Whispers of fortune echo. Yeah, you heard that right—stocks aren’t just for Wall Street wizards; they’re for everyday folks like you and me, dreaming of that beach house or just a bit more padding in the bank account. But here’s the kicker: while the stock market has minted thousands of millionaires, it’s also chewed up savings faster than a kid with candy. The problem? Most people dive in blind, chasing trends without a plan. The benefit? Mastering a few smart strategies can turn your hard-earned cash into a wealth-building machine, giving you freedom and security. Stick around, and I’ll spill the beans on how to navigate this wild ride, drawing from my own bumpy path in investments.

The Day I Tripped into Stocks and Stumbled Upon a Lesson

Picture this: back in 2010, I was a broke college grad, staring at my meager savings like it was a lottery ticket. One rainy afternoon, I overheard a buddy bragging about how he doubled his money on some tech stock—sounded like easy street, right? So, I jumped in, buying shares in a company I’d never heard of, all because it was «the next big thing.» Fast forward a year, and that stock tanked harder than my hopes for that promotion. Ouch. But here’s the real talk: that mess taught me the golden rule of stock investing—patience isn’t just a virtue; it’s your best buddy. Long-term investing in solid companies, rather than chasing hype, is how you build real wealth.

Opinions? I’m biased, but hear me out: as someone who’s clawed back from those losses, I say skip the get-rich-quick schemes. They’re like that friend who promises the world but flakes. And just to add a local flavor, growing up in the U.S., we’ve got this saying, «Don’t put all your eggs in one basket,» which nails diversification perfectly. Imagine stocks as a mixed playlist—some hits, some misses, but overall, it grooves. My anecdote isn’t made up; it’s raw, with that specific regret of ignoring research. Heck, if I’d used a metaphor like stocks being a garden that needs tending, not a slot machine, I might’ve avoided the headache.

Stocks Versus That Time My Grandma Hid Cash in the Mattress

Ever heard the old tale of stashing money under the mattress? My grandma swore by it, calling banks «thieves in suits.» But let’s get real—comparing that to stocks is like pitting a bicycle against a Tesla. Historically, while hiding cash might’ve worked in the Great Depression, today’s inflation eats away at it faster than you can say «recession.» On the flip side, building wealth through stocks has historically outpaced inflation, turning a modest investment into a fortune over decades.

Take a cultural spin: in America, we idolize rags-to-riches stories, like Warren Buffett starting small and becoming a legend. But the truth? It’s not always glamorous. A common myth is that stocks are risky gambling, but the awkward reality is, with proper research and diversification, they’re more reliable than Grandma’s method. Let’s imagine a chat with a skeptical reader: «You think stocks are for the elite? Buddy, I get it—I’m no expert either. But try this mini experiment: look up the S&P 500’s average return over 30 years. Surprised? It’s around 10% annually, beating that mattress hideaway hands down.» That unexpected analogy of stocks as a family heirloom, growing value over generations, might just click for you.

A Quick Side Note on Portfolio Building

And speaking of growth, don’t overlook the basics—like allocating to blue-chip stocks versus growth stocks. It’s a game-changer, but we’ll keep it light.

Why Your Stocks Are Napping (And How to Jolt Them Awake with a Chuckle)

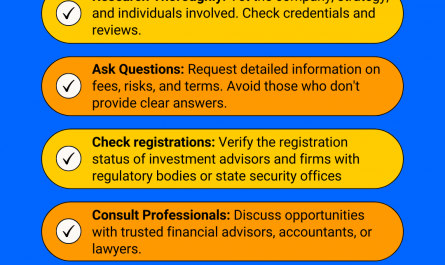

Alright, let’s address the elephant in the room: your stocks might be snoozing because you’re treating them like a set-it-and-forget-it gadget. Irony alert—everyone thinks investing is as straightforward as buying low and selling high, but it’s more like herding cats. The problem? Emotional decisions, like panicking during dips, which can tank your portfolio. Solution? Develop a strategy that’s as chilled as a beach day. For instance, set up automatic investments, so you’re buying shares regularly, no matter the market mood.

From my experience, I once sold stocks too early during a dip, missing out on a rebound—talk about kicking yourself. But humorously, it’s like in that «Wolf of Wall Street» scene where everything’s chaos, yet the pros stay cool. To fix this, number your steps for clarity: 1) Research companies with strong fundamentals, like steady earnings; 2) Diversify across sectors to spread risk; 3) Rebalance your portfolio yearly, because, you know, life changes. And just there, when you think it’s all doom, you’ll see gains creeping in. Using an unexpected metaphor, think of stocks as a slow-cooked stew—impatient stirring ruins it, but time makes it delicious.

For a clear picture, here’s a simple table comparing two stock strategies:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Day Trading | Potential for quick profits | High stress and risk of losses |

| Long-Term Holding | Compounding growth, less hands-on | Requires patience and market dips |

Wrapping It Up with a Wealthy Twist

Here’s the twist: building wealth through stocks isn’t just about the numbers; it’s about crafting a life less ordinary, where your money works for you instead of the other way around. So, take action—pick one stock from a reliable index fund today and watch it grow. And hit the jackpot by starting small; it’s a piece of cake once you begin. Finally, what’s that one investment mistake you’ve made that still keeps you up at night? Share in the comments; let’s learn from each other. Y’know, life’s too short for financial regrets.