Dollars dance dangerously in the stock market, where fortunes flip faster than a TikTok trend. Yet, here’s the kicker: women hold over $10 trillion in assets but often shy away from investing, leaving potential gains on the table. That’s a truth that stings, especially when studies show female investors typically outperform men by a slim margin due to their patient approach. If you’re a woman eyeing that financial freedom, these tips aren’t just advice—they’re your secret weapon to build wealth without the overwhelming pressure. Stick around, and I’ll share how to dive in with confidence, drawing from real stories and a bit of my own missteps, because let’s face it, nobody gets it perfect on the first try.

My Clumsy Start in the Market – A Lesson Wrapped in Regret

Picture this: me, fresh out of college, staring at my computer screen like it was an alien artifact, trying to figure out why my first stock pick tanked harder than a superhero in a bad reboot. I remember pouring savings into a trendy tech stock because, hey, everyone on social media was raving about it. Tips for women in investing start with avoiding that herd mentality, but back then, I didn’t know any better. It was like chasing a mirage in the desert—you think it’s water, but it’s just hot air. In my opinion, this fear of jumping in stems from years of being told we’re not «wired» for finance, which is total nonsense. We’re wired for smart decisions, especially when we trust our instincts.

Fast forward, and that blunder taught me the power of women and investments: education is your best ally. I dove into books and online courses, discovering how diversification isn’t just a buzzword—it’s like building a balanced wardrobe that works for every season. And just to add a local twist, as someone from the UK, I often think of it like that British saying, «Don’t put all your eggs in one basket.» It’s commonsense advice that saved me from future heartaches. Y justo ahí fue cuando I realized investing doesn’t have to be a man’s world; it’s about claiming your space with a metaphor that’s as unexpected as comparing it to baking a cake—measure twice, mix once, and watch it rise.

From Suffragettes to Stocks: How History Empowers Female Investors

Ever wondered how women like Hetty Green, dubbed the «Witch of Wall Street,» amassed a fortune in the 19th century while fighting societal norms? It’s a comparison that’s as eye-opening as binge-watching a season of «The Crown.» Green wasn’t your typical investor; she was a trailblazer, using her wits to navigate a male-dominated world, much like how women today can leverage female investment strategies to outmaneuver market volatility. This historical lens shows that investing has always been about resilience, not rocket science.

But let’s get real—culturally, we’ve got myths to bust. In places like the US, where the American dream often glosses over gender gaps, women face unique barriers, such as the wage gap affecting our savings. A truth that’s uncomfortable: women live longer on average, so our retirement funds need to stretch further. That’s where strategies like index funds shine, offering steady growth without the drama. Imagine a conversation with a skeptical reader: «You think I can handle this? What if I lose it all?» I’d say, «Hey, it’s like learning to ride a bike—wobbles happen, but with historical data as your training wheels, you’ll pedal steadily.» This approach isn’t just practical; it’s empowering, drawing from real cultural shifts, like how series such as «Billions» glamorize finance but remind us that anyone can play the game with the right mindset.

Laughing at the Risks: Turning Investment Fears into Wins

Okay, let’s lighten up—because who says investing has to be as serious as a boardroom full of suits? Here’s a problem that’s as common as rain in London: the idea that women are too risk-averse to succeed in investments. Ha, what a load! In reality, that «aversion» is often our superpower, leading to better long-term results. But if you’re still chuckling nervously, consider this irony: men might swing for the fences like in a baseball game, while we hit singles steadily—how women can start investing is by embracing that patience as a strategy, not a flaw.

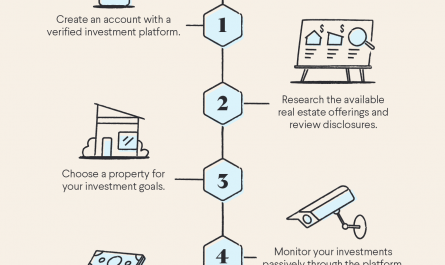

To solve this, start with baby steps that feel as easy as pie. First, build an emergency fund—think of it as your financial safety net, preventing knee-jerk decisions. Second, explore low-risk options like bonds or ETFs, which offer diversification without breaking the bank. And third, seek communities or apps designed for women, where you can share stories and get advice without the intimidation. For a quick comparison, here’s a simple table to weigh your choices:

| Investment Type | Pros | Cons |

|---|---|---|

| Stocks | High potential returns, exciting growth | Volatile, requires research |

| Bonds | Stable income, lower risk | Lower returns, inflation risk |

| ETFs | Diversified, cost-effective | Market fluctuations, management fees |

This isn’t about perfection; it’s about progress. And just like in that meme of the dog surfing the internet, «This is fine,» even when things get wavy—empowering women through investments means riding the waves with a smile.

Wrapping this up with a twist: while we’ve chatted about tips and tales, the real game-changer is that investing isn’t a sprint; it’s a marathon where women often cross the finish line stronger. So, here’s your call to action—grab that phone and open a brokerage app right now, even if it’s just to peek at your options. What’s one common mistake women make in investing that you’ve dodged or learned from? Share in the comments; let’s keep the conversation going and build that supportive network we all need.