Bulls charge wildly into markets, but derivatives? They’re the sneaky shadows that can trip you up or propel you forward. Here’s the kicker: while everyone dreams of easy money from stocks, derivatives often lurk as the misunderstood villains or heroes of investments. I remember chatting with a buddy who lost a chunk on options, thinking it was a sure bet—turns out, it’s not. This tutorial dives into derivative investments, stripping away the jargon to show you how they work, why they’re worth your time, and how to avoid common pitfalls. By the end, you’ll grasp the basics to potentially boost your portfolio, all while keeping things chill and real. Stick around, and let’s explore why mastering derivatives could be your secret weapon in the investment game.

My Wild Ride with Futures: A Lesson from My Own Wallet

Okay, picture this: a few years back, I was knee-deep in my first job, eyeing the stock market like it was the next big adventure. I’d heard about futures—those contracts betting on future prices—and thought, «Hey, this sounds like a piece of cake.» Spoiler: it wasn’t. I jumped in, buying futures on oil prices, thinking I’d nailed it when prices spiked initially. But then, boom, geopolitical tensions eased, and prices tanked. Lost a couple hundred bucks, and let me tell you, that stung. It’s like trying to surf a wave you can’t see coming; exhilarating at first, but wipeout city if you’re not prepared.

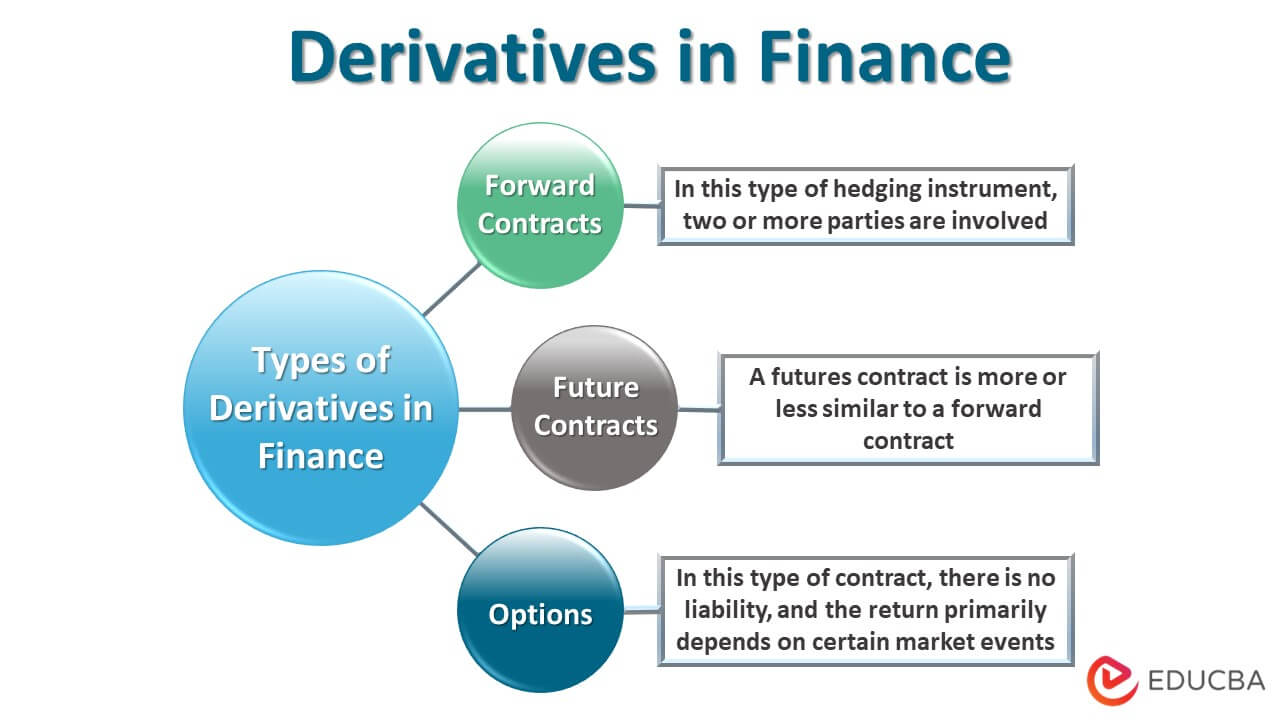

What I learned, though, was golden. Derivatives, especially futures, aren’t just gambling tools; they’re for hedging risks or speculating smartly. In my opinion, they’re like that double-edged sword from old myths—amazing for protecting your investments, say, if you’re a farmer locking in crop prices, but deadly if you swing wildly without strategy. And just to keep it real, futures contracts let you agree to buy or sell an asset at a set price later, which can be a lifesaver in volatile markets. Synonyms like forward contracts or derivatives trading strategies often pop up, and they all boil down to managing uncertainty. That experience taught me to always, always research first—don’t be like me, charging in blind.

From Tulip Mania to Crypto Calls: A Quirky History Lesson

Ever heard of the Dutch Tulip Mania in the 1630s? People went nuts over tulip bulbs, trading them like hot stocks, and it crashed spectacularly. Fast forward, and derivatives have evolved into something even wilder, like options in the crypto world. It’s a wild comparison, right? Back then, folks were essentially dealing with early forms of derivatives without knowing it—speculating on future values. Today, derivative investments include options, which give you the right (but not the obligation) to buy or sell at a specific price, much like hedging against a market drop.

Think about it: in the 1929 crash, derivatives weren’t as prevalent, but now they’re everywhere, from Wall Street to your trading app. This historical twist shows how understanding options and futures can prevent repeats of those bubbles. And here’s a fun analogy—derivatives are like that plot twist in «Inception,» where layers upon layers make you question reality. One minute you’re in, the next you’re out, but with proper knowledge, you navigate it. In British lingo, it’s «not all beer and skittles»; there’s real risk, but also rewards, like in modern markets where derivatives help with portfolio diversification. Y’know, that time in «The Big Short» when they bet against the housing market? Pure derivative genius, but don’t try it at home without homework.

A Mini Experiment: Try Pricing an Option Yourself

Alright, let’s shake things up. What if I asked: could you price a call option on your favorite stock right now? Probably not, and that’s the point. Grab a calculator and pretend you’re buying a call option for, say, Apple stock at $150 when it’s trading at $140. Factors like volatility and time value come into play—it’s like baking a cake where ingredients matter. This exercise shows how derivative pricing models, like Black-Scholes, aren’t magic; they’re tools to estimate value. Give it a go; you’ll see why long-tail keywords like «how to calculate option premiums» are crucial for deep dives.

Dodging the Derivative Traps: A Humorous Tumble and Recovery Plan

Here’s the irony: derivatives sound fancy, but they’re often the butt of jokes in finance circles, like that friend who promises riches but delivers headaches. I once overheard a trader say, «Derivatives? More like derailed investments!» And he wasn’t wrong—leverage can amplify gains, but oh boy, losses too. Imagine leveraging 10x on a futures trade; it’s thrilling, like riding a rollercoaster, until you’re upside down. The problem? Many folks dive in without grasping risks of derivative investments, such as margin calls or market manipulation.

But let’s fix that with a relaxed solution. First, start small—paper trade before real money, like practicing guitar riffs before a gig. Second, diversify; don’t put all eggs in one basket, as they say. And third, educate yourself on regulations; in the U.S., the CFTC oversees futures, adding a safety net. It’s straightforward: treat derivatives as tools, not toys. That way, you sidestep the pitfalls and maybe even chuckle at the memes, like that one from «The Office» where Michael’s schemes flop. Y’know, «And just when you think you’ve got it…»—well, you might actually do.

In wrapping this up, here’s a twist: while derivatives can seem like the wild west of investments, they’re actually a path to stability if handled right. So, take action—simulate a simple futures trade on a demo platform today and see how it feels. What’s your take on balancing risk and reward in derivatives? Drop a comment; I’d love to hear if you’ve had your own market rollercoaster. Remember, investing’s not just numbers; it’s about smart, human choices.