Chaos in ledgers. Yep, you heard that right—financial statements aren’t the snoozefest everyone’s cracked them up to be, especially if you’re knee-deep in investments. I remember staring at my first balance sheet like it was ancient hieroglyphics, wondering how on earth this scribble of numbers could make or break my stock picks. The problem? Most folks dive into investing without decoding these docs, leaving cash on the table or worse, losing it. But stick around, and I’ll show you how reading financial statements can sharpen your investment game, turning vague hunches into smart, profitable moves. It’s like upgrading from a rusty bike to a sleek motorcycle on the investment highway.

My Blundering Beginnings: A Tale of Lost Profits

Picture this: back in my early twenties, fresh out of college and buzzing with dreams of beating the market, I plunked down cash on a hot tech stock without a second glance at its financials. Yikes, what a rookie move. I thought investing in stocks was all about tips from buddies or flashy news headlines. Fast forward a few quarters, and that stock tanked harder than a character in «The Wolf of Wall Street» during a bad trade. In my opinion, ignoring the income statement was my biggest blunder—it hid rising costs that should’ve screamed «sell!» right at me.

This personal fiasco taught me a gritty lesson: financial statement analysis isn’t just bookkeeping; it’s your shield in the investment arena. Think of it as being a detective in a noir film, piecing together clues from numbers to spot red flags early. And just there, when I finally dug into the cash flow statement, I realized how cash burn can sink even the shiniest startups. If you’re an investor, skipping this is like ignoring storm clouds on a hiking trip—sure, you might get lucky, but why risk it? Across the pond in the UK, where I once chatted with mates over pints, they call this «keeping your ducks in a row,» meaning staying organized with your finances to avoid surprises.

Financial Docs: More Like a Family Reunion Than You Think

Ever compare reading financial statements to decoding a family secret? It’s got layers, just like that awkward Thanksgiving dinner where everyone’s got a story. Historically, think about how ancient traders in Mesopotamia used clay tablets for accounts—basic ledgers that evolved into today’s reports. In modern terms, for us investors, it’s a cultural mash-up: the balance sheet is like the family matriarch, steady and revealing assets and liabilities, while the income statement plays the lively uncle, showing profits and losses with flair.

But here’s a twist—many myths swirl around these docs. For instance, folks often think the cash flow statement is just for accountants, but that’s a load of hogwash. In reality, it’s your best mate for spotting real investment opportunities, like how Netflix’s streaming cash flows turned it into a giant. If you’re skeptical, imagine a chat with that doubtful voice in your head: «Why bother with all this when stocks go up and down anyway?» Well, pal, because understanding financial analysis for investors lets you see through the hype, much like how memes from «The Office» poke fun at office life’s absurdities—except here, it’s about not getting burned by overvalued shares.

Let’s throw in a quick table to clear the air, comparing the big three statements for your investment toolkit:

| Statement Type | What It Shows | Why It Matters for Investments |

|---|---|---|

| Balance Sheet | Snapshot of assets, liabilities, and equity | Helps gauge a company’s stability—think of it as checking if your investment has a solid foundation before building on it. |

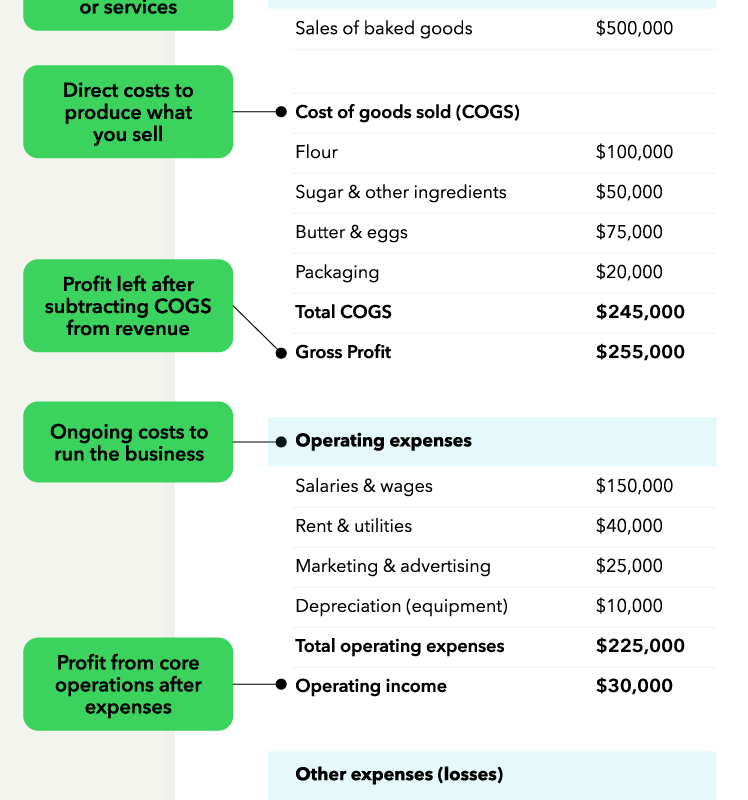

| Income Statement | Revenues, expenses, and profits over time | Reveals profitability trends, so you can spot growth stocks or fading ones, like picking winners in a horse race. |

| Cash Flow Statement | Cash inflows and outflows | Uncovers liquidity—essential for avoiding traps in volatile markets, ensuring your picks aren’t just paper profits. |

The Investor’s Headache: Turning Confusion into Confidence with a Chuckle

Okay, let’s get real—staring at a jumbled financial report can feel like trying to solve a Rubik’s cube blindfolded, especially when you’re aiming for solid investing basics. The irony? Most investors sweat over terms like «depreciation» without realizing it’s just accounting for wear and tear, not some sneaky trick. In my laid-back view, it’s like overthinking a Netflix binge; you miss the good parts if you’re too wound up.

To fix this, start with a mini experiment: grab a company’s annual report online and zero in on one section, say the income statement. Ask yourself, «Does this revenue growth align with my investment goals?» You’ll find it’s a piece of cake once you break it down. And just there, when the numbers click, you’ll see how understanding financial reports can guide better decisions, like ditching overhyped stocks before they crash. For a cultural nod, remember how American investors often say «don’t put all your eggs in one basket»—applying that means diversifying based on solid financial insights, not gut feels.

Wrapping up this relaxed ramble, here’s a provocative question to ponder: what if your next big investment win comes from simply reading between the lines of a balance sheet? In conclusion, twist your perspective—it’s not about mastering finance overnight; it’s about building habits that protect your portfolio. So, take action right now: pick a stock you own, pull up its financial statements, and jot down one key insight. What’s that one financial mystery you’ve always wanted to unravel—share in the comments and let’s chat about it.