Whispers of wealth echo. Wait, that sounds too mystical for money matters, but hear me out—it’s not all about chasing get-rich-quick schemes that fizzle like a bad fireworks show. Picture this: over 70% of new investors dive headfirst into a single stock, only to watch their dreams crash harder than a superhero in a Marvel flop. The problem? You’re basically betting the farm on one horse, leaving your financial future vulnerable to market mood swings. But here’s the real benefit: building a diversified portfolio can shield your investments from unexpected blows, turning that risky gamble into a steady path toward long-term growth. Stick around, and I’ll walk you through the steps with some personal tales and light-hearted twists, because investing doesn’t have to be as stiff as a boardroom meeting.

My Wild Ride with Stocks: A Lesson from My Wallet’s Woes

Oh, man, let me take you back to my early days in the investment world—it was a mess, pure and simple. I remember pouring all my savings into tech stocks back in 2018, thinking I was the next Elon Musk just because I binge-watched «The Office» and felt inspired by its underdog vibes. Yeah, that was a hit, alright—a hit to my bank account when the market dipped. And that’s when it hit me: putting everything in one basket is like trusting a single wheel on a car; one pothole, and you’re stranded. But through that blunder, I learned the golden rule of investment diversification: spread out to minimize risks.

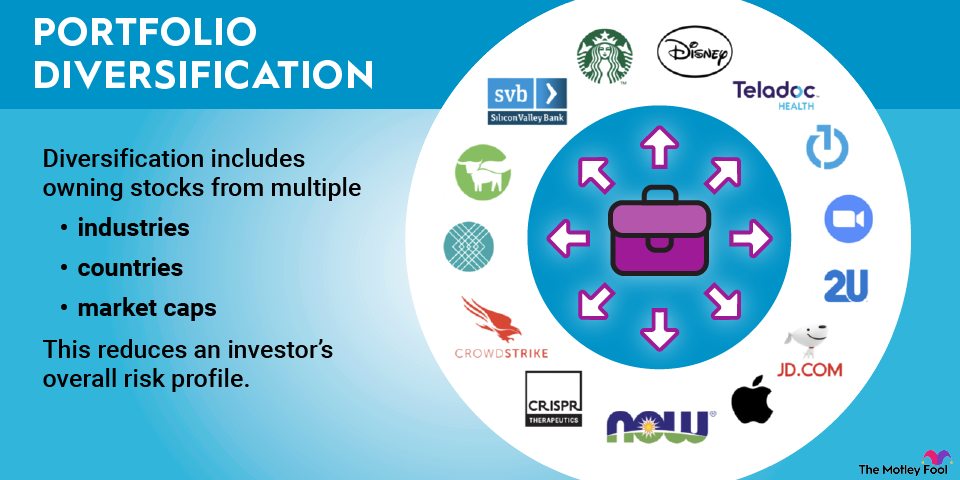

Fast-forward, and I’ve built a portfolio that mixes stocks, bonds, and even a sprinkle of real estate. It’s not about being a Wall Street wizard; it’s about that human touch, like adding spices to a family recipe. In my opinion, subjective as it may be, starting with a mix of assets based on your risk tolerance is key. For instance, if you’re in the US like me, think about how local economic shifts—say, a tech boom in Silicon Valley—affect your choices. Diversification isn’t just smart; it’s a metaphor for life’s unpredictability, like trying to predict the weather in New England—good luck with that. By allocating across different sectors, you’re not eliminating risks entirely, but you’re making your portfolio as resilient as a well-worn pair of jeans.

Timeless Tales from Investment Gurus: Blending History with Your Wallet

Ever wondered how folks like Warren Buffett turned pennies into empires? It’s not magic; it’s a masterclass in diversification, drawn from historical playbooks that feel as relevant as today’s headlines. Compare that to the Roaring Twenties, when investors piled into stocks like it was a speakeasy party, only to face the Great Depression’s hangover. That era’s lesson? Over-reliance on one asset class can lead to a spectacular fall, much like how a character in «Breaking Bad» trusts the wrong ally and ends up in hot water.

But let’s get real—Buffett’s approach, with his famous «circle of competence,» shows how mixing value stocks with safer bets creates balance. In my view, this isn’t just history; it’s a cultural nudge for modern investors. If you’re from a place like the Midwest, where folks value steady growth over flashy gains, you’ll appreciate how diversification echoes that «slow and steady wins the race» mindset. A diversified investment strategy means weaving in international stocks or ETFs to counter local downturns, like adding global flavors to a backyard barbecue. This comparison highlights how, unlike the myths of overnight riches, true wealth building is about historical wisdom meeting personal goals—think of it as a unexpected analogy to a vinyl record collection, where each track adds depth without overpowering the whole album.

Why This Beats the Hype

Sure, social media screams about the next big crypto moonshot, but that’s often a truth uncomfortably ignored: most fads crash harder than a viral meme. Diversification counters this by ensuring your portfolio isn’t tied to one hype train.

Turing Risks into Riches with a Smile: The Hilarious Hurdles of Diversifying

Alright, let’s address the elephant in the room—or should I say, the bull in the stock market? Many folks shy away from diversifying because it feels overwhelming, like trying to juggle flaming torches at a circus. I mean, who wants to deal with asset allocation when your coffee’s already cold? But here’s the ironic twist: skipping it is like betting on a horse named «Long Shot» every time. The solution? Break it down into manageable steps that even a newbie can handle, with a dash of humor to keep things light.

First off, assess your current situation—piece of cake, right? Look at what you’ve got: maybe too many stocks from one industry, which is as balanced as a seesaw with one kid. Step one: Aim for a mix, say 60% stocks and 40% bonds if you’re risk-averse. Step two: Explore options like mutual funds or index funds for that easy diversification—it’s like hitting the jackpot without the casino drama. And step three: Rebalance annually, because markets change faster than fashion trends. To make this fun, imagine your portfolio as a band: stocks are the lead guitar, bonds the steady bass, and alternatives like real estate the quirky drummer. This way, even if one instrument fumbles, the show goes on.

| Asset Type | Advantages | Disadvantages |

|---|---|---|

| Stocks | High growth potential, like a startup success story | Volatile, can drop unexpectedly |

| Bonds | Stable returns, perfect for steady income | Lower yields in low-interest times |

| ETFs | Diversified exposure with low fees | Requires market knowledge to pick wisely |

Through this process, I’ve found that diversification isn’t just about numbers; it’s about peace of mind, like finally getting that perfect night’s sleep after a caffeine binge.

Wrapping It Up with a Fresh Spin: Your Investment Awakening

Here’s the twist you didn’t see coming: building a diversified portfolio isn’t merely about stacking cash; it’s about crafting a life where money works for you, freeing up time for what really matters, like that weekend hike or family dinner. So, take action now—grab a notebook and jot down your assets, then map out a simple diversification plan based on what we’ve covered. What’s the biggest investment mistake you’ve made that taught you a lesson? Share in the comments; let’s keep this conversation real and relaxed. After all, in the world of investments, we’re all in this together, one smart step at a time.