Whispers in the dark, options trading isn’t just for Wall Street wizards. Yeah, you heard that right—while everyone’s chasing the next big stock like it’s the latest iPhone drop, options trading sits in the shadows, often painted as a high-stakes gamble that could wipe out your savings faster than a bad blind date. But here’s the contradiction: it’s actually a powerful tool for everyday investors to hedge risks and potentially multiply gains without betting the farm. If you’re a beginner feeling overwhelmed by all the jargon, this tutorial will break down options trading basics in a relaxed chat, helping you build confidence and maybe even spot opportunities you’ve been missing. Stick around, and by the end, you’ll see how this can be your secret weapon in the investment game.

My First Options Trade: A Rollercoaster Ride

Okay, picture this: back in my early days of investing, I was glued to my screen, watching stocks bounce around like kids on a trampoline. I remember my first options trade vividly—it was a call option on tech stocks during that wild 2020 market swing. I’d just read about it in a forum, thinking, «This is gonna be a piece of cake.» Spoiler: it wasn’t. I bought a call option expecting the stock to soar, but instead, it dipped, and I ended up losing a chunk of change. And that’s when it hit me—options aren’t just about predicting the future; they’re about managing uncertainty with strategy.

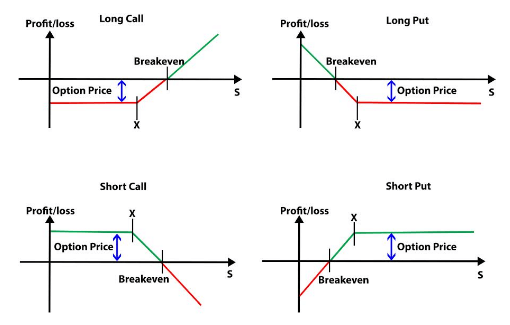

This personal blunder taught me a key lesson: **options trading basics** revolve around contracts that give you the right, but not the obligation, to buy or sell an asset at a set price before a certain date. Think of it like reserving a ticket to a concert—you’re not committed until you show up, but if the band’s a no-show, you’re out the reservation fee. In my case, that fee was my premium, and the lesson? Always factor in volatility. For beginners, starting with **how to trade options** means understanding calls and puts: calls bet on price rises, puts on falls. It’s not magic; it’s calculated risk, and mastering it can turn your portfolio into a more resilient beast.

The Unexpected Twist in My Learning Curve

What surprised me most was how options can act as insurance. Imagine hedging your stocks like wearing a seatbelt—it’s there just in case. That trade? It stung, but it pushed me to dive deeper into **beginner options trading strategies**, like using spreads to limit losses. Don’t overlook the human element; emotions can derail even the best plans, so keep a journal, folks.

Options Trading vs. That Epic Game of Thrones Plot

Ever binge-watched «Game of Thrones» and marveled at those intricate alliances and betrayals? Well, **options trading basics** aren’t so different—it’s like plotting your way through Westeros, where every move has layers. Historically, options date back to ancient Greece, but let’s compare it to something more relatable: trading options is akin to the strategic mind games in that series, where you’re not just fighting for the throne but positioning for surprises.

In a cultural twist, think about how Americans view risk—it’s like our love for road trips without a map. Options let you control a larger position with less capital, much like Cersei scheming with whispers instead of armies. For instance, buying an options contract might cost you peanuts compared to owning the stock outright, giving you leverage. But beware the «iron throne» of risks: time decay erodes value, similar to how seasons change in the show. A **tutorial for options trading** should highlight this—it’s not just about strikes and expirations; it’s about timing your entry like a plot twist. In the U.S., where we’re all about that hustle, options trading has boomed with apps like Robinhood, making it accessible, yet it’s easy to forget that, as in GoT, not every alliance pays off.

This comparison isn’t perfect—who knew medieval drama could mirror modern finance?—but it underscores how **understanding options contracts** means anticipating variables. Don’t put all your eggs in one basket; diversify like the houses of Westeros.

Why Options Can Sting Like a Bad Coffee Brew, and How to Sweeten It

Alright, let’s get real: options trading often gets a bad rap, painted as this volatile monster that’ll chew you up. Irony alert—it’s actually more predictable than you think, if you approach it right. I mean, who hasn’t heard the myth that options are pure luck, like winning the lottery? Truth bomb: with proper education, **options trading strategies for beginners** can be as straightforward as brewing your morning joe.

The problem? Newbies dive in without grasping the Greeks—delta, gamma, theta—that measure risk factors. It’s like trying to fix a car without knowing the engine. Humor me: imagine options as that friend who’s fun but unreliable; you need boundaries. Solution? Start small with paper trading, simulating trades without real money. For example, pick a stock like Apple and practice buying a call option when it’s undervalued. Number it out for clarity: 1. Research the underlying asset, 2. Choose your strike price based on trends, 3. Set an expiration that aligns with your thesis. This way, you’re not just throwing darts; you’re aiming with data.

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Leverage | Control large positions with little capital | Amplified losses if wrong |

| Hedging | Protects against market drops | Costs premiums upfront |

| Flexibility | Various strategies for different scenarios | Requires constant monitoring |

As you can see, weighing these makes **how to start options trading** less intimidating. And just like in that meme of a cat trying to look innocent after knocking over a vase, options might seem sneaky, but with practice, you’ll tame them.

Wrapping It Up with a Fresh Spin

Who’d have thought that something as complex as options trading could feel like flipping through Netflix options on a lazy Sunday? That’s the twist—it’s not about mastering Wall Street overnight; it’s about building habits that grow your wealth steadily. So, here’s your call to action: fire up a demo account and try a simple call option trade right now, tracking it for a week to see the real impact.

And one last question to ponder: if options trading were a movie sequel, what plot hole would you fix in your strategy? Drop your thoughts in the comments—let’s keep this conversation rolling.