Money whispers secrets. Yeah, you heard that right—those green bills in your wallet aren’t just for lattes and impulsive Amazon hauls. But here’s the kicker: a whopping 68% of folks in the US feel lost when picking retirement accounts, according to a recent survey that made me do a double-take. We’re talking about your future nest egg, the one that could let you sip piña coladas on a beach instead of stressing over bills. In this article, I’ll walk you through the steps for retirement account selection, blending my own slip-ups with practical advice, all while keeping things light and real. By the end, you’ll feel equipped to make smarter investment choices that actually stick, without the usual financial jargon overload.

My Wake-Up Call with IRAs

Picture this: I’m in my late 20s, glued to my desk job, thinking retirement is as distant as Mars. Then, bam—one rainy afternoon, I opened that first statement from my fledgling IRA and nearly choked on my coffee. I’d picked the wrong type without a second thought, lured in by high-risk stocks that tanked faster than a bad plot in a superhero movie. That mess taught me a hard lesson about **retirement account selection**—it’s not just about chasing big returns; it’s about balance and your personal timeline.

Let me share a quick story: Back in 2015, I was that guy who thought, «401(k) or IRA? Eh, whatever.» Big mistake. I went for a traditional IRA thinking it was a piece of cake, only to realize later that my tax situation made a Roth IRA way better. Opinions vary, but from my corner, starting early with the right account can turn a modest salary into a comfy retirement fund. And just like in that iconic episode of «The Office» where Michael Scott bungles his finances, we all need a reality check. Here’s a metaphor for you: Selecting a retirement account is like choosing a life raft—pick the sturdy one, not the flashy inflatable that pops at the first wave.

To dive deeper, consider this **best retirement investments** angle: IRAs offer flexibility, but you’ve got to weigh the pros and cons. For instance, a traditional IRA lets you deduct contributions now, while a Roth grows tax-free later. It’s all about your current income and future plans.

From Pensions to 401(k)s: A Cultural Flip-Flop

Ever wonder how we shifted from grandma’s pension plans to today’s DIY **retirement investments** jungle? It’s like comparing a cozy family dinner to a solo microwave meal—convenient, but you miss the warmth. Historically, in the mid-20th century, pensions were the norm in the US, promising a steady paycheck post-work. Fast forward, and the 1980s brought 401(k)s as a cost-saving move for companies, leaving us to fend for ourselves. That’s a cultural whiplash if I’ve ever seen one, especially in a country where individualism is practically a national pastime.

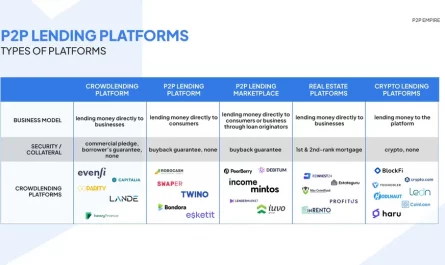

But let’s get real— this evolution isn’t all bad. Take my buddy from the Midwest, who swapped his pension dream for a 403(b) plan and hit the jackpot with compound interest. The truth? Modern accounts like 401(k)s encourage personal responsibility, though they demand more homework. A **comparison of retirement account options** might look like this:

| Account Type | Advantages | Disadvantages |

|---|---|---|

| 401(k) | Employer matches, higher contribution limits | Vested over time, limited investment choices |

| IRA | More control, flexible investments | Lower limits, no employer match |

See? It’s not rocket science, but ignoring this shift could leave you paddling upstream. And that’s when it hit me—investments aren’t just numbers; they’re about adapting to the times, like how millennials turned to index funds over stocks, riding the wave of tech booms.

Why Your Retirement Plan Might Be a Laugh Riot – And How to Straighten It Out

Okay, let’s get ironic for a sec: If your **steps for retirement account selection** involve picking based on a friend’s tip or that shady ad on social media, you’re basically treating your future like a sitcom punchline. I mean, who hasn’t chuckled at those memes about broke retirees? But here’s the uncomfortable truth—many folks overlook fees and diversification, turning potential gold into fool’s gold.

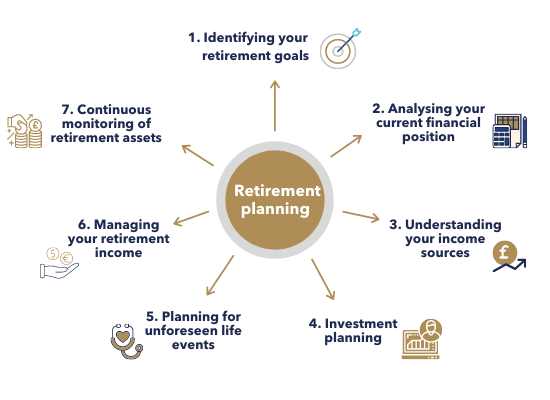

Imagine a chat with a skeptical reader: «Wait, you want me to analyze my risk tolerance? Sounds boring,» you’d say. Fair point, but hear me out: Start by assessing your goals (1. Define your retirement age and lifestyle), then match it to account types (2. Compare fees and taxes), and finally, diversify like your portfolio’s a balanced meal. It’s that simple twist that saves the day. For a mini experiment, grab a notebook and jot down your current savings rate—bet it’ll reveal gaps you didn’t know existed.

In my view, blending stocks and bonds in a 401(k) isn’t just smart; it’s like seasoning a stew—just the right mix keeps it from spoiling. And don’t even get me started on how overlooking inflation can sneak up on you, eroding your nest egg faster than a viral TikTok trend.

Wrapping this up with a fresh spin: Turns out, the real treasure in **retirement investments** isn’t the cash pile, but the peace of mind it brings—like finally binge-watching your favorite shows without money worries. So, here’s a straightforward call to action: Dive into your current accounts today and tweak one thing, whether it’s upping your contributions or switching to a low-fee option. What’s one bold step you’ll take to safeguard your golden years, instead of leaving it to chance? Seriously, drop a comment below and let’s keep the conversation going—your future self will thank you.