Money whispers secrets. Wait, hear me out—it’s not the cash talking, but the quiet power of early investments that often gets ignored. Picture this: while you’re scrolling through memes or binge-watching your favorite show, your money could be quietly growing into a fortune. Here’s the uncomfortable truth—most folks delay investing until their 30s or 40s, missing out on compound interest that could turn a modest sum into a retirement dream. But by diving in early, you unlock financial freedom, turning small steps into giant leaps. In this article, we’ll explore when to start investing early, bust some myths, and give you practical advice to get ahead, all while keeping things light and real.

My Blunder with Bucks: A Tale from My Own Wallet

Okay, let’s get personal for a second. Back in my early 20s, I was that guy—fresh out of college, living on ramen and dreams, thinking investing was for suits on Wall Street. Then, one random Tuesday, I overheard my uncle chatting about his stock picks over a family barbecue in the Midwest. He casually mentioned how he’d started throwing a few dollars into mutual funds at 22, and now, decades later, it was funding his golf trips. That hit me like a ton of bricks. Me? I was just letting my savings sit idle in a low-interest account, basically watching it collect dust.

Fast forward, and I finally dipped my toes in at 28, which felt late compared to folks who began in their teens or early 20s. The lesson? Early investment benefits are like planting a seed in spring versus waiting for fall—it grows stronger roots when you give it time. I remember thinking, «Why didn’t I do this sooner?» It’s that regret that pushed me to research investment strategies for beginners. My opinion? Don’t wait for a «perfect» moment; it’s a myth. Start small, like I did with a simple index fund, and watch it snowball. And just like in ‘The Wolf of Wall Street’, minus the wild parties, a little knowledge goes a long way—but without the risks.

Time Travelers and Tycoons: What History Teaches Us About Timing

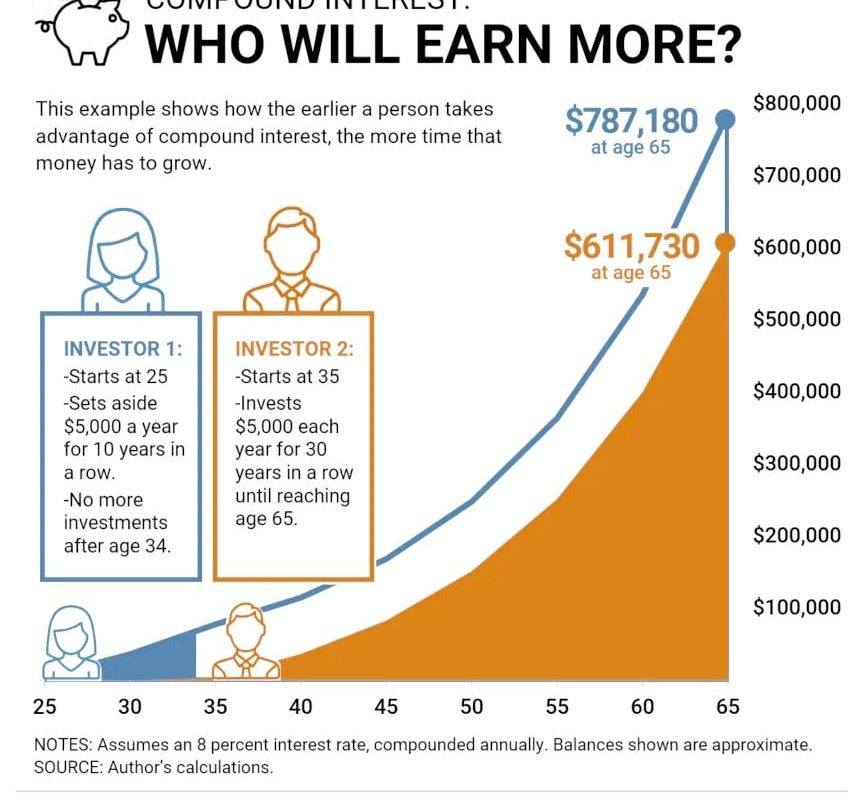

Ever wonder what the greats like Warren Buffett would say about when to start investing early? Let’s rewind to the Roaring Twenties or even the post-war boom, when everyday folks jumped into stocks and built empires. Take Buffett himself—he was buying his first shares at 11, turning pennies into millions through patience and compound growth. It’s a stark contrast to today’s hustle culture, where we often kick the can down the road, thinking we’ll «get to it later.»

In Latin America, for instance, where economic ups and downs are as common as soccer matches, families have passed down investment wisdom for generations. My friend’s grandparents in Mexico started a small business fund in the 80s, weathering inflation by diversifying early. That’s a cultural nugget worth noting—it’s not just about Wall Street; it’s about local resilience. Compare that to the U.S., where 401(k)s are the go-to, but only if you start young. Here’s a quick table to break it down:

| Era/Region | Common Strategy | Key Advantage | Potential Pitfall |

|---|---|---|---|

| Post-WWII U.S. | Stocks and bonds | Long-term growth via stability | Market crashes, like 1987 |

| Modern Latin America | Diversified portfolios | Adapts to volatility | Currency fluctuations |

This comparison shows how early investment timing isn’t new—it’s a timeless hack. But here’s the twist: in our digital age, with apps like Robinhood, it’s easier than ever, yet we’re still hesitant. Why? Fear of the unknown, maybe. My take? Embrace it like a family heirloom; the earlier, the richer the story.

Why Wait? A Lighthearted Look at Excuses and Easy Fixes

Alright, let’s address the elephant in the room—excuses. You know, the ones like, «I’m too broke to invest,» or «The market’s too risky right now.» Ha, I’ve been there, staring at my bank app thinking, «This is a bad idea.» But here’s the truth: starting investments early doesn’t require a fortune; even $50 a month in a high-yield savings account can compound into thousands. It’s like betting on a slow horse that wins the race over time.

Imagine a chat with a skeptical you: «But what if I lose it all?» I’d say, «Hey, that’s valid, but with low-risk options like ETFs, you’re not gambling like in a casino.» The fix? Educate yourself—start with free resources from Khan Academy or Vanguard. Number one, assess your goals: Are you saving for a house or retirement? Two, build an emergency fund first. Three, pick beginner-friendly investments, like index funds that mirror the market. And that’s when it hit me—simplicity wins. In a world obsessed with get-rich-quick schemes, long-term investment planning is the unexpected hero, like that underdog character in a Marvel movie who saves the day.

In conclusion, flipping the script: investing early isn’t just about numbers; it’s about crafting a life less tied to the grind. So, here’s your call to action—grab that phone, download a investing app, and transfer even $10 today. It’ll thank you later. And you, reader, what’s that one fear holding you back from securing your future? Drop a comment; let’s chat about it. After all, money might whisper, but your moves will shout.