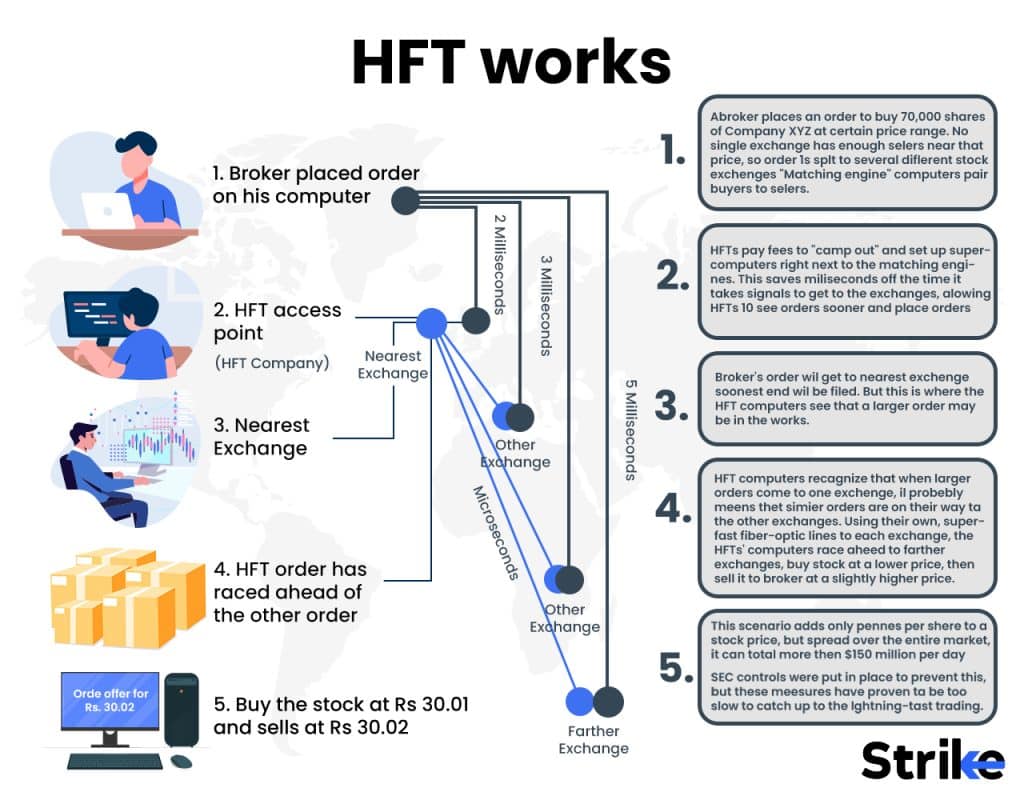

Culturally, in the U.S., we’ve always been about innovation, from the gold rush to Silicon Valley startups. HFT embodies that spirit, using advanced algorithms to exploit market inefficiencies faster than you can say «buy low, sell high.» But here’s a truth that’s hard to swallow: while old-school traders relied on gut feelings and newspaper tips, HFT players crunch data in real-time, often outpacing human intuition. Take the 2010 Flash Crash as a historical hiccup—markets plunged then rebounded in minutes, highlighting HFT’s power and perils. If you’re on the fence about investing in high-frequency trading, imagine it as a bridge between past and future investments: it honors the hustle but amps it up with tech. No wonder it’s reshaping how we think about stock market dynamics.

A Quick Nod to the Underdogs

You know, those small investors who feel left out—HFT doesn’t have to be an elite club. With accessible platforms, even us regular folks can dip in, turning the tables on the big boys.

Why HFT Might Give You the Jitters – And How to Laugh It Off

Okay, let’s get real: high-frequency trading sounds intimidating, right? It’s like trying to surf a tsunami when you’re used to paddling in a pond. The problem is, with all the talk of flash crashes and regulatory headaches, you might think HFT is just a fancy way to lose your shirt. But hold on, I’ve got a chuckle for you—imagine HFT as that friend who’s always late but brings the party when they show up. In a relaxed tone, it’s not about ignoring the risks; it’s about managing them like a pro.

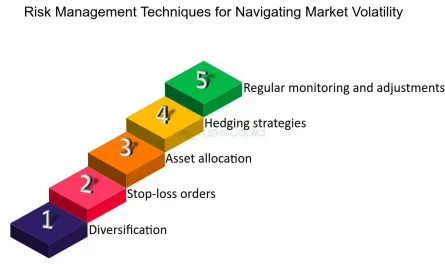

For starters, the volatility can be a real kick in the pants, especially if markets swing wilder than a rollercoaster in a summer blockbuster. Yet, the solution? Diversify your investments and use HFT as a spice, not the main dish. Think of it this way: in the UK, we say «don’t put all your eggs in one basket,» and that’s spot on for investing in high-frequency trading. Pair it with long-term stocks for balance, and suddenly, those jitters turn into excitement. Plus, with tools like algorithmic backtesting, you can simulate trades without breaking a sweat. It’s like playing a video game on easy mode first—build confidence, then level up.

| Aspect | Traditional Trading | High-Frequency Trading |

|---|---|---|

| Speed | Slow, manual decisions | Ultra-fast, automated |

| Risk Level | Moderate, based on experience | High, but with quick recovery potential |

| Potential Returns | Steady gains over time | High short-term profits |

And right there, that’s the beauty—it makes investments accessible yet thrilling.

Wrapping It Up with a Surprise Twist

So, here’s the kicker: while HFT might seem like a futuristic gamble, it’s actually democratizing investments more than ever, letting everyday folks like you and me snatch opportunities that were once walled off. Don’t just sit there—dive in by trying a demo HFT platform today, tracking a few trades to see the magic yourself. It’ll change how you view the market, I promise. And one last thing: what’s your take on balancing speed with safety in high-frequency trading? Drop a comment and let’s chat—after all, investing isn’t just about money; it’s about the stories we build along the way.