The Unexpected Path to a Cozy Retirement

Chocolate, beaches, freedom. Yeah, I know—that’s a weird way to kick off a chat about retirement savings, but stick with me. Here’s the thing: while we’re all picturing that sweet life of lounging on sandy shores with a bar of chocolate in hand, the cold hard truth is that half of us aren’t saving enough to make it happen. According to a recent survey, over 40% of Americans feel they’re behind on retirement goals, and that’s not just a number—it’s a wake-up call that could leave you working way past your prime. But hey, the good news? With some smart investment tips, you can build a plan that secures your future without turning your life upside down. In this piece, we’ll explore real strategies for retirement savings plans, blending personal stories and practical advice to help you invest wisely and sleep easier at night.

My Wake-Up Call with Stocks and That Time I Got Lucky

Picture this: a few years back, I was knee-deep in my career, thinking my 401(k) was on autopilot like some superhero gadget from the Avengers universe. But then, boom—market dips hit harder than Thanos’s snap, and I watched my savings shrink faster than I could say «infinity stones.» Y justo ahí fue cuando me di cuenta that blindly throwing money into stocks without a plan was a recipe for disaster. It’s a story as old as time, really, but mine involved a panicked late-night scroll through financial apps, sweating over every percentage point.

In my opinion, the key to retirement investments isn’t about chasing the next big trend—it’s about building a diversified portfolio that grows steadily, like planting a quirky garden where tomatoes and wildflowers coexist. Think of it as your financial safety net, woven from a mix of stocks, bonds, and maybe some real estate for good measure. A solid retirement savings plan starts with understanding your risk tolerance; for me, that meant ditching high-volatility stocks after that wake-up call and leaning into index funds, which have historically offered reliable returns with less drama. And here’s a tip straight from my playbook: don’t ignore the power of compounding—it’s like that friend who always shows up with interest, turning small investments into something substantial over time.

To make this real, let’s compare two approaches in a simple table. On one side, the «go big or go home» strategy I tried early on, and on the other, a more balanced path I’ve adopted since.

| Approach | Pros | Cons |

|---|---|---|

| Aggressive Stock Picking | Potential for high returns, like hitting the jackpot | High risk of losses, as I learned the hard way |

| Diversified Index Funds | Steady growth, easier to manage—piece of cake, really | Slower gains, but way less stress on your wallet |

This isn’t just theory; it’s what pulled me back from the edge. By focusing on long-term investment strategies, I’ve seen my retirement fund stabilize, and it’s given me that «I’m in control» vibe we all crave.

Grandma’s Cookie Jar vs. Modern Investment Magic

Ever heard the old saying, «A penny saved is a penny earned»? That’s straight from my grandma’s playbook, and boy, did she live it—stashing cash in that cookie jar like it was going out of style. But fast-forward to today, and retirement savings aren’t just about hiding money under the mattress; it’s about leveraging tools like IRAs and Roth accounts that Grandma never dreamed of. In a way, it’s like comparing a classic black-and-white film to a blockbuster with special effects—both entertaining, but one packs way more punch for your future.

Here’s a truth that’s a bit uncomfortable: many folks still cling to the myth that investing is only for Wall Street whizzes with fancy degrees. Wrong. As someone who’s been there, retirement investment tips can be as straightforward as choosing the right vehicle for your journey. For instance, a traditional IRA offers tax-deferred growth, which is great if you’re in a higher tax bracket now, whereas a Roth IRA lets you pay taxes upfront for tax-free withdrawals later—it’s like picking between a rainy day fund and a sunny vacation stash. And don’t even get me started on employer-matched 401(k)s; that’s free money, people, like finding an extra slice of pie at the family reunion.

To shake things up, imagine a quick chat with a skeptical reader: «But wait,» you might say, «what if the market crashes again?» Fair point, but that’s where asset allocation comes in—balancing your investments so you’re not all in on one risky bet. It’s not about being a fortune teller; it’s about being prepared, like stocking up on popcorn before a marathon of your favorite series. Speaking of which, remember how Walter White in Breaking Bad turned a bad situation into an empire? Channel that energy into your saving for retirement plan, but legally and with less drama.

Why Your Retirement Plan Feels Like a Comedy Sketch (And How to Fix It)

Alright, let’s get real for a second: trying to navigate investments can feel about as fun as juggling flaming torches—exciting, but one wrong move and ouch. I mean, who hasn’t stared at their bank app thinking, «Is this really going to work out?» But here’s the ironic twist: the biggest barrier is often our own hesitation, like we’re waiting for a sign from the universe instead of just diving in. The solution? Start small and build from there, turning what feels like a comedy of errors into a success story.

For example, consider this mini experiment: grab a notebook and jot down your monthly expenses for a week. You’ll probably spot some «guilty pleasures» that could free up cash for investments—maybe that daily coffee run isn’t as essential as you thought. Once you’ve got that extra dough, funnel it into a low-cost ETF, which offers diversification without the headache. It’s all about effective retirement planning, where you prioritize growth over gadgets. And remember, consulting a financial advisor isn’t admitting defeat; it’s like calling in the pros for a tune-up on your car before a road trip.

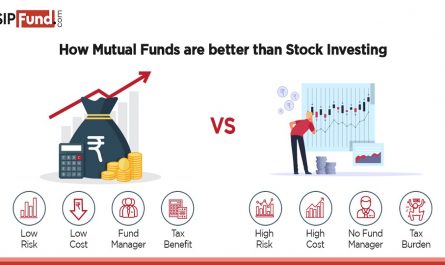

In wrapping up this section, the beauty of investments is in the variety—whether it’s mutual funds for steady income or stocks for a bit of thrill, the goal is to match your plan to your life. After all, a well-rounded retirement savings strategy isn’t just smart; it’s your ticket to that freedom we talked about earlier.

A Fresh Twist on Your Golden Years Ahead

So, here’s the plot twist: while I’ve shared my bumps and wins with retirement investments, the real magic happens when you take action yourself. It’s not about becoming a finance guru overnight; it’s about realizing that every dollar you invest today is a step toward that beachy freedom. And just like in those feel-good movies, the underdog wins by playing the long game.

Here’s a specific call to action: pull out your budget right now and allocate just 5% more to your retirement fund—trust me, it’s easier than you think. What’s one bold move you’re making for your financial future? Drop a comment below and let’s chat; your story might just inspire the next reader.