Hidden gems await. Wait, hear me out—while everyone’s chasing the next big thing, most folks overlook that the stock market’s volatility has made millionaires and paupers alike. Picture this: in 2023, over 60% of potential investors sat on the sidelines, missing out on gains that could have funded their dream vacations. But here’s the rub—finding **top investment opportunities** isn’t about luck; it’s about smart, strategic digging that could pad your wallet without turning you into a stressed-out suit. In this chat, I’ll spill the beans on where to spot those lucrative spots, drawing from my own bumpy rides and a dash of history, all while keeping it real and relaxed. Stick around, and you might just uncover ways to grow your cash flow effortlessly.

My Accidental Fortune: A Tale of Unexpected Investments

Okay, let’s kick things off with a story that’s as true as my coffee addiction. Back in 2015, I was just a regular guy in New York, scrolling through apps late at night—think, «endless doom-scrolling like on TikTok.» I stumbled upon an article about emerging tech stocks, and honestly, I thought, «What’s the harm in throwing a few bucks at this?» Fast forward, and that whim turned into a modest nest egg. See, I invested in a little-known renewable energy firm, not because I was a green guru, but because it reminded me of that scene in «The Big Short» where they bet against the housing bubble. Irony hit hard when that company skyrocketed, teaching me that **where to find top investment opportunities** often hides in plain sight, like that forgotten $20 in your jeans pocket.

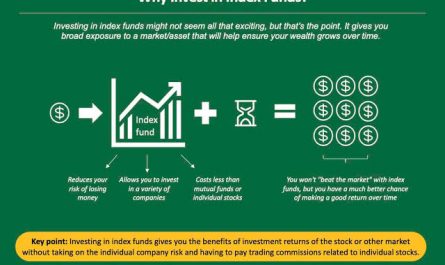

But here’s my subjective take: the stock market isn’t some mystical beast; it’s more like a neighborhood barbecue—everyone’s got a story, and the good picks are the ones that sizzle without burning your fingers. I mean, incorporating a bit of personal research, like checking out dividend yields or growth potential, can turn a gamble into a solid plan. And just to add a local flavor, as a New Yorker, I’ve seen how Wall Street’s hustle mirrors the city’s vibe—fast-paced and unforgiving, but with rewards if you’re patient. Metaphorically speaking, investing is like fishing in a pond full of big fish; you need the right bait, which for me was diving into ETFs for diversification. Y’know, that accidental win made me realize, sometimes the best opportunities aren’t flashy; they’re the steady growers that pay off when you least expect it.

From Tulip Mania to Tech Boom: Lessons from the Past

Ever heard of Tulip Mania? Back in 17th-century Netherlands, people went bonkers over tulip bulbs, driving prices sky-high before it all crashed—talk about a historical facepalm. Fast-forward to today, and we’re seeing echoes in the crypto craze or AI stocks. This comparison isn’t just trivia; it’s a wake-up call that **top investment opportunities** often stem from understanding cycles, like how the dot-com bubble burst but paved the way for today’s tech giants. I remember chatting with a skeptical friend over coffee: «You really think putting money in electric vehicles is smart?» I’d counter, «Well, if Tulip Mania taught us anything, it’s that hype fades, but innovation sticks.»

Let’s get real—culturally, in the U.S., we idolize rags-to-riches tales, from Elon Musk’s Tesla bets to everyday folks hitting paydirt with index funds. But the truth is uncomfortable: many chase memes like GameStop shorts without grasping the fundamentals. Instead, look at real estate as a parallel; it’s like comparing a historic Dutch canal house to a modern Silicon Valley startup—both can appreciate, but you need to know the market. And here’s an unexpected analogy: investing wisely is like binge-watching a series on Netflix; skip the filler episodes (trendy fads) and focus on the plot arcs (blue-chip stocks) that lead to a satisfying end. By weaving in historical insights, you can spot **high-return investment opportunities** that aren’t just flashes in the pan.

Why Your Wallet’s Yawning and How to Wake It Up

Alright, let’s address the elephant in the room—your wallet’s probably as bored as I am on a rainy Sunday, thanks to overlooking prime spots for growth. Irony alert: while everyone’s glued to social media tips that scream «Get rich quick!», the real gems are in overlooked areas like peer-to-peer lending or emerging markets. Picture this mini experiment: grab a notebook and jot down your current investments versus potential ones. For instance, I once ignored bonds because they seemed «too safe,» but they balanced my portfolio when stocks dipped. And just there, was when it hit me—you don’t need to be a finance whiz; start with high-yield savings or REITs for that steady income.

To solve this, let’s break it down with a touch of humor: think of bad investments as that friend who always flakes—exciting at first, but unreliable. A better approach? Diversify like a playlist with hits from different genres. For **best places to invest**, consider international funds for global exposure, especially in regions like Asia’s tech hubs. Here’s a simple table to compare options, keeping it straightforward:

| Investment Type | Potential Returns | Risks | Best For |

|---|---|---|---|

| Stocks (e.g., Tech Sector) | High (10-15% annually) | Market volatility | Growth seekers |

| Real Estate | Moderate (6-8%) | Economic downturns | Long-term stability |

| Bonds | Low (3-5%) | Inflation erosion | Risk-averse investors |

This isn’t about reinventing the wheel; it’s about mixing it up to avoid that «all eggs in one basket» blunder. Throw in a modism like «knocking it out of the park» with balanced portfolios, and you’ll see your finances perk up.

Wrapping It Up with a Fresh Spin

Here’s the twist: while we’ve dug into **top investment opportunities**, it’s not just about stacking cash—it’s about crafting a life less ordinary, free from financial tethers. So, take action now: dive into a free online course on investment basics and track one potential opportunity for a week. And think on this: what’s the risk you’re avoiding that could actually be your biggest breakthrough? Share your thoughts in the comments; let’s keep the conversation rolling.