Whiskey, wisdom, and wallets – that’s how I often kick off chats about money, especially when we’re diving into the world of investments. Here’s a contradiction for you: while Wall Street paints stocks as a high-stakes gamble, dividend-paying stocks can feel like your favorite comfy chair, offering steady income without the constant drama. But let’s face it, in a world where everyone’s chasing the next big tech unicorn, ignoring these reliable earners means missing out on building real wealth over time. Did you know that, according to historical data from Standard & Poor’s, reinvesting dividends has accounted for about 85% of the total return of the S&P 500 since 1926? That’s not just a number; it’s a wake-up call for anyone seeking passive income. In this article, we’ll explore practical ideas on **dividend-paying stocks**, sharing strategies that could turn your portfolio into a dependable cash machine, all while keeping things relaxed and real.

My First Dividend Check: A Tale of Triumph and Takeaways

Picture this: back in 2010, I was a wide-eyed newbie in the investment game, fresh out of college and armed with about $500 from a summer job. I remember plunking it into shares of a solid utility company known for its **high-yield stocks**. Fast forward a few months, and there it was – my first dividend payout, a modest $15 that felt like hitting the jackpot. But here’s the thing, it wasn’t the amount that blew me away; it was the realization that money could make money while I slept. That experience taught me a crucial lesson: **dividend investing strategies** aren’t about get-rich-quick schemes; they’re about patience and picking companies with a history of payouts.

Of course, not every story ends perfectly. I once overlooked a stock’s payout ratio – you know, that metric showing if a company can actually afford its dividends – and ended up with a cut. And that’s when it hit me… the importance of due diligence. In my opinion, based on years of tinkering with portfolios, you should always hunt for stocks from sectors like consumer staples or healthcare, where businesses are as reliable as your morning coffee. Throw in a dash of that American can-do spirit, like how folks in the Midwest swear by steady gigs over flashy ones, and you’ve got a recipe for long-term success. It’s like comparing a reliable old pickup truck to a sports car – the former might not turn heads, but it’ll get you where you need to go.

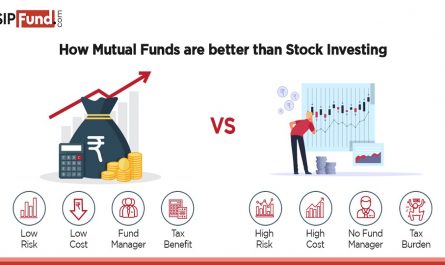

Dividends vs. The Wild West of Growth Stocks: A Historical Showdown

Let’s flip the script and wander into history for a bit. Imagine the 19th-century Gold Rush, where dreamers flocked to California chasing overnight fortunes, only for most to come up empty-handed. That’s eerily similar to the frenzy around growth stocks today – think of those tech darlings soaring «to the moon,» as the meme goes, but crashing just as fast. On the flip side, **dividend-paying stocks** are like the steady miners who built sustainable operations, providing consistent yields year after year.

Take a cultural angle: in places like the UK, where tea and tradition rule, investors have long favored dividend aristocrats – companies that have increased payouts for at least 25 years. It’s a nod to that British stiff-upper-lip approach, valuing stability over speculation. But here’s an unexpected analogy: investing in dividends is like binge-watching a classic series like «The Office» instead of hopping on the latest Netflix hype. Sure, the new shows might dazzle, but the old favorites deliver reliable laughs and, in this case, income. A common myth is that dividends signal a boring, low-growth company, but the uncomfortable truth? Many of these firms, like Procter & Gamble, have handily beaten the market over decades. So, next time you’re pondering your options, ask yourself: do I want the Wild West adventure or the proven path?

A Quick Twist on That Old Debate

If you’re skeptical, imagine a chat with a buddy who’s all in on growth: «Dude, why tie yourself to dividends when crypto could 10x your money?» I’d counter with a grin, «Because, my friend, it’s like choosing a steady paycheck over lottery tickets – sure, you might win big, but what’s your plan for the lean times?» This mini experiment: pick one dividend stock and track its yield versus a growth stock for six months. You’ll see the quiet power of compounding returns.

Why Your Portfolio Might Be Napping – And How to Jazz It Up With Smart Picks

Alright, let’s get ironic for a second: if your investment strategy is as exciting as watching paint dry, it’s probably because you’re ignoring **ideas on dividend-paying stocks** that could spice things up. I mean, who wants a portfolio that’s just sitting there, snoozing away while inflation nibbles at your gains? The problem? Many folks chase trends without considering yield, ending up with stocks that cut dividends faster than a bad haircut. But here’s the fix, delivered with a relaxed smirk: start by focusing on **stocks for passive income** from blue-chip companies.

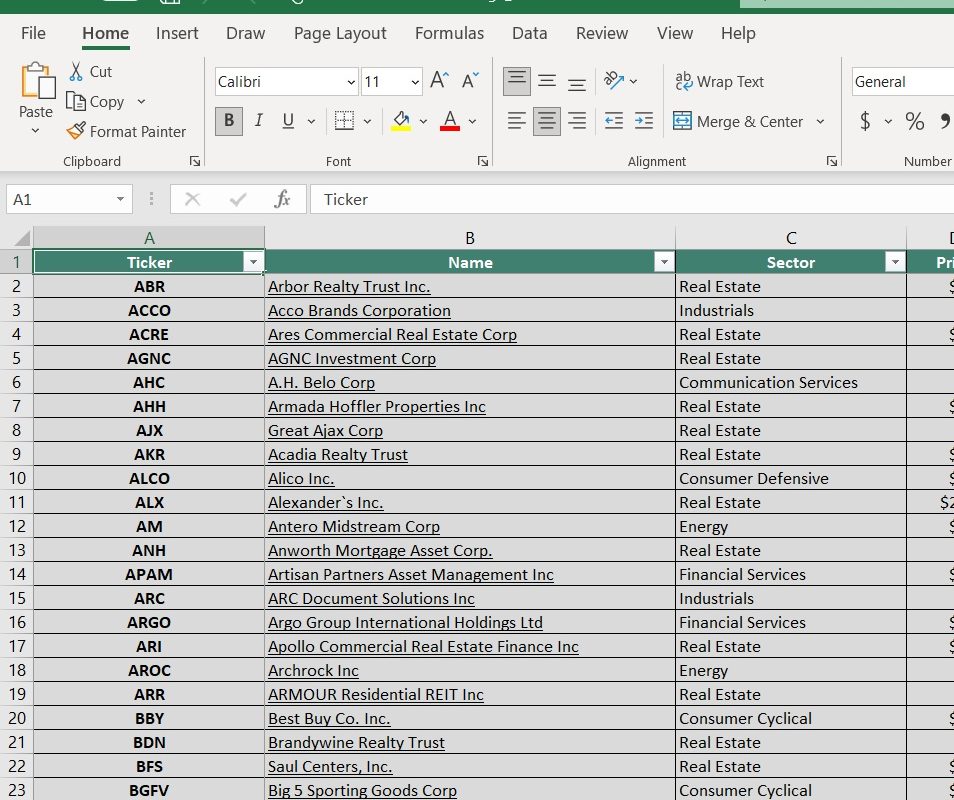

For instance, let’s break it down with a simple comparison. Take two popular options:

| Feature | Dividend-Paying Stock (e.g., Johnson & Johnson) | Growth Stock (e.g., Tesla) |

|---|---|---|

| Average Yield | 2-3% annually | 0% (reinvests profits) |

| Risk Level | Moderate, with steady payouts | High, volatile prices |

| Long-Term Appeal | Builds wealth through reinvestment | Potential for massive gains, but losses too |

See? It’s a piece of cake to spot the advantages. In my subjective view, blending in some dividend gems can turn your investments into a well-rounded ensemble, like adding a solid bass line to a song. And just when you think you’ve got it figured out… remember to diversify across industries to avoid getting burned by sector downturns. A pro tip: use tools like dividend screeners on sites like Yahoo Finance to filter for **best dividend stocks**, but don’t go overboard – keep it simple, like that easygoing vibe of a Sunday barbecue.

What if I told you that **dividend-paying stocks** aren’t just about padding your bank account, but about crafting a life with more freedom and less worry? That’s the twist: they’ve been my secret to traveling on a whim or splurging on family without guilt. So, here’s a specific call to action – pick one **high-yield stock** from a familiar sector and add it to your watchlist right now. And to wrap this up, I’ll leave you with a reflective question: how might embracing dividends reshape your financial story, turning what feels like a gamble into a genuine legacy? Share your thoughts in the comments; I’m all ears.