Money whispers secrets, but millennials often hear static. Yep, in a world where avocado toast gets blamed for everything, it’s easy to overlook that 78% of us under 35 feel anxious about finances yet only half are actually investing—ouch, right? That’s the uncomfortable truth: we’re digital natives drowning in apps and memes, but when it comes to building wealth, many feel lost in the sauce. These tips aren’t just another list; they’re your laid-back guide to turning that coffee money into something smarter. By the end, you’ll see investing as less «scary stock market» and more «your ticket to future freedom,» making your wallet happier and your future less stressful. Let’s dive in, shall we?

My First Stock Fumble: Lessons from a Caffeinated Rookie

Okay, picture this: I’m 25, sipping on overpriced lattes, and deciding to throw $500 at some hot stock tip from a Reddit thread. Spoiler alert—it tanked faster than my enthusiasm for early mornings. That day, staring at my screen as the numbers dipped, I realized investing isn’t just about picking winners; it’s about not losing your shirt in the process. As a millennial investor knee-deep in student loans and side hustles, this was my wake-up call. Stock market basics for beginners suddenly felt crucial, not some boring finance class.

Fast forward, and I’ve learned that starting small with index funds can be a game-changer. Think of it like building a playlist—diversify your tracks so one bad song doesn’t ruin the vibe. Here’s a quick, real anecdote: I diversified into a mix of tech stocks and bonds, and suddenly, my portfolio wasn’t as volatile as my ex’s mood swings. Opinions? Well, I firmly believe that as millennials, we’re wired for tech-savvy picks, like apps that let you invest spare change. But don’t just take my word; that initial fumble taught me the golden rule: research is your best friend, not some flashy trend. And that’s when it hit me—patience pays off, even if it feels slower than waiting for your favorite series to drop.

Investing Smarter Than Your Favorite Superheroes

Ever watched Tony Stark build his empire in the Avengers? He’s got Iron Man suits and a portfolio that screams «winning,» but let’s get real—most of us aren’t billionaires, just regular folks trying not to get crushed by economic villains. This comparison might sound cheesy, but bear with me: just like Black Panther protects Wakanda with vibranium, you can shield your finances with solid investment strategies for millennials. Historically, folks in the ’90s rode the dot-com wave, but many crashed and burned without a plan. Today, we’re in a similar spot with crypto and AI stocks, yet the truth is, not every shiny gadget is worth the hype.

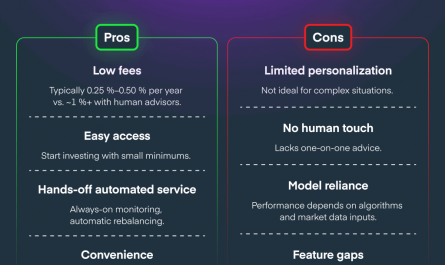

Here’s a twist: imagine a chat with a skeptical reader named Alex, who’s all, «Investing? Nah, that’s for old folks with trust funds.» I’d say, «Hold up, Alex, what if I told you that passive income from ETFs could fund your next travel adventure?» Yeah, it’s that accessible. In the U.S., we’ve got this under-the-radar gem called Roth IRAs, perfect for young investors since they grow tax-free—like a secret superpower. But let’s bust a myth: you don’t need a ballpark figure of thousands to start; apps like Robinhood let you dip in with pennies. This unexpected analogy? Investing is like curating your Netflix queue—pick a mix that excites you, but don’t binge on risks. By blending historical lessons with modern tools, you’re not just investing money; you’re investing in your story.

Why Your Daily Grind Isn’t Killing Your Wallet—And How to Fix It Anyway

Alright, let’s address the elephant in the room with a dash of irony: everyone’s joking that millennials are too busy with brunch and memes to invest, but come on, that’s as outdated as flip phones. The real problem? We’re overwhelmed by choices, from stocks to real estate, and it feels like choosing between scrolling TikTok or actually adulting. Humor me for a sec: if your avocado toast could talk, it’d say, «Hey, invest in me instead of eating me!» But seriously, the solution starts with breaking it down into bite-sized steps, making tips for millennial investors feel less intimidating.

First off, consider this mini experiment: track your spending for a week using an app—bet you’ll find at least $50 in «oops» money. Step 1: Redirect that to a high-yield savings account for emergency funds. Step 2: Once you’re comfy, explore low-cost index funds; they’re like the reliable sidekick in your financial story. Step 3: Don’t ignore real estate crowdfunding—it’s a fresh way for us to dip into property without buying a house. As someone who’s juggled freelance gigs, I get it; life throws curveballs, but these steps build resilience. Plus, in a culture where «YOLO» is a meme, remember that smart investing is the ultimate flex. And just like in that episode of «The Office» where Michael makes a bad call, learning from mistakes keeps you ahead.

Wrapping this up with a fresh spin: investing isn’t just about stacking cash; it’s about crafting the life you want, free from financial drama. So, here’s your call to action—grab that phone and open an investment app right now, even if it’s just $10 on something simple like an S&P 500 fund. What’s one investment habit you’ve been putting off, and how might it change your game? Think about it, share in the comments, and let’s turn those whispers into roars.