Money whispers secrets – wait, that sounds more poetic than it should, but hear me out. While everyone’s chasing the latest get-rich-quick scheme, the cold hard truth is that most folks are fumbling in the dark when it comes to basic investing. Did you know that a whopping 78% of millennials feel unprepared for retirement savings, according to a recent survey? That’s a truth that’ll keep you up at night. But here’s the flip side: arming yourself with the right knowledge can turn that anxiety into excitement, building a nest egg that’s as reliable as your favorite coffee spot. In this laid-back chat, we’ll explore where to dive into basic investing, sharing real spots that won’t bore you to tears, and maybe even spark that «aha» moment for your wallet.

My First Investing Blunder – And What It Taught Me the Hard Way

Okay, picture this: back in my early twenties, I thought I was a stock market wizard after binge-watching «The Wolf of Wall Street.» Yeah, bad idea. I plunked down a few hundred bucks into some trendy tech stock without a clue about diversification – you know, that golden rule where you don’t put all your eggs in one basket. Spoiler: the stock tanked faster than a bad meme goes viral. Lost about 20% of my investment overnight. Yikes. But here’s the silver lining – that screw-up pushed me to seek out proper education. I stumbled upon online platforms like Khan Academy, which broke down investing basics into bite-sized videos. It’s like having a patient friend explain why basic investing isn’t just about picking winners, but understanding risk and returns. My opinion? If you’re starting out, these free resources feel like a warm hug for your finances, especially when you’re drowning in student loans. And just like that detour taught me, skipping the learning curve can cost you big time.

Investing Wisdom from Pharaohs to Your Couch

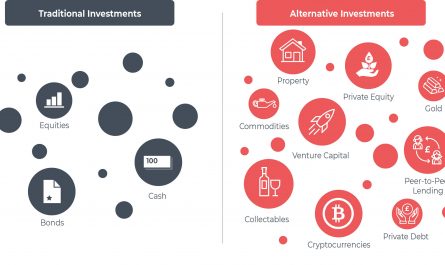

Ever think about how ancient Egyptians were basically the OG investors? They hoarded grain and gold, building wealth that outlasted pyramids – talk about long-term planning! Fast forward to today, and it’s not so different; investing is still about securing your future amidst chaos. In the U.S., we have this cultural obsession with the stock market, kind of like how Hollywood glamorizes it in films. But here’s an unexpected analogy: investing is like tending a garden, not a slot machine. You plant seeds (your money) in fertile soil (diverse assets), and with a little rain (market ups and downs), you reap what you sow. A common myth is that you need a fat wallet to start, but that’s baloney – apps like Robinhood let you dip your toes with as little as $1. Comparing that to historical figures, like how the Medici family in Renaissance Italy funded art and commerce through smart investments, shows that investment education has always been key to empires, big or small. In my book, it’s less about timing the market and more about time in the market, a lesson that hits home harder than a plot twist in «Game of Thrones.»

Why Your Bank Account’s Playing Hide and Seek – And the Easy Fixes

Alright, let’s get real for a sec: if your savings are just sitting there like a wallflower at a party, not earning a dime, that’s irony at its finest. I mean, who knew that inflation is basically that uninvited guest eating away at your cash? But instead of panicking, let’s chuckle about it – after all, in a world obsessed with viral challenges, why not challenge yourself to beat the market? The problem? Too many people skip where to learn about basic investing because it sounds as thrilling as watching paint dry. My subjective take: it’s actually a piece of cake once you find the right spots. For instance, websites like Investopedia offer glossaries and articles that demystify terms like ETFs and mutual funds without the jargon overload. Or, try a conversation with your skeptical self: «Wait, you’re saying I should read a book? Nah, too much effort.» Well, buddy, that’s where audiobooks from Audible come in – listen to «The Intelligent Investor» on your commute. As a fix, I’d recommend starting with a mini experiment: pick one platform, say Coursera’s free investing courses, and commit to one lesson a day. It’s that simple, and before you know it, you’ll be spotting opportunities like a pro. Oh, and don’t forget, Y justo ahí fue cuando… your finances start thanking you.

| Platform | Best For | Pros | Cons |

|---|---|---|---|

| Khan Academy | Beginners | Free, video-based, easy to follow | Limited advanced topics |

| Investopedia | Quick learners | Detailed articles, tools, and quizzes | Can be overwhelming at first |

| Coursera | Structured courses | Certifications, university-backed | Some courses require payment |

A Twist That’ll Make You Rethink Your Couch Cushions

Here’s the kicker: investing isn’t just about stacking cash; it’s about crafting a life where money works for you, freeing up time for what really matters, like that spontaneous road trip. So, don’t just sit there – take action by exploring one of these resources today, like firing up Khan Academy’s investing module right this minute. And here’s a question to chew on: what’s the one investment in yourself that could change your financial story forever? Drop your thoughts in the comments; I’m all ears.