Whispers of wealth, anyone? It’s easy to daydream about college funds multiplying like rabbits, but let’s face it: with tuition fees climbing faster than a kid on a sugar rush, saving for education can feel like a high-stakes game you’re not quite ready for. Here’s the contradiction—while everyone talks about the «American Dream,» student debt has ballooned to over $1.7 trillion, trapping graduates in a financial quicksand. But don’t sweat it; this article dives into smart college fund investments that could turn your savings into a powerhouse, giving you peace of mind and a leg up for your family’s future. We’ll explore real strategies, sprinkled with my own blunders, to help you navigate investment ideas for college without losing your cool.

Remembering My Own College Fund Fumble

Picture this: back in the early 2000s, I was a wide-eyed parent staring at a piggy bank like it held the secrets of the universe. I thought stuffing cash under the mattress was the ultimate safe bet—talk about a rookie mistake. But one rainy afternoon, inflation hit harder than a plot twist in a Marvel movie, and poof, my daughter’s college dreams started looking blurry. That experience taught me a gritty lesson: passive saving isn’t enough when it comes to educational investments. It’s all about diversification, folks.

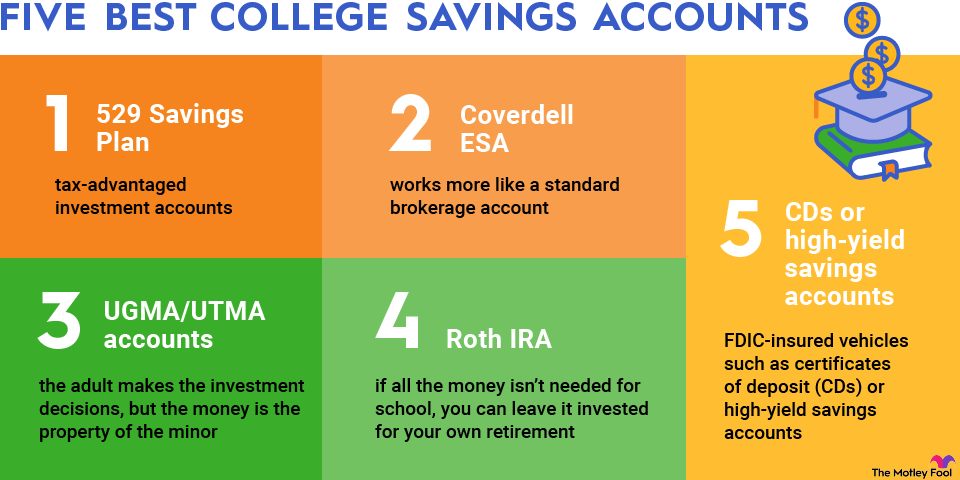

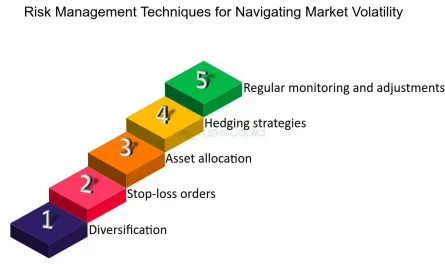

Let me share a quick anecdote from my neck of the woods in the Midwest. I finally wised up and dipped my toes into a 529 plan, those tax-advantaged accounts designed specifically for college fund investments. It wasn’t a piece of cake at first—I mean, balancing stocks and bonds felt like juggling flaming torches. But here’s my subjective take: if you’re aiming for long-term growth, blending in some mutual funds can be a game-changer. Think of it as planting a garden; you wouldn’t just sow one seed, right? By mixing low-risk bonds with a sprinkle of growth stocks, I watched our fund grow steadily, turning what could’ve been a disaster into a solid win. And just when I thought I’d nailed it, life threw a curveball—market dips that had me questioning everything. Yet, that imperfection made me appreciate the beauty of risk management in investments, like a unexpected plot in your favorite binge-watch series.

From Piggy Banks to Portfolios: How Investments Have Evolved

Ever wonder how our great-grandparents funded education? Back in the day, it was all about stashing coins in a jar or relying on family trades—simple, sure, but hardly equipped for today’s economy. Fast-forward to now, and investment strategies for education have morphed like characters in a «Game of Thrones» saga, from feudal simplicity to complex empires. In the U.S., we’ve shifted towards modern tools like Roth IRAs or ETFs, which offer flexibility that old-school methods just couldn’t match.

Let’s compare this evolution in a straightforward table to highlight the shift:

| Traditional Approach | Modern Alternative | Key Advantages |

|---|---|---|

| Savings accounts or CDs | 529 plans or index funds | Tax benefits and potential for higher returns, versus low interest rates that barely beat inflation |

| Family loans | Education savings bonds | Lower risk with government backing, compared to strings-attached loans that could strain relationships |

This comparison isn’t just numbers; it’s a cultural nod to how we’ve moved from «pull yourself up by your bootstraps» folklore to savvy, data-driven decisions. As someone who’s seen the stock market swing wilder than a rodeo bull, I say skip the myths—don’t buy into the idea that stocks are too volatile for saving for college. Sure, they can dip, but over time, they’ve historically outpaced inflation. It’s like trading in your old jalopy for a hybrid car; yeah, it’s an adjustment, but the mileage is worth it. And that’s when it hit me—investing isn’t about perfection; it’s about adapting, especially in a world where memes like the «This is fine» dog remind us to stay calm amid chaos.

Dodging the Bullet: Funny Investment Pitfalls and Smart Moves

Okay, let’s get real for a second—nobody wants to admit they’ve chased the wrong shiny object in investments. Imagine me, years ago, getting starry-eyed over some hot tech stock tip from a buddy, only to watch it crash faster than a viral TikTok trend. Hilarious in hindsight, right? But here’s the truth: common pitfalls like ignoring diversification can turn your college fund investments into a comedy of errors. The fix? Start with a simple exercise: grab a notebook and list your assets, then mix in some blue-chip stocks for stability.

1. First, assess your risk tolerance— are you the type to panic at market jitters or ride the waves?

2. Next, explore options like target-date funds, which automatically adjust as college nears, making it easier than piecing together a puzzle blindfolded.

3. Finally, don’t overlook international funds; they add flavor to your portfolio, hedging against local downturns.

This approach isn’t just theory; it’s born from my own blunders, where I once overlooked fees that ate into returns like ants at a picnic. By focusing on low-cost options, you sidestep those traps and build a robust plan. It’s like upgrading from a flip phone to a smartphone—suddenly, everything’s more connected and efficient. In a relaxed tone, I’d argue that with a bit of humor and strategy, educational savings investments become less daunting and more empowering.

And wrapping this up with a twist: while we’ve chatted about dollars and cents, the real gold is in the memories you’ll create, debt-free. So, here’s your call to action—dive into a free online calculator for a 529 plan right now and see how far your money can go. What’s your wildest dream for your child’s education, and how will smart investing play a part? Share in the comments; I’m all ears.