Money whispers secrets. Yep, those crumpled bills in your wallet aren’t just paper—they’re gatekeepers to fortunes, especially in the wild world of startup investments. But here’s the kicker: while everyone’s chasing the next unicorn, nine out of ten startups bite the dust, leaving investors high and dry. That’s a truth that’ll make you squirm, right? The problem? Diving in blindfolded can torch your savings faster than a bad Tinder date. Yet, with the right strategies, you could turn a modest stake into a life-changing windfall. Stick around, and I’ll spill the beans on effective ways to invest in startups, blending my real-life blunders with smart, relaxed advice that’ll have you nodding along.

My Wild Ride with a Tech Startup That Taught Me Tough Love

Picture this: back in 2015, I was that starry-eyed investor, pouring cash into a fledgling app promising to revolutionize grocery shopping. It sounded foolproof—think seamless deliveries straight to your door, minus the hassle. But oh boy, was I wrong. I remember the day I signed on the dotted line, my coffee going cold as I daydreamed about early retirement. Fast forward a year, and the thing tanked harder than a superhero in a Marvel flop. Effective startup investment isn’t just about throwing money at shiny ideas; it’s about learning from screw-ups like mine.

What hit me hardest was realizing I hadn’t dug deep enough. I skipped the due diligence—interviews with the founders, market analysis, the works. That oversight cost me, but it hammered home a key lesson: always, and I mean always, vet the team like you’re hiring your own crew. Think about it, in a world where Shark Tank pitches can make or break dreams, you need founders with grit and a plan that’s more than vaporware. My opinion? It’s not just smart; it’s essential, especially if you’re eyeing startup funding strategies that minimize risks. And just like that Netflix binge that keeps you up all night, once you’re hooked, there’s no turning back.

From Gold Rushes to Silicon Valley: How History Mirrors Modern Startup Bets

Ever notice how investing in startups feels like a throwback to the 1849 California Gold Rush? Back then, folks ditched their farms for muddy hills, hoping to strike it rich with a pickaxe and a prayer. Sure, a few hit the jackpot, but most ended up with blisters and regrets. Flash forward to today, and we’re swapping shovels for stock options in tech darlings. It’s a cultural parallel that’s as American as apple pie, highlighting how ways to invest in startups effectively demand patience and smarts.

In the Gold Rush era, savvy miners diversified—trading nuggets for tools or land to hedge their bets. Similarly, in our digital gold rush, spreading your investments across sectors like fintech or green tech isn’t just wise; it’s a game-changer. Take the dot-com boom: companies like Amazon soared, while others fizzled. This historical nod shows that effective investment strategies involve balancing high-risk ventures with stable ones, almost like mixing a cocktail that’s strong but not overwhelming. It’s not a walk in the park, mind you, but when you connect the dots from prospectors to VCs, you see the blueprint for success. And that’s the beauty—history doesn’t repeat, but it rhymes, giving us a edge in navigating startup investment risks.

Why That «Can’t Miss» Startup Might Just Be a Mirage—And How to Spot the Real Deal

Okay, imagine you’re at a barbecue, and your buddy swears by this «revolutionary» startup he heard about on a podcast. You know the type—it’s going to «disrupt everything» faster than a plot twist in a Game of Thrones episode. But hold up, skeptic mode activated: is it really the next big thing, or just hype? Let’s chat this out, you and me, like we’re grabbing beers after work. «Come on,» you’d say, «investing’s easy—pick the hot one and cash in.» Yeah, right. The irony? That approach often leads to a portfolio that’s more leaky boat than luxury yacht.

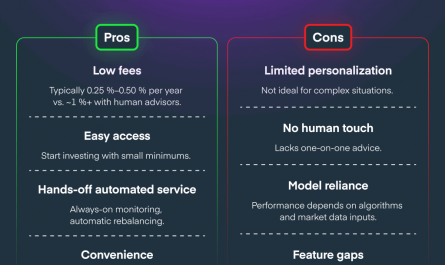

Here’s the fix, and it’s simpler than you think. First off, crunch the numbers: evaluate the startup’s valuation against its revenue projections. If it doesn’t add up, bail out. Second, dive into the market— is there real demand, or are they peddling snake oil? And third, network like your financial future depends on it, because it does. Talk to other investors, join forums, get the inside scoop. It’s like playing detective in a mystery novel, where the clues lead to gold. Y’know, that moment when you uncover the truth and think, «And just there it was…» Imperfect, sure, but these steps turn diversifying investments from a chore into a thrill. By addressing these head-on with a dash of humor, you’re not just investing; you’re outsmarting the game.

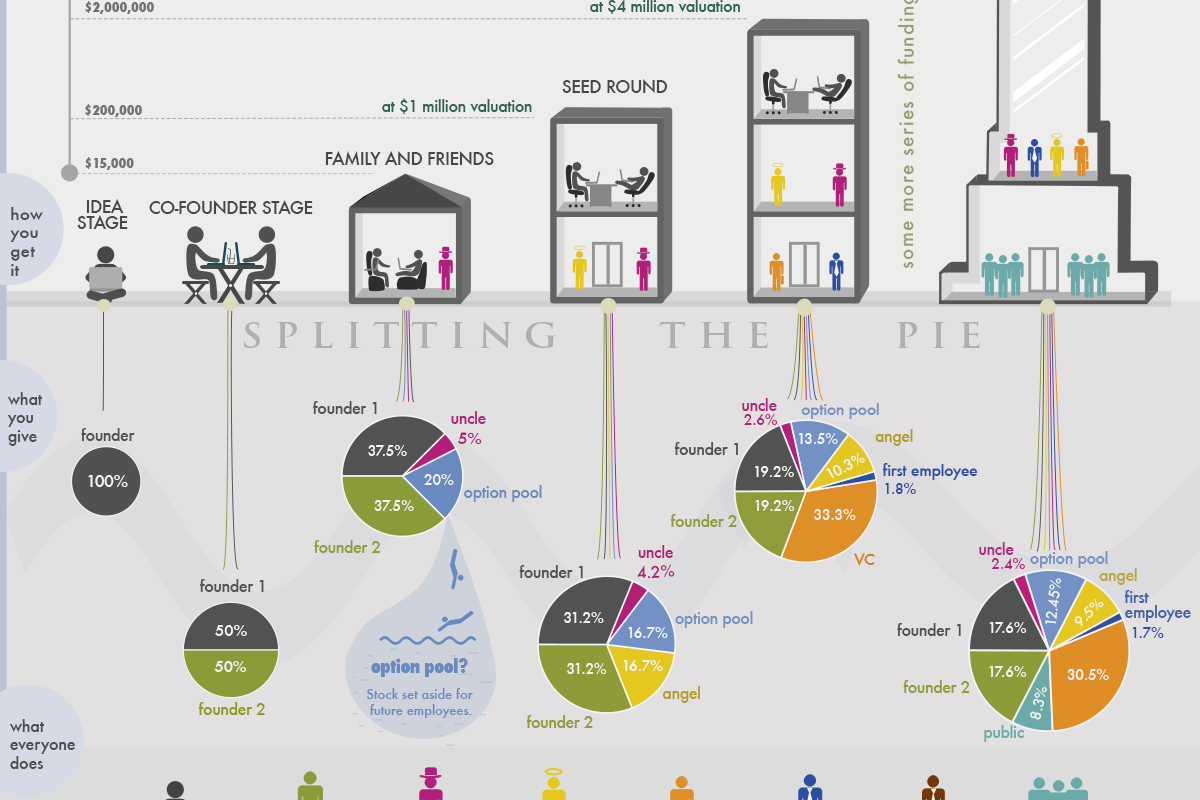

A Quick Reality Check on Funding Rounds

Speaking of thrills, let’s break it down with a simple table to compare common funding stages. This isn’t exhaustive, but it’ll give you a clear picture without the fluff.

| Stage | Typical Investment | Risks | Potential Returns |

|---|---|---|---|

| Seed | Small, often under $1M | High—idea might not pan out | Huge if it hits, like lottery wins |

| Series A | $2M to $15M | Moderate—product needs scaling | Solid growth, but competition looms |

| Series B+ | Over $15M | Lower—company is established | Steady, less explosive but reliable |

Wrapping this up, investing in startups isn’t just about dollars; it’s about believing in the crazy ideas that shape our world, like that underdog in a blockbuster film who saves the day. But here’s the twist: even the best plans can flop, so stay humble and adaptable. Your call to action? Pick one promising startup, research it thoroughly right now, and jot down three reasons why it might succeed. Oh, and here’s a question to chew on: What if the startup you back tomorrow becomes the household name of the future—how would that change your story? Drop your thoughts in the comments; let’s keep this chat going.