Dreams cost money, but here’s the twist: not everyone gets a fair shot at turning those dreams into brick-and-mortar reality. Imagine this—real estate, the golden goose of investments, has beaten the stock market over decades, yet it’s locked behind gates of hefty down payments and exclusive clubs. That’s the problem: traditional investing feels like a VIP party you’re not invited to. But enter real estate crowdfunding, and suddenly, you’re in the mix, pooling funds with everyday folks to snag property deals that were once out of reach. In this tutorial, we’ll dive into how this modern twist on investments can democratize real estate investing, offering you passive income streams and portfolio diversification without breaking the bank. Stick around, and I’ll share my real journey, bust some myths, and guide you through the ropes in a way that’s as relaxed as chatting over coffee.

My Accidental Foray into Property Crowdsourcing

Okay, picture this: I’m sitting in my cluttered home office, scrolling through emails one rainy afternoon, and I stumble upon an ad for a crowdfunding platform. «What’s this?» I mutter, half-distracted by the dog barking outside. Turns out, it was the start of something big. A few years back, I dipped my toes into real estate crowdfunding after years of eyeing properties I couldn’t afford outright. I remember my first investment vividly—it was a mid-sized apartment complex in Austin, Texas, backed by a platform that let me throw in just $500. Fast forward, and that little stake earned me a steady 8% return annually. But here’s the human side: I almost backed out, thinking it was too good to be true, like finding a lottery ticket in your pocket. In my opinion, what makes this so appealing is how it humanizes investing; it’s not about cold numbers but about real people, like you and me, banding together for a common goal.

This experience taught me a key lesson: crowdfunding for real estate investments isn’t just about making money—it’s about building community. Think of it as a neighborhood potluck where everyone chips in for the big feast. I grew up in a small town in the Midwest, where folks say things like «pulling together like a barn raising,» and that’s exactly what this feels like. Sure, there were bumps—my returns dipped during a market dip, and I thought, «Y justo ahí fue cuando todo se complicó.» But that imperfection made me appreciate the diversified real estate investment opportunities it offers, spreading risk across multiple projects. If you’re skeptical, imagine a conversation with your doubtful self: «Wait, is this safer than buying stocks?» Well, yeah, because it’s tied to tangible assets, not abstract market swings.

When Crowdfunding Met the Wild West of Finance

Let’s rewind a bit—ever heard of the 19th-century land rushes in America? Folks raced to claim plots, turning dirt into dollars, much like how real estate investment platforms today let you «claim» a stake without the dust and drama. But here’s a cultural comparison that might surprise you: it’s akin to how crowdfunding platforms operate like modern-day cooperatives, echoing the spirit of European guilds from the Middle Ages, where artisans pooled resources for bigger ventures. In the U.S., we’ve got our own flavor, with platforms like Fundrise or RealtyMogul making property investment through crowdsourcing as American as apple pie mixed with a dash of Silicon Valley innovation.

Now, for a mini-experiment to shake things up: grab your phone and search «best real estate crowdfunding sites.» What pops up? Probably a list dominated by user-friendly apps that lower the barrier to entry. This isn’t just tech; it’s a evolution from the exclusive real estate deals of yesteryear. Take my friend’s story—he’s a teacher in Chicago, not a Wall Street whiz, and through crowdfunding, he diversified his retirement fund without quitting his day job. It’s like comparing a solo road trip to carpooling: one is lonely and risky, the other shares the load. And if you’re thinking, «But what about the fees?»—they’re there, but platforms often beat traditional brokers by cutting out middlemen, making it a piece of cake for beginners.

The Hidden Perks Nobody Talks About

Dig deeper, and you’ll find perks like tax advantages—some investments qualify for benefits under Section 1031 exchanges, turning profits into more investments seamlessly. It’s not all rosy, though; market fluctuations can hit hard, but that’s where the real growth happens.

Busting the «Too Good to Be True» Myth with a Chuckle

Alright, let’s get real—many folks roll their eyes at real estate crowdfunding, muttering, «Sounds like that get-rich-quick scheme from a bad infomercial.» Irony alert: it’s not, but I’ll admit, the idea of investing in properties sight unseen does feel a bit like trusting a plot twist in «The Office,» where Michael Scott’s harebrained ideas somehow work out. The problem? Misinformation spreads faster than a viral meme, like when people think you need to be a millionaire to start. Solution time: Start small, research platforms vetted by the SEC, and treat it like dipping into a community fund, not a casino.

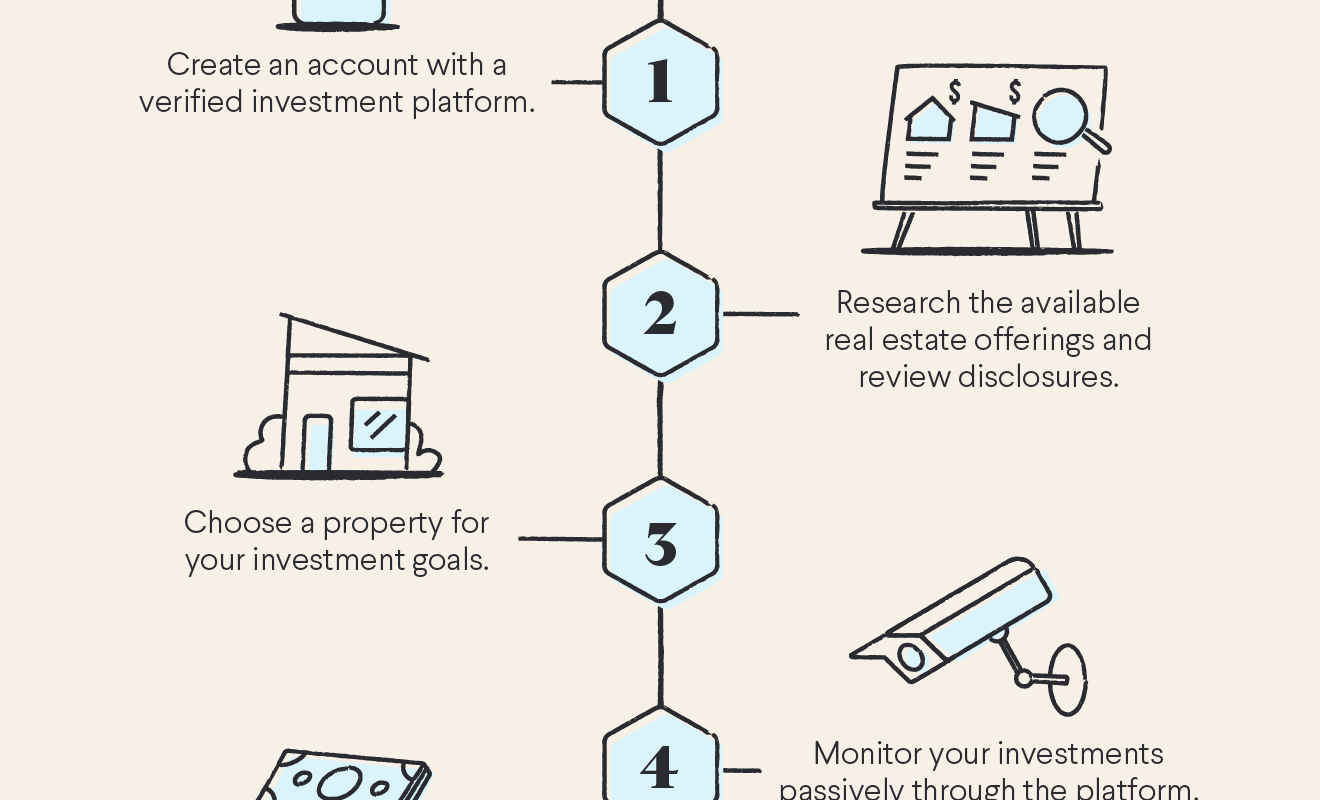

For instance, I once overheard a buddy say, «Crowdfunding? That’s just for tech startups!» Wrong—it’s evolved into a powerhouse for investing in real estate online, with platforms offering detailed project analytics to make informed choices. And boom, your portfolio grows. To fix common pitfalls, like overlooking liquidity, always check for secondary markets where you can sell shares. It’s straightforward: 1. Pick a platform, 2. Verify credentials, 3. Invest what you can afford. No fluff, just practical steps. Plus, in a world obsessed with memes like the «stonks» guy from Reddit, remember that real estate crowdfunding is the steady Eddie to crypto’s wild ride—reliable, with a touch of excitement.

Why It’s Not as Intimidating as It Seems

Often, the biggest hurdle is overthinking, but once you jump in, it’s like unlocking a new level in a video game—rewarding and fun.

As we wrap this up, here’s a twist: while real estate crowdfunding opens doors, it’s still up to you to walk through them wisely—it’s not a magic bullet, but a tool in your investment toolkit. So, take action now: sign up for a free account on a trusted platform like CrowdStreet and explore a project that piques your interest. And think about this: what’s stopping you from turning your savings into something tangible, like owning a slice of that beachfront property you’ve always eyed? Share your thoughts in the comments—have you dabbled in investments like this, or are you ready to dive in?