Money whispers secrets. Yeah, you heard that right—it’s not all about flashy trades or overnight riches. Here’s the uncomfortable truth: most folks dive into investing without a clue about their goals, turning what could be a smart journey into a chaotic mess. Picture this: you’re pouring cash into stocks or bonds, but without clear targets, you’re basically throwing darts blindfolded. That’s where setting crystal-clear investment goals comes in, offering you a roadmap to financial peace and actual growth. By the end of this read, you’ll walk away knowing how to define those goals, dodge common pitfalls, and maybe even sleep better at night knowing your money’s working for you.

My Bumpy Ride with Stocks – A Lesson in Hindsight

Okay, let’s get personal for a second. Back in 2015, I was fresh out of college, buzzing with excitement about the stock market. I remember dumping a chunk of my savings into tech stocks because, hey, everyone was talking about the next big app. But I didn’t have a plan—nothing specific like «I want to save for a house down payment in five years» or «Build a nest egg for retirement.» Fast forward a year, and that portfolio? A rollercoaster that left me queasy. I sold at a loss during a dip, panicking like a character in a bad episode of Billions. It was a wake-up call, you know? Turns out, without clear investment goals, emotions take the wheel, and that’s a recipe for regret.

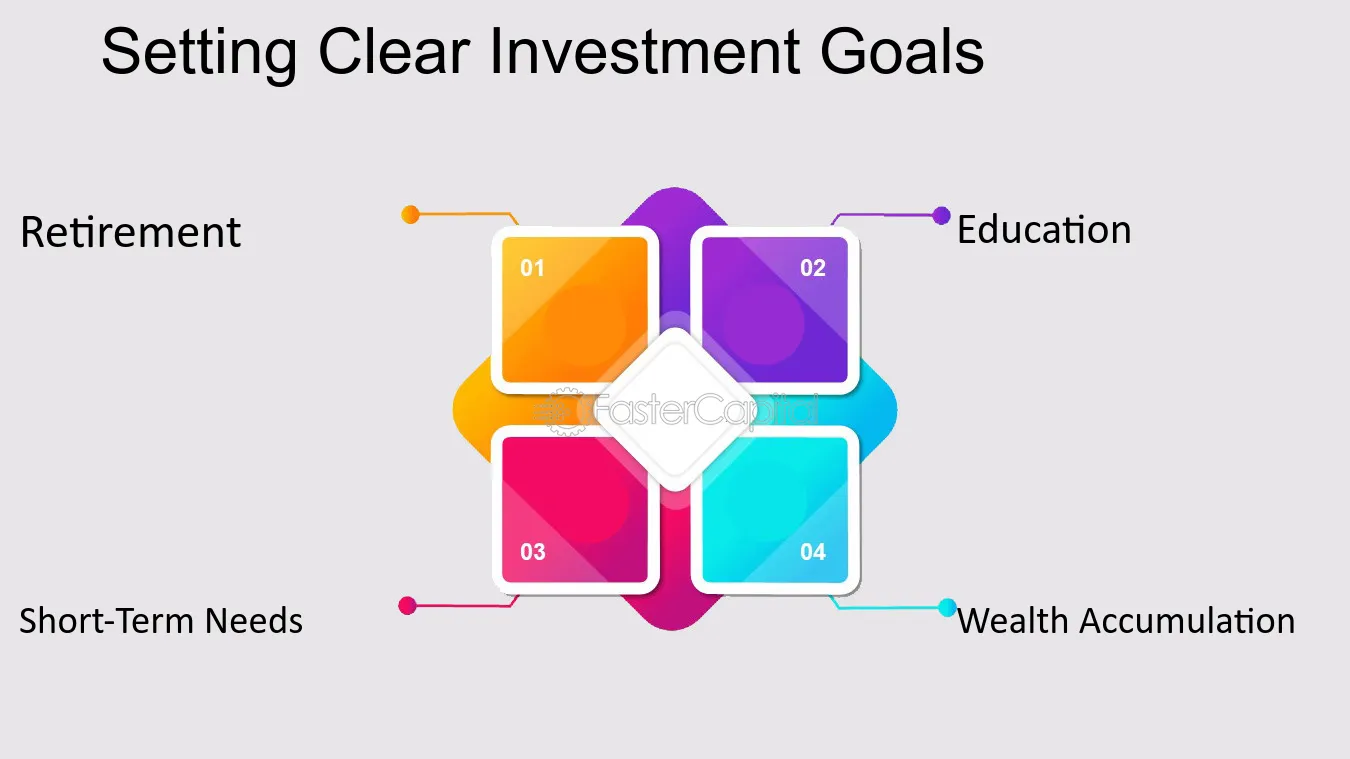

This isn’t just my story; it’s a common trap. Think about it: setting goals is like planting a garden. You wouldn’t just toss seeds everywhere and hope for the best, right? No, you’d pick what you want—tomatoes for salsa or flowers for your porch—and nurture them. In investing, that means defining investment objectives early, like aiming for growth, income, or preservation. My opinion? It’s subjective, but based on years of watching friends fumble, getting specific saves you from the «what if» spiral. And just to add a local flavor, as an American, I see how folks in the Midwest approach this with that practical, no-nonsense vibe—plan ahead, like prepping for winter storms. It’s not rocket science, but it feels like a piece of cake once you nail it.

From Pharaohs to Your 401(k) – A Timeless Comparison

Ever wonder how ancient civilizations handled their wealth? Take the Egyptians, for instance—they weren’t just building pyramids; they were masters of resource allocation. Pharaohs set clear goals for their harvests and trade routes, ensuring their empire thrived for centuries. Fast-forward to today, and it’s the same principle with your investments. Without defined financial targets, you’re like a pharaoh without a Nile—plenty of potential, but no direction. This comparison might seem unexpected, but hear me out: just as those ancient rulers diversified their assets (gold, grain, you name it), modern investors need to align their portfolios with specific aims, whether it’s beating inflation or funding a dream vacation.

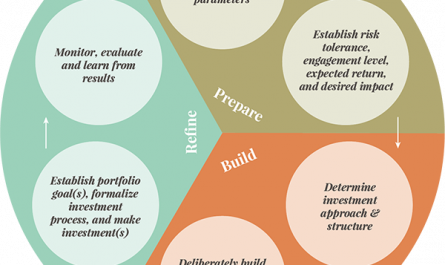

Now, here’s a twist—many assume investing is all about chasing trends, like how Silicon Valley startups grab headlines. But that’s a myth. The real truth is, historical data shows that clear investment goals lead to better long-term outcomes, much like how the Romans built enduring roads with purpose. In my view, incorporating cultural nods, such as how indigenous communities in the Americas traditionally shared resources for communal goals, reminds us that investing isn’t isolated—it’s woven into life’s fabric. And that’s when it hits you: by setting goals like «achieve 7% annual growth for retirement,» you’re not just investing money; you’re building a legacy, quirks and all.

Why Fuzzy Goals Are a Laugh – And How to Sharpen Them Up

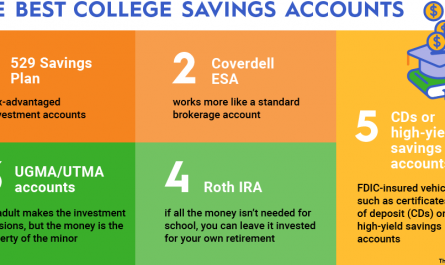

Alright, let’s iron out the kinks with a bit of irony. Imagine telling your buddy, «I want to get rich someday,» and watching them roll their eyes. Sounds vague, right? Well, that’s exactly how the universe treats your investments if you don’t get specific—it’s like asking for a surprise party but forgetting to invite anyone. The problem? Vague goals lead to scattered efforts, and in the investment world, that means chasing hot tips or bailing during market jitters. But here’s the fix, and I’ll keep it light: start by asking yourself, what do I really want? Is it funding your kid’s college, or maybe just a cozy retirement cabin?

To make this practical, let’s break it down without turning it into a dry list. First off, grab a notebook—yeah, the old-school kind—and jot down your aspirations. For example, if you’re aiming for setting clear financial goals, define them with the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. Say, «I want to invest $500 monthly to reach $100,000 in five years for a house down payment.» That’s better than «save more money,» which is about as helpful as a screen door on a submarine. And if you’re skeptical, imagine me chatting with you: «Come on, reader, you know deep down that without this, you’re just winging it.» The solution? Review your goals quarterly, adjust for life changes, and maybe even run a quick experiment—track your portfolio’s performance against your targets for a month. It’s that straightforward, and it’ll leave you feeling more in control, without the drama.

Wrapping this up with a fresh spin: what if your investments weren’t just numbers, but chapters in your life’s story? Instead of ending in confusion, picture them as plot twists leading to triumph. So, here’s your call to action—right now, pull out that notebook and outline one clear investment goal. It’ll change the game. And on a reflective note, what’s that one financial dream you’ve been shelving, the one that keeps you up at night? Share it in the comments; let’s turn talk into action.