Money whispers secrets. Wait, hear me out—it’s not the dramatic plot twist from a thriller, but in a world where job security feels like a myth, generating steady income through investments can be your quiet rebellion. Picture this: you’re trading the hamster wheel of 9-to-5 for something more reliable, like a trusty old bike that keeps pedaling even when you’re not. But here’s the uncomfortable truth—most folks think investments are for Wall Street wizards, yet data from the Federal Reserve shows that everyday Americans with diversified portfolios see a 7-10% annual return on average. In this article, we’ll dive into practical ways to build that steady income stream, helping you ditch financial stress and wake up to a more secure tomorrow. Stick around; it’s easier than you think, and by the end, you might just feel empowered to make your first smart move.

That Time I Tripped into the Stock Market – A Lesson in Patience

Okay, let’s get real for a second. Back in 2015, I was that guy staring at my bank account like it was a bad magic trick—poof, gone. Y justo ahí fue cuando I decided to dip my toes into stocks, figuring it couldn’t be worse than my coffee budget. I started small, buying shares in a blue-chip company, thinking it’d be a piece of cake. Spoiler: it wasn’t. There were ups and downs, like riding a rollercoaster blindfolded, but over time, those dividends trickled in, turning into a steady drip of income. My opinion? **Diversification is key** to avoiding the heartburn of market volatility; it’s like not putting all your eggs in one basket, as the old saying goes. This personal saga taught me that investments aren’t about getting rich quick—they’re about building a reliable foundation, much like how Warren Buffett’s Berkshire Hathaway has churned out consistent returns for decades. If you’re skeptical, imagine chatting with your buddy over coffee: «Nah, man, stocks are risky,» you’d say. I’d counter, «But what if we focus on index funds, which historically beat inflation by a mile?» Steady income from stocks comes from reinvesting dividends and holding steady, not chasing trends.

Busting the «Rich Only» Myth – A Cultural Wake-Up Call

Hold on, let’s flip the script. You know that meme from «The Wolf of Wall Street» where Jordan Belfort’s living large? It’s hilarious, but it feeds into this cultural nonsense that investments are for the elite. Truth bomb: In countries like the UK or US, regular Joes are parking money in IRAs or 401(k)s, proving it’s accessible. Take my neighbor, a teacher who started with $50 a month in mutual funds—now, that’s generating a modest but steady income in retirement. The irony? People obsess over lottery tickets, which have worse odds than a snowball in hell, while ignoring bonds that offer predictable yields. In a conversation with a skeptical reader, I’d say, «Look, I get it—you think investments are complicated, like decoding ancient hieroglyphs. But here’s the deal: government bonds are as straightforward as your grandma’s recipe, providing fixed interest without the drama.» This comparison to everyday life highlights how **investment strategies for steady income** can be demystified. Don’t just take my word; consider the historical parallel—post-WWII, middle-class families built wealth through steady real estate investments, not wild gambles. It’s time to shake off that myth and realize that with apps like Robinhood, anyone can start building passive income flows.

An Unexpected Analogy: Investments as Your Garden

Think of investments not as a high-stakes poker game, but as tending a garden—plant seeds (like stocks or bonds), water them with regular contributions, and harvest the fruits year after year. It’s a fresh take, right? This analogy underscores the need for patience and care in choosing assets that yield reliably.

Mixing Up Your Portfolio: From Safe Havens to Fun Risks

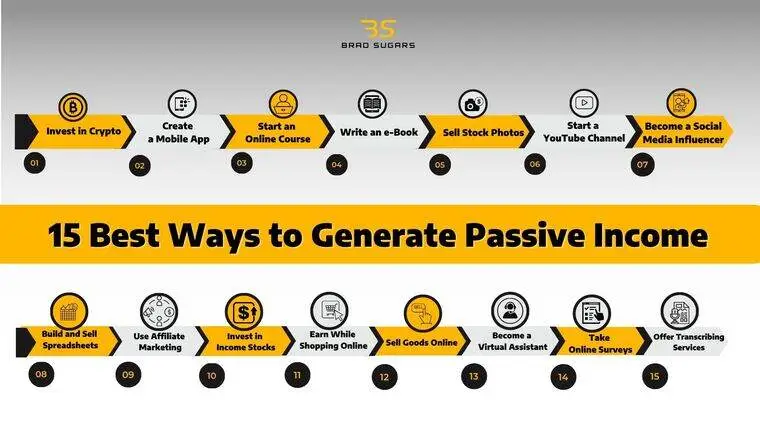

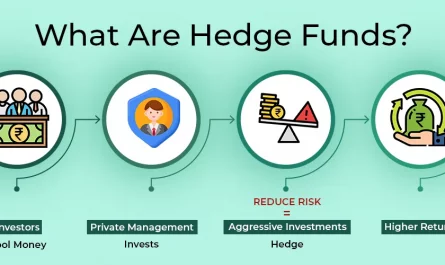

Alright, let’s lighten things up—investing doesn’t have to be all spreadsheets and stress; it’s like mixing a playlist for your finances. Picture this: you’re balancing chill tracks (bonds) with some upbeat hits (stocks). A problem I often see is folks going all-in on one thing, which is like betting your whole vacation on a single sunny day—it might rain. The solution? Diversify with a mix that includes real estate for rental income, which can provide that steady cash flow you crave. For instance, I once experimented with a small REIT (Real Estate Investment Trust), and boom, it paid dividends quarterly without me lifting a finger. Here’s a simple table to compare a few options, because who doesn’t love a quick cheat sheet?

| Investment Type | Pros | Cons | Potential Steady Income |

|---|---|---|---|

| Dividend Stocks | Regular payouts; potential growth | Market fluctuations | 4-6% annually |

| Government Bonds | Low risk; fixed returns | Lower yields in low-interest eras | 2-5% annually |

| Real Estate (REITs) | Passive income from rents; inflation hedge | Property market dips | 6-8% annually |

This setup shows how **ways to generate steady income** vary, and as an exercise, I challenge you: pick one from this table and research it for 15 minutes today. It’ll feel like unlocking a new level in a game, but with real rewards. Sarcasm aside, the key is blending these for a **reliable investment income** stream, turning your money into a workhorse, not a sprinter.

Wrapping It Up with a Fresh Twist

In the end, generating steady income through investments isn’t just about padding your wallet—it’s about reclaiming your time, like that plot twist in «Inception» where the dream becomes reality. So, here’s a specific call to action: Grab a notebook, jot down three investment ideas from this article, and set up a meeting with a financial advisor this week. And one last, thoughtful question: What if the real wealth isn’t in the numbers, but in the freedom they buy—will you take the first step to make it yours? Trust me, it’s worth it.