Whispers of wealth, they say, but let’s face it—most of us end up chasing shadows. Here’s a shocker: the average investor loses about 2-3% annually just from bad advice, according to a study by Dalbar Inc. That’s like flushing money down the drain while the market climbs. But what if you could sidestep that pitfall and actually build a nest egg that grows? In this laid-back chat, we’ll dive into where to seek reliable investment advice, helping you make smarter choices without the stress. Stick around, and you’ll walk away with practical tips to protect your hard-earned cash from hype and hype alone.

My Wild Ride with Bad Advice and What It Taught Me

Picture this: back in 2018, I was glued to my screen, mesmerized by some flashy online guru promising the next big crypto moonshot. «Easy money,» they said, and being the optimistic fool I am, I jumped in with both feet. Yikes, what a mess. Lost a chunk of savings faster than you can say «Bitcoin bubble.» And that’s when it hit me, you know? Not all shiny advice is gold. In my opinion, relying on social media influencers for investment strategies is like trusting a weather app during a hurricane—it might look good, but it’s often way off.

Fast-forward to today, and I’ve clawed my way back by turning to more trustworthy sources. Think certified financial advisors or reputable platforms. It’s like swapping that unreliable friend for a steady mentor. Here’s a quirky metaphor: investing without solid advice is like trying to bake a cake without a recipe—sure, you might get something edible, but it’s probably gonna flop. To weave in a bit of local flavor, as an American, I often hear folks say «don’t put all your eggs in one basket,» which rings true for diversifying based on expert input. What really sealed the deal for me was chatting with a planner who broke down risks with real data, not just hype.

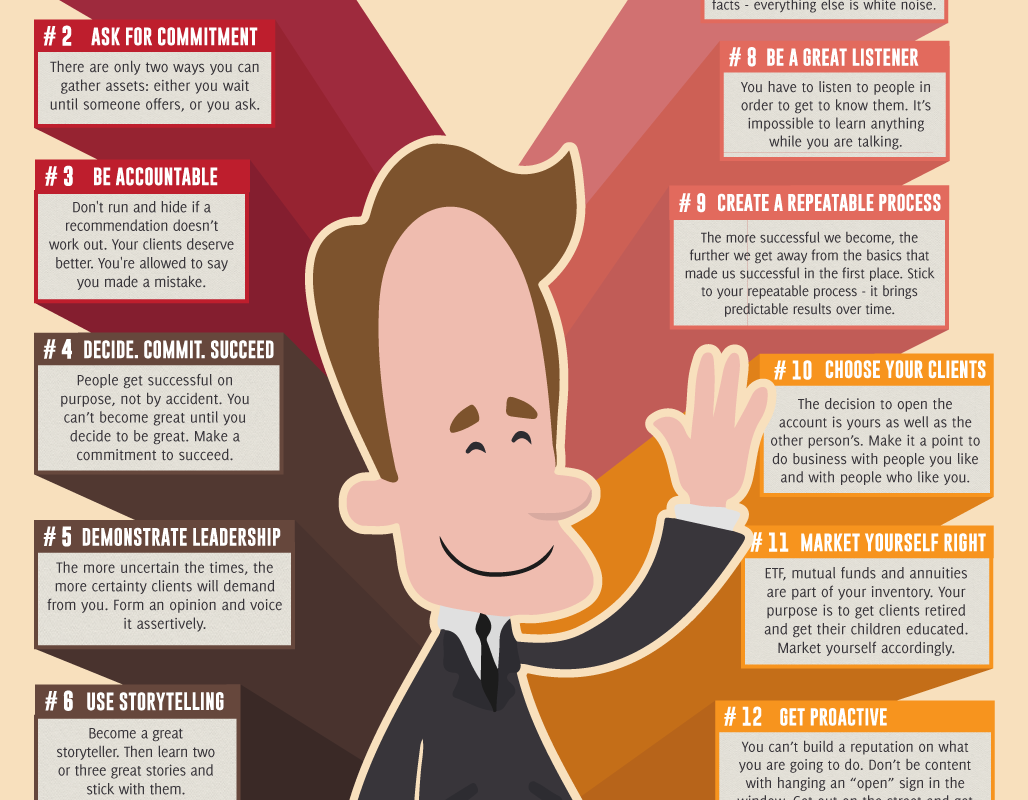

Unearthing Timeless Wisdom from Wall Street Legends

Ever wonder how figures like Warren Buffett built empires? It’s not just luck; it’s leaning on reliable investment advice from proven sources. Compare that to ancient traders on the Silk Road, who relied on trusted merchants for tips on valuable goods—much like how modern investors use established financial institutions. But here’s a truth that’s uncomfortable: many chase get-rich-quick schemes, thinking it’s the path to hitting the jackpot, when history shows steady, vetted advice wins the race.

Take Buffett himself; his folksy wisdom, like «be fearful when others are greedy,» echoes through books and interviews. I once tried a mini experiment: I read his annual letters for a week and applied one tip to my portfolio. Lo and behold, it steadied my nerves during a market dip. That’s the power of drawing from cultural icons. And to keep it relaxed, imagine a conversation with a skeptical reader: «Yeah, but who has time for all that reading?» I’d say, «Start small, buddy—pick one book, like ‘The Intelligent Investor,’ and see how it shifts your perspective.» This isn’t about overwhelming you; it’s about building a foundation, British-style, where a cup of tea and a solid plan go hand in hand. Oh, and if you’re into culture pop, think of it like the steady rise of Tony Stark in the MCU—he didn’t wing it; he had tech and smarts backing him up.

Spotting the Real Deals Without Getting Burned

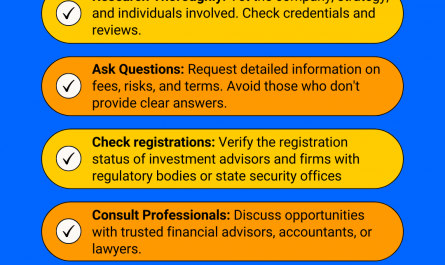

Alright, let’s get real—scams are everywhere, lurking like sharks in the investment waters. But here’s the ironic twist: while everyone warns about Ponzi schemes, many still fall for them because, well, they sound too good to pass up. In a world where «meme stocks» go viral, distinguishing trustworthy financial guidance from junk is crucial. For instance, I remember eyeing a «hot tip» app that promised daily wins, only to realize it was peddling outdated info. The solution? Stick to regulated sources like FINRA-approved advisors or platforms from Vanguard or Fidelity.

To make this practical, let’s break it down with a simple table comparing two common advice sources:

| Source | Pros | Cons |

|---|---|---|

| Certified Financial Advisor | Personalized plans, backed by credentials | Can be pricey, requires meetings |

| Reputable Online Platforms (e.g., Morningstar) | Free resources, data-driven insights, accessible 24/7 | Overwhelming for beginners, no one-on-one chat |

See? It’s about weighing options. And just for fun, if you’re skeptical, try this exercise: Pick one source, review their credentials, and test a small investment idea. You’ll feel more empowered, I promise. Don’t forget that old modism, «keep your powder dry,» meaning save your resources for the right moment. Y’know, it’s not always about the big splash; sometimes, it’s the quiet, steady advice that pays off in the long run.

As we wrap this up, here’s a perspective twist: what if the best investment advice isn’t out there, but inside you, honed by reliable sources? So, take action—sign up for a free consultation with a certified advisor today. And ponder this: If you’re ignoring solid guidance now, what stories will you tell about your portfolio tomorrow? Drop a comment below; I’d love to hear where you’ve found your own golden nuggets. After all, we’re all in this money maze together.