Rainy days loom, unexpected and uninvited, like that surprise plot twist in your favorite binge-watch session. Did you know that nearly 60% of folks in the US can’t scrape together $500 for an emergency without going into debt? It’s a harsh truth in our investment-heavy world, where we’re all chasing the next big stock tip, but forgetting the basics. The problem? Life’s curveballs—car breakdowns, medical bills—hit hard, leaving you stressed and scrambling. But here’s the real benefit: mastering emergency fund strategies in investments can build a financial safety net, giving you peace of mind and the freedom to invest boldly elsewhere. Stick around, and I’ll share how, with a relaxed chat over what works best.

That Time My Wallet Played Hide and Seek – A Personal Wake-Up Call

Okay, picture this: back in 2018, I was riding high on some tech stocks, thinking I was the next Warren Buffett. Then, bam—lost my job out of nowhere, and suddenly, bills were piling up like unread emails. I had a measly emergency fund, tucked away in a basic savings account, but it barely covered a month’s rent. And you know what happened next? It was a mess, full of late-night worries and ramen noodles for dinner. But that screw-up taught me a golden lesson: investing for emergency funds isn’t about getting rich quick; it’s about creating a buffer that grows steadily without the high risks.

I remember scouring investment options, weighing pros and cons with a cup of coffee in hand. Turns out, a high-yield savings account was my unsung hero—offering better interest than a regular bank, yet staying liquid for quick access. In my opinion, it’s like having a trusty sidekick; it’s not flashy, but it saves the day. For us everyday investors, especially in the US, where «keeping up with the Joneses» is a real thing, starting small with automated transfers feels more doable. Heck, I even threw in a bit of sarcasm when friends bragged about crypto gains: «Sure, go for it, but don’t cry when you need cash for that flat tire.» Building that fund transformed my approach, turning investments from a gamble into a reliable strategy.

Emergency Funds Through the Lens of Yesterday’s Money Woes

Ever compare modern emergency fund strategies to how our grandparents handled the Great Depression? Back then, families stashed cash under mattresses or in safe community banks, prioritizing liquidity over flashy stocks. It’s a cultural throwback—think of it as the financial equivalent of that old-school American saying, «A penny saved is a penny earned.» But here’s the twist: today, we’re smarter with tools like money market accounts or short-term Treasury bonds, which offer low-risk growth while keeping your funds accessible.

In contrast, ignoring this is like binge-watching «The Office» without laughing—pointless and a bit sad. A common myth is that all investments need to be high-octane, but the truth is uncomfortable: low-volatility options, such as certificates of deposit (CDs) laddered for different maturities, provide a steady climb without the market’s mood swings. For instance, in a country where «ballpark figures» guide our estimates, aiming for 3-6 months of expenses in a diversified setup feels more grounded. This historical nod reminds me that, just like Jim Halpert’s pranks on Dwight, sometimes the simplest plays win the game. So, if you’re skeptical, imagine chatting with your great-grandpa: «Kid, don’t put all your eggs in one basket—keep some for a rainy day fund.»

Why Procrastinating on Your Fund Feels Like a Bad Comedy Sketch – And How to Punchline It

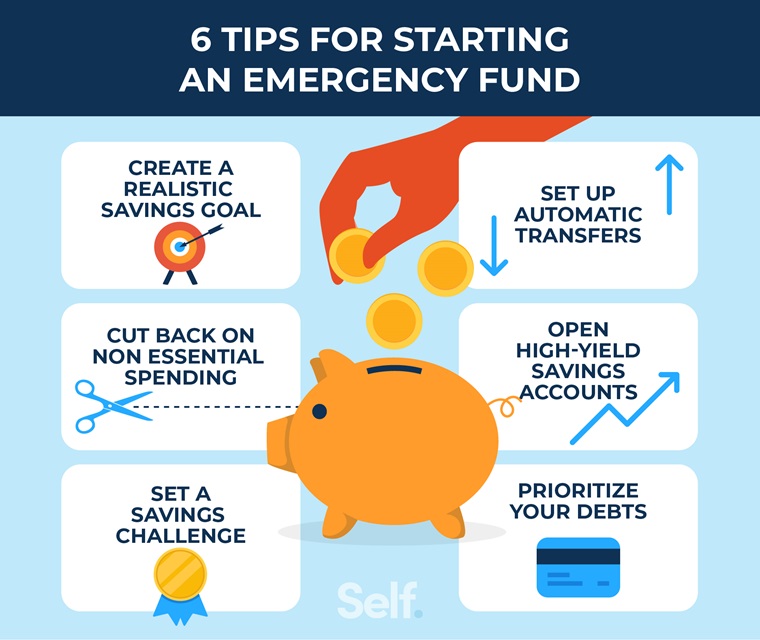

Alright, let’s get real: many of us treat building an emergency fund like that gym membership we never use—full of good intentions but zero follow-through. It’s almost funny, in a cringy way, how we chase steps to build an emergency fund only when disaster strikes, right? Picture this mini experiment: grab a notebook and jot down your monthly essentials. Now, add up what you’d need for three months—eye-opening, isn’t it? The problem? We get lured by high-return investments, forgetting that an emergency fund should be your boring, reliable backup, not your headline act.

To fix this, let’s break it down with a relaxed twist. First, assess your current savings and aim for a target based on your lifestyle—say, $1,000 to start if you’re just beginning. Two, choose vehicles like a Roth IRA for tax advantages, but keep it liquid; think of it as your financial «emergency brake.» And three, automate contributions, because who has time for manual transfers? In my book, this is like upgrading from a flip phone to a smartphone—suddenly, managing saving for emergencies becomes effortless. Plus, with inflation nibbling at your heels, opting for accounts with competitive yields keeps your money from losing value. Oh, and if you’re in the US, remember that «don’t count your chickens before they hatch» vibe—over-relying on investments can backfire.

| Investment Option | Pros | Cons |

|---|---|---|

| High-Yield Savings Account | Easy access, low risk, decent interest | Lower returns than stocks |

| Money Market Funds | Stable and liquid, slight growth | Inflation might outpace gains |

| Short-Term Bonds | More yield than savings, government-backed | Requires monitoring for maturity |

A Fresh Spin on Your Financial Future – Wrapping It Up

But here’s the twist: what if your emergency fund isn’t just about money, but about reclaiming your time and choices? Instead of panicking over unexpected bills, you’ll be that cool, collected person who says, «I’ve got this.» So, take action now—start by setting aside just $50 a week into a dedicated account; it’s simpler than you think. And just when you feel set, ask yourself: what’s the one investment habit holding you back from true financial freedom? Share in the comments; I’m all ears for your stories.