Money whispers secrets. Wait, hear me out—it’s not every day you cozy up to your bank account for a heart-to-heart, but when markets swing like a pendulum on steroids, ignoring those whispers can cost you big time. Picture this: 78% of investors stick to their original plans despite major economic shifts, according to a recent study by Vanguard. That’s a truth bomb right there, folks. The problem? Life doesn’t stand still, and neither should your investments. By learning when to adjust investment plans, you’ll dodge unnecessary losses and maybe even ride the wave to better returns. Stick around, and I’ll share some real talk on turning financial turbulence into your secret weapon.

That Time My Coffee Fund Tanked and Taught Me Tough Love

Okay, let’s get personal for a sec. Back in 2018, I had this bright idea to pour my savings into a trendy tech stock, thinking it was the next big thing—like, imagine if Netflix had a baby with Amazon. Spoiler: it wasn’t. I was riding high until the market dipped, and suddenly my «coffee fund» (that’s what I called it, ‘cause I dreamed of fancy lattes from the gains) evaporated faster than cream in hot java. And that’s when it hit me—adjusting isn’t about panic; it’s about listening to the signals.

In my case, I ignored red flags like earnings reports that screamed «slow down!» My opinion? Too many folks treat investments like a set-it-and-forget-it Crock-Pot, but that’s a recipe for burnout. Think of it as surfing: you catch the wave or get wiped out. For SEO buffs, terms like investment adjustment strategies aren’t just buzzwords; they’re lifelines. Here’s a quirky metaphor: adjusting your portfolio is like tweaking a recipe—add a pinch of diversification when the economy’s under the weather, and you’ve got a feast instead of a flop.

Investing Like Ancient Traders Who Rode the Silk Road Waves

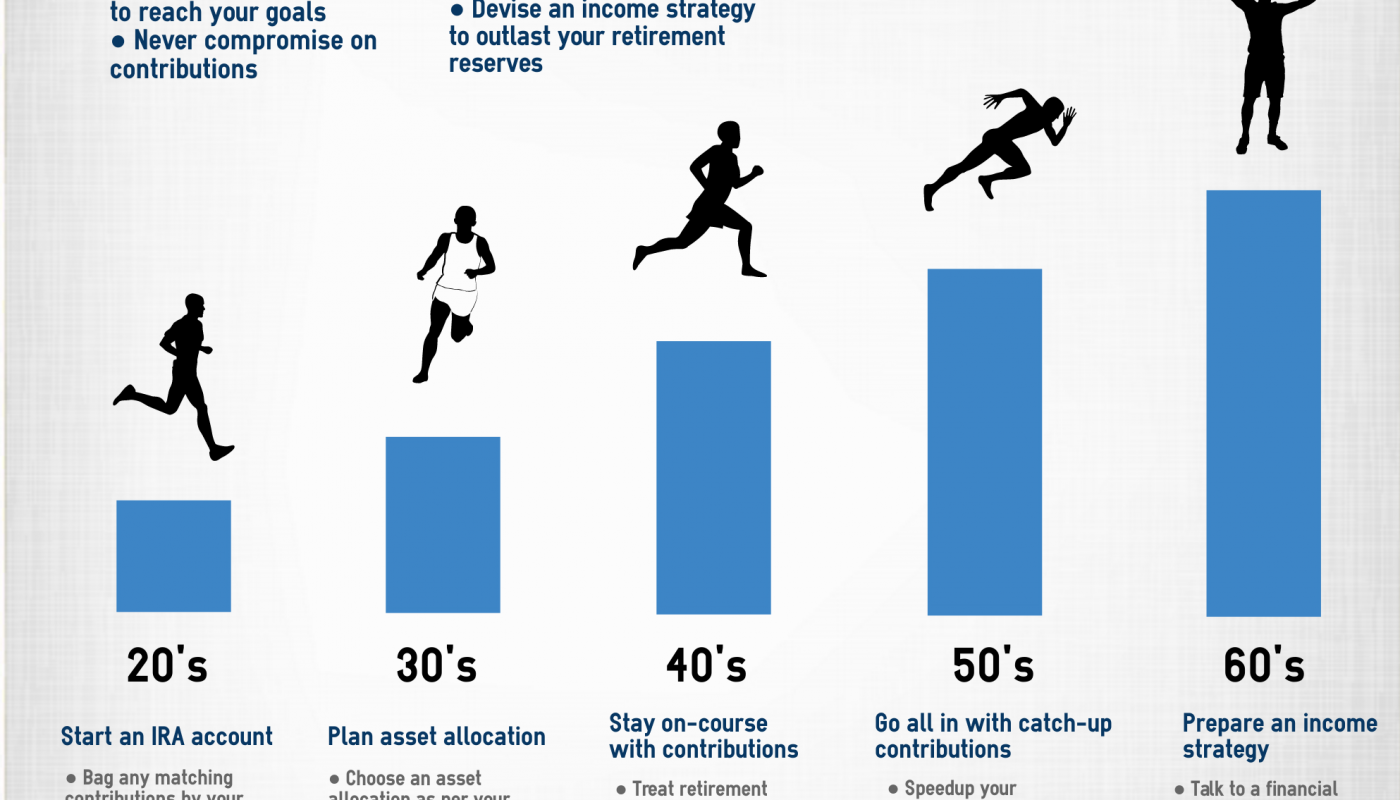

Ever wonder how those old-school merchants on the Silk Road stayed afloat? They didn’t just load up camels and hope for the best; they adjusted routes based on sandstorms, bandits, or that random oasis drying up. Fast-forward to today, and rebalancing your investment portfolio is basically the same vibe—adapting to global events, inflation spikes, or even a pandemic curveball. In the U.S., we often say «don’t put all your eggs in one basket,» a modism that echoes those traders’ wisdom, but with a modern twist: mix in bonds when stocks are volatile, like blending spices for the perfect curry.

Here’s where it gets fun—a cultural comparison. Just as Japanese investors draw from Zen principles for patience, we in the West might channel that with a dash of American hustle. But the truth? Many myths persist, like the idea that frequent tweaks equal more fees. Not true; smart timing for investment changes can minimize costs. Imagine a conversation with a skeptical reader: «You think staying put is safer? Buddy, that’s like ignoring a storm while your ship leaks.» To make it real, try this mini experiment: track your portfolio’s performance against key indicators for a month. You’ll see why phrases like market changes and investments matter more than ever.

When the Market Throws a Tantrum—And How to Laugh It Off

Markets can be real drama queens, throwing fits over elections, interest rate hikes, or even a celebrity tweet gone viral—think of that Elon Musk meme fiasco. The problem? You wake up to red numbers and think, «Great, there goes my vacation fund.» But with a relaxed chuckle, let’s iron this out. First off, recognize signs like a 10% drop in your portfolio or shifting economic forecasts; that’s your cue to adjust investment plans. I remember scoffing at financial advisors until one pointed out how ignoring inflation is like forgetting to water your plants—they wither.

For a clear picture, here’s a simple table comparing two approaches:

| Approach | Advantages | Disadvantages |

|---|---|---|

| Stick to Original Plan | Less stress, fewer transaction fees | Risk of major losses in volatility |

| Regular Adjustments | Better alignment with goals, potential for higher returns | Requires time and market knowledge |

See? It’s not about overreacting; it’s strategic, like hitting the brakes on a slippery road. And just when you think you’ve got it figured, remember that pop culture reference from «The Big Short»—those guys bet against the housing bubble and won big by adjusting early. Y’know, «under the weather» markets call for bold moves, not hiding under the covers.

A Final Twist: Your Investments Are a Mirror, Not a Mirror Ball

Here’s the kicker—what if your investment plan isn’t just numbers on a screen, but a reflection of your life’s twists and turns? Adjusting isn’t admitting defeat; it’s like pruning a bonsai tree, shaping it to thrive. So, take action: review your portfolio right now and swap one underperforming asset for something stable. And hey, have you ever paused to ask yourself: what if your investments could tell your future story—would they align with the plot? Drop a comment below; let’s chat about your aha moments.