Wealth hides traps. Yeah, you heard that right—those shiny investment opportunities aren’t always straightforward. Did you know that hedge funds, often hailed as the secret sauce for the ultra-wealthy, control trillions in assets but remain a mystery to most folks? That’s a problem because, in a world buzzing with investment options, misunderstanding hedge funds could mean missing out on smart growth or, worse, stepping into pitfalls. But here’s the benefit: by grasping the basics, you’ll feel more confident navigating investments, turning that intimidating financial jargon into a tool for your own portfolio. Stick around, and we’ll break it down in a relaxed chat, no suits required.

My Wild Ride with Hedge Funds: A Lesson from My Coffee Shop Days

Okay, picture this: I’m sitting in a bustling New York coffee shop, sipping on a latte that’s way too expensive, and I overhear a group of suits talking about «alpha» and «short selling.» At the time, I was just a newbie investor, fresh out of college, trying to figure out why my stock picks kept flopping like a bad improv show. That conversation? It sparked my dive into hedge funds. See, I grew up in a small town where investments meant stuffing cash under the mattress—nothing fancy. But one day, I decided to mimic what those Wall Street types were doing, and hedge fund basics became my unexpected obsession.

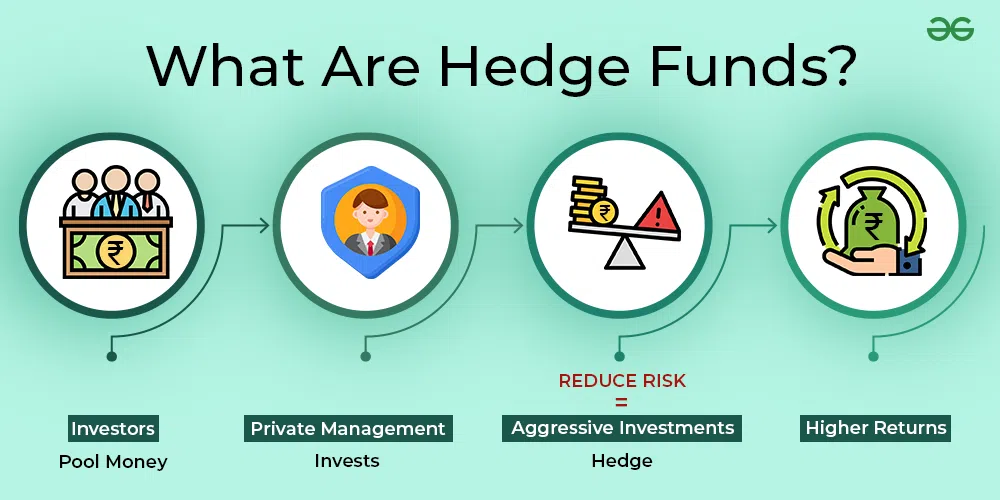

Fast forward, and I recall trying my hand at a simple hedge fund strategy, like betting against a stock I thought was overvalued. It was messy at first; I lost a bit, but learned the hard way that hedge funds aren’t just about making quick bucks—they’re about investment strategies that balance risk and reward. Think of it like that time I juggled too many coffee cups and dropped one; you adapt, right? My anecdote here is real: that experience taught me that hedge funds, at their core, use tools like leverage and derivatives to outperform the market. It’s not magic; it’s calculated moves, often managed by pros who charge fees that make your eyes water. And just like in my coffee shop eavesdropping, blending in with the big players requires patience and a dash of that American can-do spirit. You know, «pull yourself up by your bootstraps» style, but with spreadsheets.

Hedge Funds vs. the Family Piggy Bank: A Historical Showdown

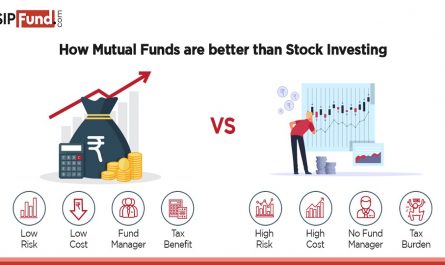

Ever compared hedge funds to something as everyday as your grandma’s old savings jar? It’s like pitting a Ferrari against a trusty bicycle—both get you places, but one’s a thrill ride. Historically, hedge funds emerged in the 1940s, pioneered by folks like Alfred Winslow Jones, who basically invented modern investing by hedging bets during market swings. Fast forward to today, and it’s a far cry from the simple bond investments of yesteryear. In the U.S., where capitalism is almost a religion, hedge funds have become the darlings of high-net-worth individuals, often outperforming traditional mutual funds through aggressive tactics.

But let’s get cultural for a sec. Imagine a conversation with a skeptical reader: «Wait, why bother with hedge funds when my diversified portfolio is doing just fine?» Good point, but here’s the twist—hedge funds offer flexibility, like how jazz evolved from structured blues into something unpredictable yet harmonious. They’re not for everyone, though; regulations keep them exclusive, often requiring investors to be «accredited» with serious cash. This exclusivity can feel like gatekeeping, reminiscent of how exclusive clubs in old Hollywood movies barred the everyday Joe. Yet, the truth is, understanding hedge fund fundamentals lets you appreciate their role in broader investments, such as protecting against downturns, much like how a safety net saved that trapeze artist in Cirque du Soleil. And yeah, it’s ironic that something so elite can be a safety valve in volatile markets—talk about a plot twist.

Why Hedge Funds Feel Like a Scary Movie Plot (And How to Laugh It Off)

Hedge funds get a bad rap, don’t they? People picture them as shadowy figures pulling strings, à la the villains in a Marvel flick—think Thanos with a portfolio. But let’s expose the problem with some humor: if investing were a horror movie, hedge funds would be that jump-scare you didn’t see coming, full of complex fees and market risks that make you yell, «Not the portfolio!» The issue? Many beginners overlook the basics, leading to misconceptions, like thinking hedge funds are guaranteed winners. Spoiler: they’re not; they can underperform, especially in stable markets.

So, how do we solve this? Start simple: educate yourself on key elements, such as how hedge funds use short selling or arbitrage to generate returns. It’s like fixing a leaky faucet—once you identify the drip (the risks), you tighten the nuts (diversify your investments). For instance, propose this mini experiment: grab a notebook and jot down three stocks you’re watching. Now, imagine hedging one by shorting it if you suspect a drop. See? It’s about strategy, not sorcery. And in a relaxed tone, I’ll admit, «Y justo ahí fue cuando realized that blending hedge funds into your mix isn’t as daunting as it seems—it’s just another tool in your investment toolbox.» Plus, with fees often hitting 2% plus 20% of profits, it’s crucial to weigh pros and cons, like in that episode of «The Office» where Michael Scott’s schemes backfire hilariously.

| Aspect | Hedge Funds | Traditional Investments |

|---|---|---|

| Risk Level | High, with hedging strategies | Moderate, like stocks or bonds |

| Access | Limited to accredited investors | Open to the public |

| Potential Returns | Above-average, but volatile | Steady, with less excitement |

Wrapping It Up with a Fresh Angle

Here’s the twist: while hedge funds might seem like the elite’s playground, they’re really just a smarter way to play the investment game, accessible through knowledge rather than cash alone. So, take action—start by researching one hedge fund strategy today, maybe using a free online simulator to test the waters without real risk. And ponder this: if hedge funds can evolve like characters in a binge-worthy series, what role will they play in your financial story? Drop a comment below; I’d love to hear your thoughts on demystifying investments.