Money doesn’t sleep, especially when it’s working for you on autopilot. Wait, that’s not entirely true—most of us toss and turn over investment choices, right? Picture this: you’re glued to your screen, second-guessing every stock move, only to watch your portfolio swing like a caffeinated squirrel. But here’s the uncomfortable truth—manual investing often leads to costly mistakes, with studies showing that emotional decisions tank about 80% of individual portfolios. Enter automated investing: it’s like having a chill financial buddy who handles the heavy lifting while you sip coffee. By following simple steps, you can build wealth without the daily drama, turning your money into a reliable sidekick. Stick around, and I’ll walk you through it all, sharing my own slip-ups and wins to make this journey feel real and doable.

My Bumpy Ride into Automated Investing

Oh man, where do I start? Back in 2018, I was that guy staring at my laptop until 2 a.m., convinced I could outsmart the market like some Wall Street wizard. Spoiler: I couldn’t. I poured cash into a few hot stocks based on a tip from a cousin—yeah, bad idea—and watched it evaporate faster than ice cream on a summer day. That’s when I stumbled upon automated investing, almost by accident. I remember signing up for a robo-advisor platform, thinking, «This better not be another tech fad.» Fast forward a couple of years, and my portfolio’s humming along, diversified and growing without me losing sleep. The lesson? Automation isn’t about being lazy; it’s about smart delegation. Automated investing steps start with assessing your risk tolerance, which I totally botched at first by going all-in on tech stocks.

Let me break it down with a quick, real anecdote: I once set up an automated plan that rebalanced my assets quarterly. At first, it felt weird, like trusting a robot with your wallet—think of it as handing your car keys to that reliable friend who never speeds. But when the market dipped in 2020, my setup sold high and bought low without me panicking. Opinion time: as someone who’s been there, automated investing beats manual hands-down for folks like us who aren’t financial gurus. And hey, if you’re in the UK, it’s a bit like that «bob’s your uncle» ease—set it and forget it, mate. Just don’t expect perfection; even algorithms have off days, you know?

From Stockbrokers to Algorithms: When History Got a Tech Upgrade

Ever think about how your great-grandparents handled investments? They probably chatted with a broker over tea, poring over newspapers for tips—sounds quaint, but it was a rollercoaster of guesswork. Fast-forward to today, and automated investing is like swapping that old bicycle for an electric scooter. Take Warren Buffett, for instance; he’s the king of value investing, but even he admits to using tech tools now. It’s a cultural shift, really—from the Wild West days of trading floors to apps that do the math for you. In the U.S., this evolution mirrors how streaming services like Netflix changed movie nights; no more waiting for schedules, just on-demand convenience.

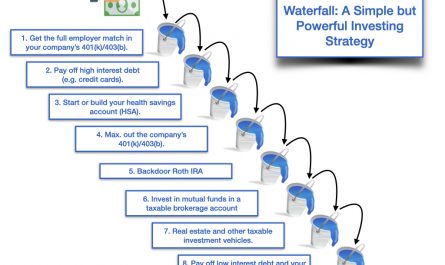

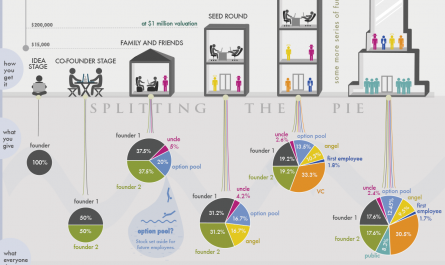

Here’s a twist: imagine comparing that historical hustle to modern automated investing strategies. Back then, diversification meant spreading bets across railroads and oil; now, it’s algorithms slicing your portfolio into ETFs and bonds with precision. But don’t get me wrong—it’s not all roses. While old-school methods built empires, they lacked the data-driven edge we have. For a clear picture, let’s lay it out in a simple table:

| Aspect | Historical Investing | Automated Investing |

|---|---|---|

| Speed | Slow, manual decisions | Instant adjustments |

| Cost | High broker fees | Low, often under 0.25% annually |

| Risks | Emotional biases galore | Reduced human error, but tech glitches |

| Accessibility | For the wealthy elite | Open to anyone with a smartphone |

This comparison shows how steps for automated investing make finance more inclusive, like turning a exclusive club into a neighborhood barbecue. And just when you think it’s too good to be true, remember that episode of «The Office» where Michael Scott tries day trading? Yeah, hilarious mess—don’t be that guy.

Imagining a Chat with Your Doubting Inner Voice on Autopilot Wealth

Alright, skeptic, let’s have it out. You’re thinking, «Automated investing? Sounds like a scam to rob me blind while I nap.» Fair point, but hear me out—what if I told you it’s more like setting your phone to auto-update apps? No fuss, just smoother operation. Picture us chatting over coffee: You say, «But what about market crashes?» And I’d counter, with a smirk, that algorithms adjust faster than you can say «recession,» using tools like stop-loss features. The problem? Many folks overthink it, missing out on passive income that could fund their dreams.

Irony alert: We stress about controlling every penny, yet automation handles it with the ease of a British «cuppa tea»—simple and soothing. Try this mini experiment: Grab your investment app right now and simulate a portfolio. Set your goals, watch it suggest allocations. And that’s when it hits you… how much time you’ve wasted manually tweaking. Best practices for automated investing include regular reviews, not micromanaging. In the end, it’s about trusting the process, like relying on that trusty GPS instead of a crumpled map.

To wrap this up with a fresh spin: Who knew that stepping back could actually propel you forward in the investment game? Instead of endless monitoring, automated investing lets your money do the marathon while you enjoy life. So, here’s a specific call to action—dive in today by opening a free robo-advisor account and linking it to your bank. You’ll thank yourself later. And on a reflective note, what’s one bad investment decision that’s still haunting you, and how might automation have changed that?