Whales and wallets—wait, hear me out. In a world where billionaires flex their yachts and everyday folks chase stock tips, it’s a real head-scratcher that giving back often gets sidelined in the investment game. Here’s the uncomfortable truth: traditional investing can pile up cash but leave a trail of inequality, while philanthropic investing flips the script, letting you grow your portfolio and tackle global issues like poverty or climate change. Stick around, and I’ll share ideas that not only boost your returns but also make you feel like you’re part of the solution, not the problem. It’s about turning your money into a force for good, without the guilt.

My Accidental Dive into Giving Back

Picture this: a few years back, I was buried in spreadsheets, obsessing over tech stocks, when a friend dragged me to a seminar on impact investing. «Come on, it’s not as boring as it sounds,» she said. And boy, was she right—or wrong in the best way. I ended up sinking cash into a fund supporting renewable energy in underserved communities, thinking it’d be a side gig to my usual bets. Fast forward, and that move doubled my initial investment while helping power schools in rural areas. Philanthropic investing, it turns out, isn’t just for the Rockefellers; it’s for anyone wanting to align their wallet with their values.

But let’s get personal—I’ve got this quirky habit of comparing investments to my love for hiking. You know, like how a steady climb leads to a breathtaking view? Well, my first foray felt like that: treacherous at first, with market dips making me sweat, but the payoff was this warm, fuzzy sense of purpose. Opinions vary, but I reckon it’s a no-brainer; why chase pure profits when you can impact investing strategies that weave in social good? Throw in some local flavor—here in the States, we say «hit the nail on the head» for getting things just right—and you’ve got a recipe for change. And that’s when it hit me: investing doesn’t have to be all about me, me, me.

From Old-School Givers to Modern Movers

Ever wonder how we got from Andrew Carnegie donating libraries to today’s apps that let you micro-invest in clean water projects? It’s a wild evolution, blending history’s big gestures with our digital age. Take Carnegie, for instance—he amassed a fortune in steel but poured it back into education, proving that philanthropic investing ideas have roots in the Gilded Age. Fast-forward to now, and it’s like comparing a vintage car to a Tesla: both get you places, but one is sleek, efficient, and plugged into the future.

This cultural shift hits home when I think about how memes like the «Bill Gates giving away money» ones poke fun at wealth redistribution. It’s ironic, really—while Gates pushes for innovative funds targeting global health, your average investor might still cling to the myth that charity means losing out. But here’s the truth: studies show that socially responsible investments can outperform traditional ones, especially in volatile markets. In places like Europe, where «sustainability» isn’t just a buzzword, folks are biting the bullet on green bonds. Me? I see it as an unexpected analogy to binge-watching «The Office»—you start for the laughs, but end up reflecting on life’s bigger lessons, like how your investments could foster community ties.

The Hilarious Hurdle of Hoarding and How to Hop Over It

Okay, let’s address the elephant in the room—or should I say, the golden goose hiding under the bed? So many people stockpile wealth like it’s going out of style, convinced that mixing money with morality is a fool’s errand. Irony alert: in a culture obsessed with «The Wolf of Wall Street» vibes, we’re ignoring how philanthropic investing could turn that wolf into a sheepdog for good causes. Picture a conversation with a skeptical reader: «Wait, you’re telling me I can fund affordable housing and still see returns? Sounds too good to be true.» Well, buddy, it’s not—it’s just smart.

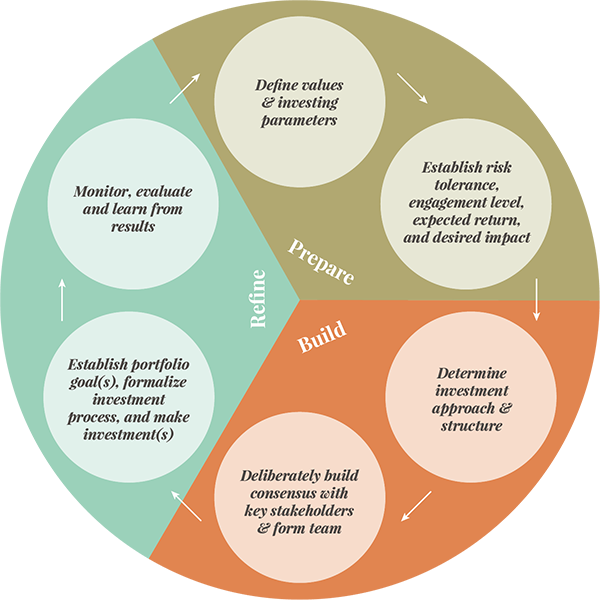

To solve this, start by exploring ethical investment options like ESG funds, which screen for environmental, social, and governance factors. Step 1: Audit your current portfolio—do any holdings clash with your beliefs? Step 2: Dive into diversified options, such as community development funds that support local economies. And step 3: Track progress with tools that measure both financial gains and social impact, making it a piece of cake to stay accountable. I’ve tried this myself, and let me tell you, it’s like upgrading from a flip phone to a smartphone—suddenly, everything’s connected, and you’re not just investing; you’re influencing. Y’know, that incomplete thought where you realize, «And just when you thought money was all about numbers…»

A Fresh Twist on Your Wallet’s Purpose

Wrapping this up with a curveball: what if the real ROI isn’t just in dollars, but in the legacy you leave? Philanthropic investing isn’t a nice-to-have; it’s a game-changer that proves you can profit while protecting the planet. So, here’s your call to action—pick one philanthropic investing idea from this chat, like researching a microfinance fund, and give it a whirl right now. It’ll feel empowering, I promise.

And to leave you pondering: how might redirecting even a fraction of your investments reshape the world you live in? Drop your thoughts in the comments; let’s keep this conversation rolling.