Money whispers secrets. Yep, those crumpled bills in your wallet aren’t just green—they’re gossiping about your future. But here’s the kicker: while 78% of folks dream of financial freedom, a whopping 60% couldn’t swing a $500 emergency without spiraling into debt. That’s not just a number; it’s a wake-up call that hits home, especially in the wild world of investments. Today, we’re diving into the **steps for creating an emergency fund**, not as some dry checklist, but as a relaxed chat about building that safety net. Think of it as your personal financial bodyguard, ready to shield you from life’s curveballs. By the end, you’ll see how smart investments can turn this from a chore into a chill, empowering habit. Let’s ease into it, shall we?

That Time I Almost Lost It All – A Wake-Up Call from My Own Wallet

Picture this: I’m sitting in my tiny apartment, bills piling up like unpaid parking tickets, and bam—my car decides to throw a tantrum. Flat tire, engine woes, the works. And just like that, I was staring down a $1,200 repair bill. No exaggeration, folks; this was me a few years back, fresh out of college and thinking investments were for the suits on Wall Street. But here’s the real story: I had zilch in my emergency fund, relying on credit cards that charged interest faster than a caffeinated squirrel. That mess taught me a harsh lesson—without a buffer, life’s surprises can knock you flat.

Fast-forward, and I’ve turned things around by focusing on **emergency fund investments** that actually grow. It’s not about stashing cash under the mattress; it’s about parking it in high-yield savings accounts or short-term bonds that earn you a decent return without the rollercoaster of stocks. My opinion? This approach feels like giving your money a cozy blanket—it grows steadily, and you sleep better knowing it’s there. Remember that Friends episode where Phoebe’s financial chaos leads to hilarity? Well, real life isn’t as funny, but building an emergency fund is like having your own Monica to organize your finances. And that’s when it hit me: start small, but start smart. By allocating just 10% of my monthly income to a dedicated account, I built up three months’ worth of expenses in under a year. It’s a game-changer, especially if you’re in the US, where unexpected medical bills can pop up like unwanted pop-ups on your phone.

From Piggy Banks to Stock Markets – How Cultures Evolved Emergency Savings

Ever wondered why your grandma swore by that old piggy bank? It’s not just nostalgia; it’s a cultural relic from times when hiding cash was the norm. Jump to modern investments, and we’re talking a whole different ballgame—like comparing a horse-drawn carriage to a Tesla. In the UK, they might say «bob’s your uncle» for something simple, but creating an emergency fund today involves savvy moves in the investment world. Historically, families in agrarian societies stashed grains as their safety net, a far cry from today’s digital portfolios. Yet, the core idea remains: protect what you’ve got.

Let’s get unexpected here—think of emergency funds as the unsung heroes of your investment strategy, similar to how jazz evolved from African rhythms to global hits. In the US, with our love for tech and stocks, you can now use robo-advisors to automate contributions to low-risk funds. This isn’t just saving; it’s investing in stability. For instance, comparing a traditional savings account (low 0.01% interest) to a money market fund (up to 4-5%) is like choosing between walking and flying—both get you there, but one is way more efficient. Here’s a quick table to break it down, because who doesn’t love a visual nudge?

| Investment Option | Pros | Cons |

|---|---|---|

| High-Yield Savings Account | Easily accessible, earns interest, low risk | Interest rates can fluctuate |

| Money Market Funds | Higher returns than regular savings, diversified | Potential for slight volatility |

| Short-Term Bonds | Stable growth, good for emergencies | Requires more knowledge to manage |

This evolution shows that **steps for creating an emergency fund** aren’t about hoarding; they’re about smart, cultural shifts in how we handle money. My take? It’s liberating, like ditching that rusty piggy bank for an app that does the heavy lifting.

Why Your Wallet is Laughing at You – Irony and the Fix for Financial Fumbles

Oh, the irony: you hustle for that paycheck, only to let it vanish on impulse buys, leaving you high and dry when the fridge breaks. «But wait,» you might say, «investments sound complicated!» Fair point, but here’s the truth—skipping an emergency fund is like ignoring the fire alarm because you’re comfy on the couch. In a world obsessed with get-rich-quick schemes, building one through thoughtful investments is the underrated hero. Let’s chat about this as if we’re grabbing coffee: imagine you’re skeptical, thinking, «Do I really need to tie up my cash?» Well, yeah, because inflation is nibbling away at your savings faster than you can say «stock market dip.»

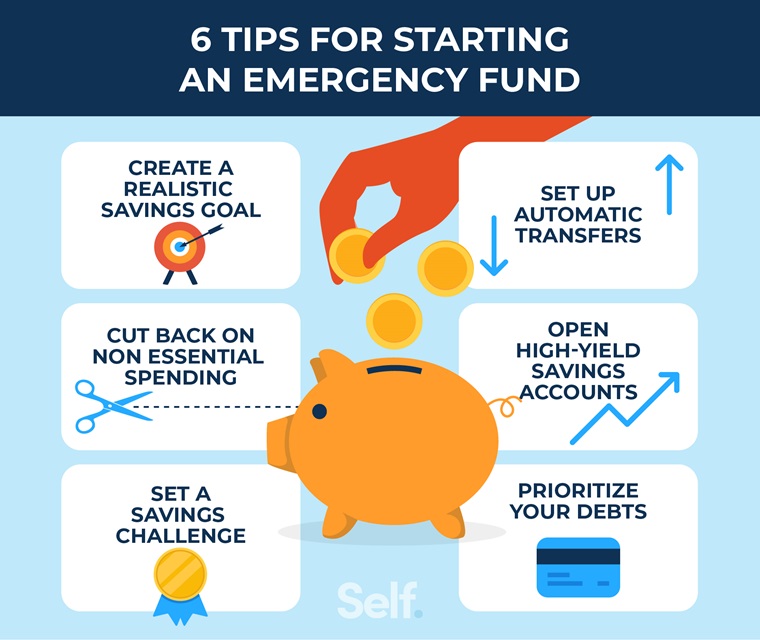

To counter that, here’s a mini experiment for you—grab a notebook and track your expenses for a week. What pops up? Probably a bunch of «oops» moments, like that coffee run you didn’t need. Now, apply that insight to **emergency fund steps**: 1) Set a goal, like covering three to six months of living costs. 2) Choose liquid investments, such as Treasury bills, that you can access quickly without penalties. 3) Automate transfers to build it painlessly. It’s not rocket science; it’s like training for a marathon—one step at a time. And just when you think it’s boring, remember how memes like the «broke student» trope make us laugh at our own habits. By weaving in a bit of irony, we see that investing in an emergency fund isn’t a buzzkill—it’s your ticket to financial chill.

Wrapping this up with a twist: what if your emergency fund isn’t just about money, but about reclaiming your time and peace? Instead of stressing over the next crisis, imagine having that buffer to pursue passions. So, here’s your call to action—dive in today: open a high-yield account and stash away your next bonus, no excuses. And one last question to ponder: how has ignoring your finances shaped your life’s story, and what one change could rewrite it? Drop your thoughts below; let’s keep this conversation going.