Money whispers secrets. Yep, that’s right—while flashy crypto crashes make headlines, the steady hum of income-focused portfolios keeps the lights on for savvy investors. Here’s the kicker: in a world obsessed with get-rich-quick schemes, ignoring reliable income streams is like skipping dessert after a feast. You’ll miss out on that sweet, ongoing payout that could fund your coffee habit or even retirement dreams. This article dives into practical ideas for building portfolios that prioritize steady income, helping you sleep better at night without the rollercoaster rides. By the end, you’ll have actionable strategies to turn your investments into a reliable cash flow machine. Let’s chat about why income-focused portfolios might just be the unsung heroes of your financial future.

That Time I Got My First Dividend Surprise

Picture this: back in my early twenties, I was glued to the stock market like a kid in a candy store, chasing every hot tip. But then, out of nowhere, a modest dividend check landed in my account from a blue-chip stock I’d almost forgotten about. And just like that, it hit me—while I was daydreaming about hitting the jackpot, this quiet earner was dropping cash into my lap. That experience taught me a golden lesson: dividend stocks aren’t just for retirees; they’re the backbone of an income-focused portfolio. Fast forward a few years, and I’ve built a mix that includes reliable names like Johnson & Johnson or Procter & Gamble, which have paid dividends for decades.

Now, don’t get me wrong, I’m no Wall Street wizard—just a regular guy who learned the hard way that not all investments need to be thrilling. In my opinion, subjective as it is, starting with dividend aristocrats—companies that have increased dividends for at least 25 years—feels like betting on a trusted old friend. Throw in some REITs (Real Estate Investment Trusts) for good measure, and you’re looking at yields that can top 4-6%. It’s like that scene in «The Office» where Michael Scott finally realizes steady wins the race; no explosions, just consistent progress. For folks in the US, this approach echoes the American dream of compound growth, where reinvesting dividends turns pennies into a fortune over time.

From Feudal Lands to Wall Street: The Evolution of Income Generators

Ever think about how medieval lords collected rents from their peasants? Fast-forward to today, and it’s basically the same vibe with bond investments or rental properties in your portfolio. Historically, income-focused strategies date back to ancient agriculture, where steady harvests meant survival. In contrast, modern investors often chase the next tech unicorn, forgetting that bonds have been the quiet stabilizers since the Renaissance. Here’s a twist: while Silicon Valley booms and busts like a bad episode of «Silicon Valley» the show, government and corporate bonds offer predictable interest payments that laugh in the face of volatility.

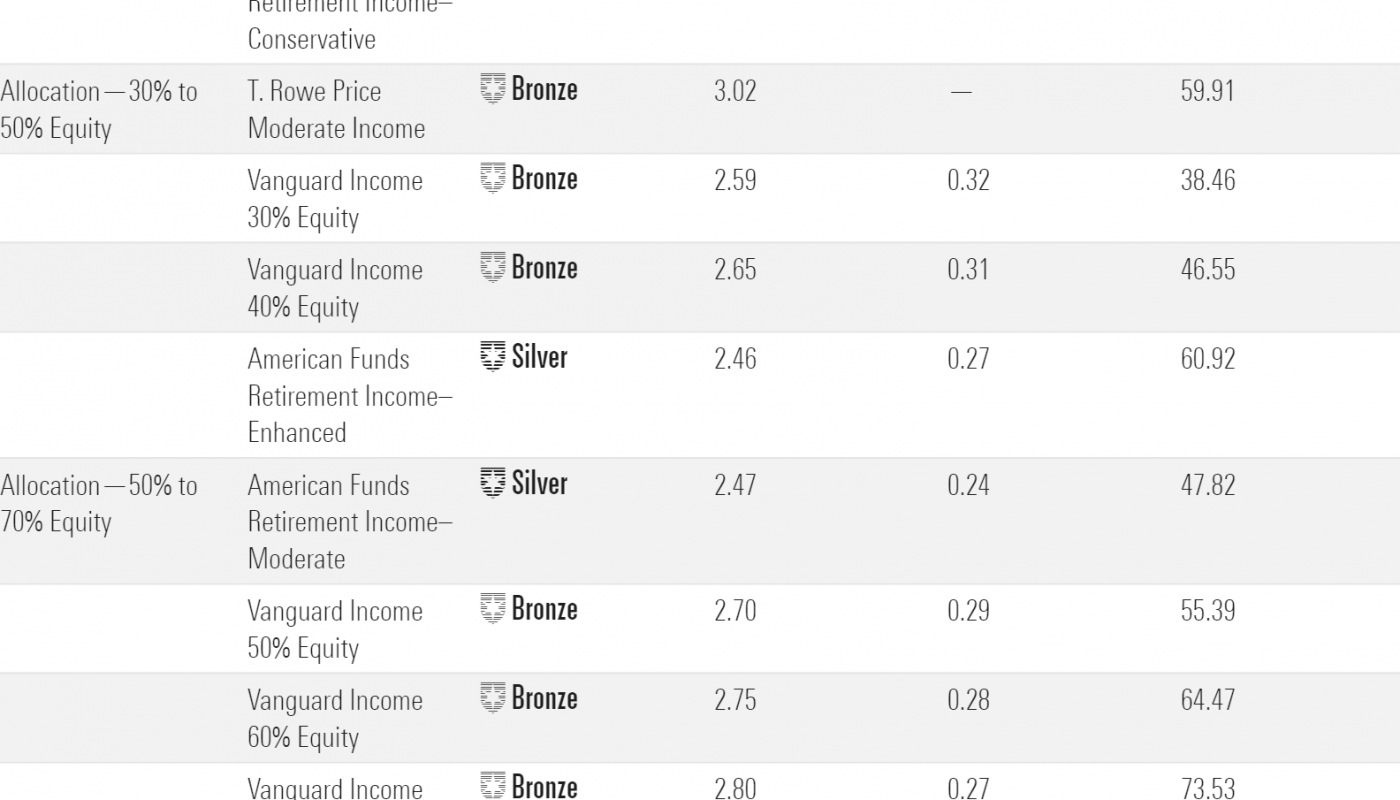

Let’s break it down with a simple comparison. Imagine pitting high-yield bonds against dividend ETFs—what’s the real deal?

| High-Yield Bonds | Dividend ETFs | |

|---|---|---|

| Risk Level | Medium-high (like spicy food—thrilling but might burn) | Lower (steady, like comfort food) |

| Average Yield | 5-8% | 2-4% |

| Liquidity | Good, but watch for market dips | Excellent, trade like stocks |

| Best For | Those seeking higher income with some adventure | Long-term stability and diversification |

See? Bonds might feel like the boring uncle at family reunions, but they’re the ones who bail you out when tech stocks tank. In British terms, it’s a bit like relying on the pound sterling versus the wild fluctuations of emerging markets—solid and dependable.

When Greed Trips You Up—And How to Sidestep It with Smarts

Alright, let’s get real for a second: chasing high-growth stocks is like hunting for buried treasure in a video game—fun until you’re left empty-handed. I mean, who hasn’t fallen for that meme stock hype, only to watch it evaporate? The irony? While everyone’s yelling about the next big thing, passive income strategies are chilling in the background, raking in checks without the drama. Take municipal bonds, for instance; they’re tax-free and steady, yet so many skip them because they sound as exciting as watching paint dry.

But here’s the fix, and it’s easier than you think. Start by allocating 40-60% of your portfolio to income assets—step 1: assess your risk tolerance, step 2: diversify with a mix of stocks and bonds, and step 3: monitor and adjust quarterly. Why? Because, as I see it, blending in some preferred stocks or annuities can turn your investments into a reliable sidekick, not a fickle fair-weather friend. And just like Walter White in «Breaking Bad» built his empire on calculated moves, you can craft a portfolio that generates cash flow without the moral dilemmas. For a local twist, it’s as straightforward as pie in the US South—simple, satisfying, and worth the effort.

Wrapping this up with a fresh spin: turns out, the real freedom isn’t in wild gambles but in the quiet confidence of steady income that lets you live life on your terms. So, here’s your call to action—grab a notebook, list out your current holdings, and swap in at least one income-focused investment idea from this chat right now. What’s one overlooked asset in your portfolio that’s quietly building your wealth? Drop a comment; I’d love to hear your thoughts and swap stories. After all, we’re all in this investment game together.