Chaos in cashflow. Wait, that might sound dramatic, but here’s the truth: while everyone’s chasing get-rich-quick schemes, venture capital investing often feels like the wild west of finance—full of potential rewards and gut-wrenching risks. Think about it: in a world where one startup could skyrocket your portfolio or leave you nursing losses, knowing the steps for venture capital investing isn’t just smart; it’s your ticket to making informed decisions that could secure your financial future. I’m diving into this not as a suit-and-tie expert, but as someone who’s been there, sleeves rolled up, learning the hard way. By the end, you’ll grasp the basics, avoid common pitfalls, and maybe even spot your next big opportunity. Let’s keep it real and relaxed, yeah?

My Accidental Adventure in Startup Stakes

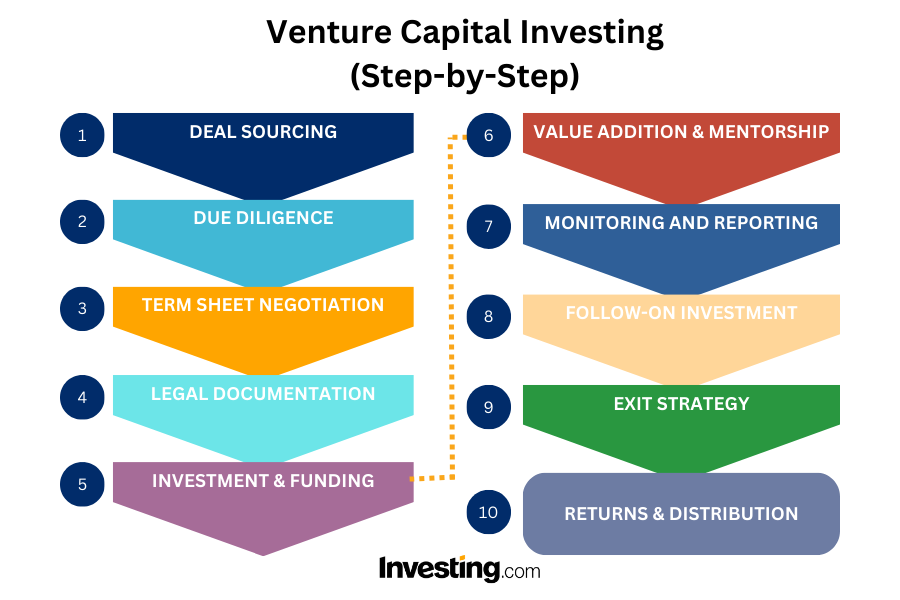

Picture this: a few years back, I was just a regular Joe with a day job, eyeing my savings like they were lottery tickets. Then, out of nowhere, a friend pitched me on this fledgling tech company—think of it as my own mini «Shark Tank» moment, but without the dramatic music. I dove in, following what I thought were the basic steps for venture capital investing: research, due diligence, and a leap of faith. Spoiler alert: it paid off, but not without a few heart-palpitating nights. Venture capital basics start with understanding that it’s not about quick flips; it’s a long game, like nurturing a garden where some seeds flourish and others… well, don’t.

In my opinion, this experience taught me a crucial lesson: always mix passion with pragmatism. I remember sifting through pitch decks late at night, coffee in hand, thinking, «Is this the next big thing or just hype?» That personal touch—yeah, the one where you actually talk to the founders—made all the difference. It’s like comparing a blind date to a arranged meeting; one feels forced, the other clicks. And just when I thought I’d nailed it, the market dipped, and I had to hold steady. Y’know, that «hang in there» mentality, as they say across the pond in the UK, «keep calm and carry on.» But here’s the twist: through that mess, I learned that how to start investing in VC involves not just money, but building relationships that turn into real insights.

VC’s Echoes from the Past: A Surprising Parallel

Ever wonder how venture capital stacks up against, say, the gold rush of the 1800s? Stick with me here—it’s not as far-fetched as it sounds. Back then, folks risked everything for a shiny nugget, much like today’s investors pouring funds into startups hoping for that unicorn exit. In the U.S., the spirit of innovation has always been this way, from railroad barons to Silicon Valley disruptors. A historical comparison shows that steps for venture capital investing mirror the due diligence of old-time prospectors: scouting the terrain (market research), assessing the ore (team evaluation), and staking your claim (funding rounds).

But let’s get real—there’s a myth that VC is only for the elite, when in fact, it’s democratized through platforms like AngelList. Imagine a conversation with a skeptical reader: «Sure, but what if I lose it all?» I’d say, «Fair point, but think of it like betting on horses; you study the form, but sometimes the underdog wins.» This analogy isn’t perfect—after all, horses don’t code apps—but it highlights the calculated risks. In places like bustling New York or tech-hub Austin, local investors often reference cultural icons, like how every startup dreams of being the next Apple. And benefits of venture capital? They include not just returns, but being part of something bigger, like fueling the economy’s engine.

A Quick Reality Check on Returns

Diving deeper, one unexpected comparison is to ancient trade routes; just as merchants diversified goods to mitigate loss, modern VC investors spread bets across sectors. This isn’t just history—it’s a strategy that works today, blending education with action.

The Hilarious Hurdles of Funding and How to Jump Them

Okay, let’s lighten up—investing in VC can feel like a comedy sketch gone wrong. Picture this: you’re all set to fund a promising startup, only to find out their «revolutionary» app is basically a fancy to-do list. Irony at its finest, right? The problem? Many newcomers skip the nitty-gritty steps, like thoroughly vetting the business model, and end up with buyer’s remorse. But here’s the solution, served with a side of sarcasm: treat it like planning a road trip. You wouldn’t hit the gas without checking the map, so why rush into venture capital investing steps without a solid plan?

First off, start with self-assessment—do you have the stomach for volatility? It’s like asking if you can handle a rollercoaster; if not, maybe stick to bonds. Then, dive into market analysis; I once overlooked this and, whoops, backed a company in a dying industry. Y’know, that «hindsight is 20/20» moment. To fix it, propose this mini experiment: grab a notebook and list three potential investments, rating them on risk and reward. You’ll see how successful VC investments often stem from blending intuition with data. And just when you think you’ve got it figured, remember: the market’s full of surprises, like a plot twist in a Netflix binge.

| Aspect | Venture Capital | Traditional Stocks |

|---|---|---|

| Risk Level | High—potential for big losses or gains | Moderate—more predictable but less explosive |

| Potential Returns | Up to 10x or more on hits | Steady 5-10% annually |

| Involvement | Active advising and networking | Passive ownership |

This table isn’t exhaustive, but it shows why VC might appeal if you’re after that thrill, all while keeping things balanced.

Wrapping It Up with a Fresh Angle

Here’s the twist: what if I told you that venture capital investing isn’t just about money—it’s about legacy, about being the wind beneath a startup’s wings? You’ve got the steps now, so don’t just sit there; take action by reviewing one potential investment opportunity this week. It could be as simple as signing up for a VC webinar or chatting with a mentor. And think on this: in a world obsessed with instant gratification, what’s the one risk you’re willing to take for long-term growth? Share your thoughts in the comments—I’m genuinely curious. After all, every journey starts with a single, bold step.