Green goldmines await – wait, did I just say that? Yeah, because while everyone’s chasing the next tech fad, renewable energy is quietly becoming the planet’s piggy bank. Here’s the kicker: fossil fuels have dominated for centuries, but they’re like that friend who’s fun at parties but leaves you with a hangover. Investments in renewables, on the other hand, offer steady growth and a guilt-free conscience. If you’re tired of volatile stocks and want to park your money where it can actually help save the world, stick around. We’ll dive into where to invest in renewable energy, uncovering spots that could turn your cash into a force for good, all while potentially boosting your portfolio. Trust me, it’s not just about being eco-friendly; it’s about smart, sustainable investments that beat inflation.

My Blunder with Solar Panels and the Lesson That Stuck

Okay, picture this: a few years back, I was just your average desk jockey, eyeing the stock market like it was a slot machine. Then, out of nowhere, I stumbled into renewable energy investments. It was during a family road trip to the windy plains of Texas – you know, where those massive wind turbines look like giants from a sci-fi flick. I thought, «Why not throw a few bucks at solar stocks?» Big mistake at first; I picked a company that flopped because I didn’t do my homework. But, man, that failure taught me a ton. Investing in renewable energy, especially solar, isn’t just about the hype; it’s about understanding the tech’s staying power.

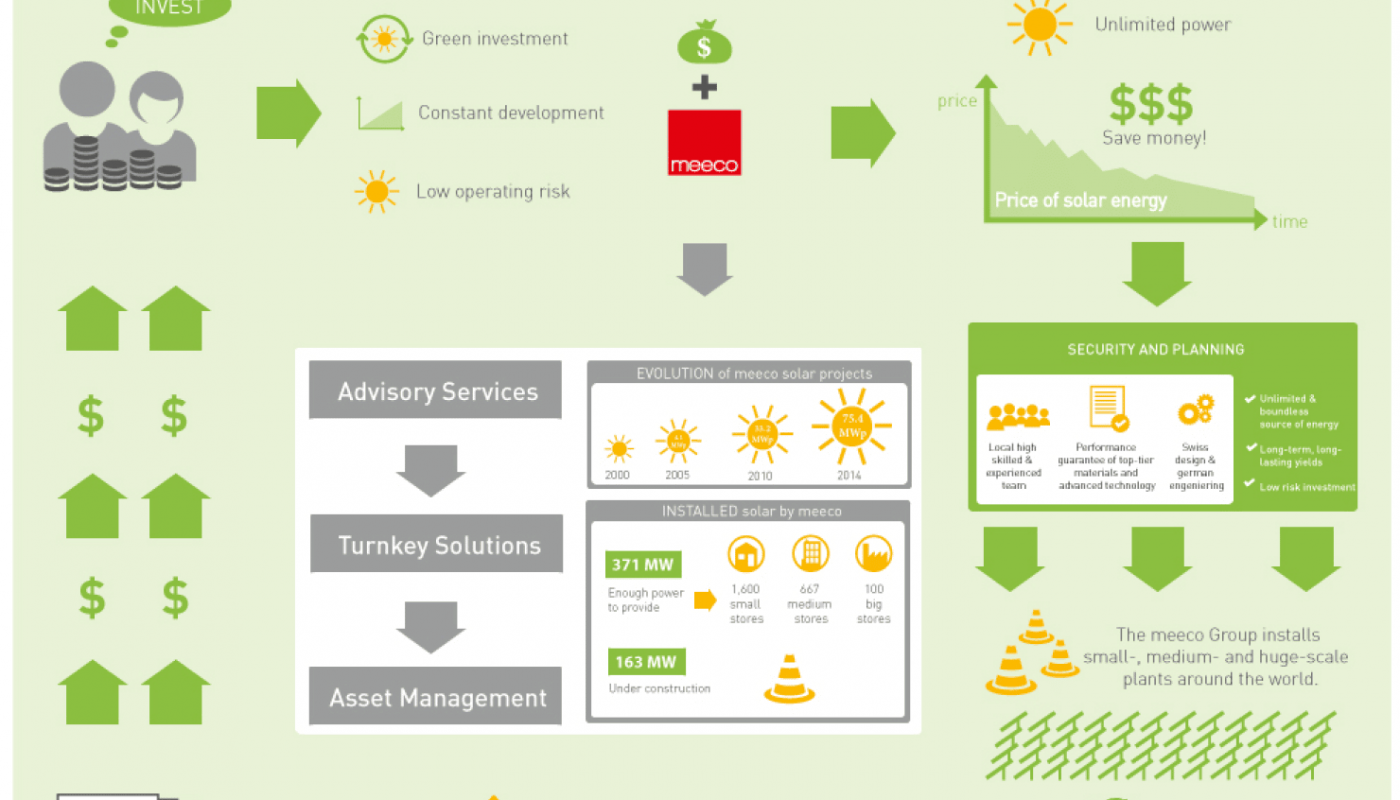

Fast forward, and I’ve seen my initial loss turn into a win. Take my anecdote: I diversified into a solar fund, and it’s been growing steadily. Opinions vary, but I reckon solar is underrated – it’s like the underdog in a Marvel movie, quietly saving the day. In the U.S., with incentives like tax credits, it’s almost a piece of cake to get started. And here’s a quirky metaphor: investing in renewables is like planting an orchard in your backyard; it takes time, but soon you’re harvesting apples – or in this case, profits. The lesson? Don’t rush; research best places for renewable energy investments, and you’ll avoid my early pitfalls. Y’know, that moment when you realize, «Wait, I could’ve done better.»

From Ancient Windmills to Modern Green Bonds: A Cultural Shift

Ever think about how wind energy isn’t exactly new? Back in the Netherlands, those iconic windmills weren’t just for show; they powered communities for centuries. Fast-forward to today, and we’re talking about renewable energy investments in wind farms off the coasts of Europe or the U.S. It’s a cultural evolution – from practical tools to lucrative assets. In places like Denmark, wind power is woven into the fabric of society, almost like a national pride thing, whereas in the States, it’s more about the almighty dollar.

But let’s get real: comparing this to historical booms, like the gold rush, feels spot on. Back then, folks flocked to California for shiny rocks; now, savvy investors are heading to emerging markets for sustainable investments. Take China, for instance – they’re dominating solar manufacturing, making it a no-brainer for global funds. It’s ironic, right? The country with coal plants is leading the green charge. This cultural mash-up shows how where to invest in renewable energy isn’t just geography; it’s about global trends. And just like in that episode of «The Office» where Michael Scott tries to go green, it’s messy but rewarding. If you’re skeptical, imagine chatting with a doubter: «Sure, renewables are trendy, but will they pay off?» My answer: absolutely, especially in regions with strong policies, like the EU’s Green Deal.

| Factor | Solar Energy | Wind Energy |

|---|---|---|

| Initial Cost | High upfront, but drops with tech advances | Moderate, depends on location |

| Return Potential | Strong in sunny areas like California | High in windy spots like Texas |

| Advantages | Scalable for homes; tax incentives | Consistent power; community benefits |

| Disadvantages | Weather-dependent; storage issues | Noisy; impacts wildlife |

The Hilarious Hurdles of Green Investing and How to Leap Over Them

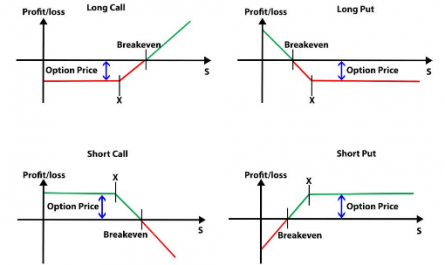

Alright, let’s address the elephant in the room – or should I say, the solar panel on the roof? Many folks shy away from investments in renewable energy because it sounds complicated, like trying to assemble IKEA furniture blindfolded. But here’s the truth: the biggest barrier is misinformation. I mean, who hasn’t heard that renewables are too volatile? That’s a myth, my friend. In reality, funds like those tracking clean energy indices have outperformed traditional ones in recent years. And just there, when you think it’s all risk…

…it turns into opportunity. For a mini experiment, try this: pull up a chart of a green ETF versus a fossil fuel stock over the last five years. You’ll see sustainable investments holding steady while oil dips and dives. To fix the common woes, start small – maybe with a green bond from a stable market like Germany’s. It’s like upgrading from a flip phone to a smartphone; once you’re in, it’s hard to go back. With a relaxed tone, I’ll throw in that investing here is a no-brainer for long-term gains, especially in countries pushing for net-zero. Oh, and if you’re into memes, think of it as your portfolio joining the «Avengers: Endgame» – assembling the heroes to fight climate change.

In wrapping this up, here’s the twist: what if I told you that investing in renewables isn’t just about money; it’s about legacy? You’re not merely buying stocks; you’re betting on a cleaner future. So, take action now: research and invest in a renewable fund today – start with one from a leader like the U.S. or EU. And ponder this: if renewables keep growing, what role will your investments play in shaping tomorrow’s world? Leave a comment; I’d love to hear your thoughts.