Whispers of wealth, hidden traps, steady streams. Ever thought that investing in real estate could feel less like climbing Everest and more like a casual stroll in the park? Well, here’s the kicker: while everyone’s chasing the next big stock or crypto moonshot, Real Estate Investment Trusts—or REITs—have been quietly building fortunes for everyday folks. But let’s face it, as a beginner, the idea of diving into property markets might make you sweat. This tutorial cuts through the jargon, showing you how REITs can deliver passive income without the hassle of managing tenants or mortgages. By the end, you’ll see why this is a game-changer for your portfolio, turning spare change into a reliable cash flow. REITs for beginners isn’t just about numbers; it’s about smart, relaxed investing that fits your life.

My Bumpy Ride into REITs – A Tale of Triumph and Oops Moments

Okay, picture this: a few years back, I was glued to my screen, binge-watching «Shark Tank» episodes, dreaming of hitting the jackpot with some hot investment. But instead of jumping into volatile stocks, I stumbled upon REITs during a late-night scroll. It was like that moment in «The Office» when Michael Scott accidentally invests in something sensible—pure luck mixed with curiosity. I remember my first buy: a retail-focused REIT that seemed as straightforward as ordering pizza online. Fast forward, and that decision netted me my first dividend check, which felt like winning a small lottery, you know?

But hold on, it wasn’t all smooth sailing. I overlooked the market dips, and oof, my portfolio took a hit during that 2020 real estate wobble. Here’s the real lesson, though: REITs taught me about diversification. Unlike owning a single property, which can be a money pit with repairs and vacancies, these trusts spread your risk across tons of assets. Think of it as a buffet instead of a single dish—safer and more exciting. How to invest in REITs starts with understanding that human error, like mine, is part of the game. And just like in life, the key is learning from it. Y’know, that time when I finally crunched the numbers and realized passive income could fund my coffee habit? Pure gold.

REITs Through the Ages – When History Meets Modern Money Moves

Let’s flip the script and compare REITs to the old-school real estate hustle. Back in the Roaring Twenties, folks were flipping houses like it was going out of style, only to crash hard in the Great Depression. Fast-forward to today, and REITs are like the evolved cousin of that era—offering liquidity without the drama. In the U.S., these trusts have been around since the 1960s, essentially democratizing real estate investing. It’s a bit like how streaming services replaced blockbuster rentals: accessible, diverse, and way less effort.

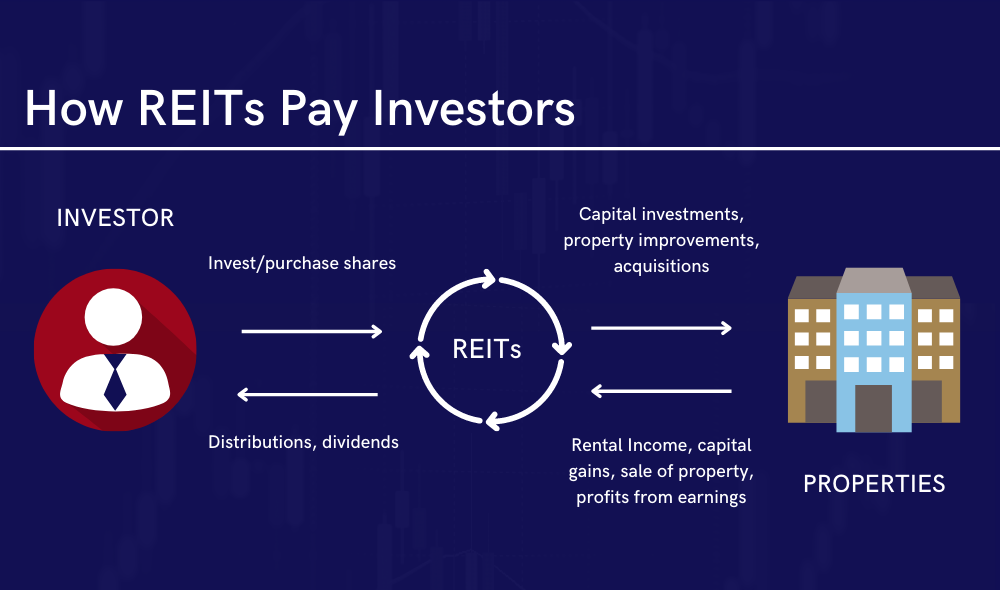

Here’s where it gets interesting—culturally, in places like the UK, property funds (a synonym for REITs) have boomed amid housing booms, but with a twist. While Americans might say «it’s a piece of cake» to buy shares in a mall-owning REIT, Brits could liken it to nabbing a stake in the London property scene without the high tea and headaches. Benefits of REITs shine here: they must distribute at least 90% of their taxable income as dividends, making them a steady earner, unlike traditional investments that can leave you hanging. And under the hood, it’s fascinating how these vehicles weathered the 2008 financial crisis better than individual properties did. If you’re skeptical, imagine chatting with your grandma about her pension fund—odds are, it’s tied to something like this, proving REITs aren’t just for Wall Street wolves.

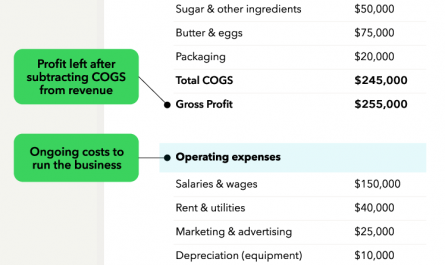

| Aspect | Traditional Real Estate | REITs |

|---|---|---|

| Accessibility | High upfront costs, management required | Low entry via stock exchanges, hands-off |

| Risk Level | Concentrated in one property | Diversified across multiple assets |

| Income Potential | Rental income with variability | Regular dividends, often quarterly |

Why REITs Might Trip You Up – And How to Laugh It Off

Alright, let’s get real: investing in anything has pitfalls, and REITs are no exception. Picture this as a comedy sketch—me, trying to explain interest rate hikes to a friend over beers. «Hey, buddy, when rates go up, REIT values might tank like that meme of the guy slipping on a banana peel.» It’s ironic, right? These trusts are sensitive to economic shifts, and if you’re not prepared, you could see your gains evaporate faster than ice cream on a hot day. But here’s the fix: diversify your REIT holdings across sectors like residential, commercial, or even healthcare properties. That way, if one area slumps, others might pick up the slack.

And that’s when it hits—many beginners overlook fees and taxes, thinking it’s all straightforward. To counter that, start small: research REITs for beginners by checking platforms like Vanguard or Fidelity for low-cost options. My advice? Treat it like planning a road trip: map out your route (research), pack essentials (emergency funds), and enjoy the ride. With a bit of humor, you’ll navigate these waters without losing your shirt. Plus, the potential for long-term growth is like finding a hidden Easter egg in your favorite video game—totally worth it.

In wrapping this up, here’s a twist: what if I told you that REITs aren’t just investments; they’re a pathway to financial chill? Instead of stressing over market swings, you’ve got a tool for building wealth while you Netflix and chill. So, take action right now: open that investment app and explore a REIT fund that aligns with your goals. And think about this: what’s the one investment mistake you’ve made that taught you the most? Share in the comments—let’s keep the conversation real and relaxed.