Taxes, you sneaky beast. Ever feel like they’re the uninvited guest at your investment party, chugging all the punch? Well, here’s a shocker: In the US alone, investors lose billions annually to suboptimal tax strategies. That’s right, while you’re dreaming of that beach retirement, Uncle Sam might be taking a bigger slice than your favorite streaming service. But what if I told you that optimizing your tax game could boost your investment returns by up to 20%? In this relaxed chat, we’ll dive into practical ways to tweak your tax strategies for investments, turning what feels like a headache into a smart, rewarding habit. Stick around, and you’ll walk away with actionable tips to keep more of your hard-earned cash—because who wouldn’t want that?

Remember That Time I Got Burned by Overlooked Deductions?

Oh man, let me take you back to 2018, when I was knee-deep in my first big stock portfolio. Picture this: I’m sitting in my cluttered home office, coffee in hand, staring at a spreadsheet that might as well have been ancient hieroglyphs. I’d just sold some shares in a tech startup that skyrocketed—investment tax optimization was the last thing on my mind. But when tax season hit, I realized I forgot about those capital gains deductions. Yikes. And that’s when it hit me… lost out on thousands because I didn’t offset with losses from another underperforming stock. It’s like trying to win at poker without knowing the bluff—embarrassing and costly.

My lesson? Always track your losses as vigilantly as your wins. In the world of investments, it’s not just about picking winners; it’s about optimizing tax strategies to minimize what you owe. Opinions vary, but I firmly believe that a bit of proactive planning feels like a piece of cake compared to the regret later. Think of it as gardening—pull those weeds (deductible expenses) early, and your portfolio blooms without the IRS pruning it down. This personal slip-up taught me to use tools like tax-loss harvesting, where you sell securities at a loss to offset gains, making your overall tax bill a tad lighter.

Taxes Through the Lens of the Great Gatsby Era

Ever wonder how the roaring twenties stack up against today’s investment scene? Back then, folks like Jay Gatsby were throwing cash around like confetti, but lurking in the shadows were taxes that could make or break empires. Fast-forward to now, and it’s a wild comparison—much like how Gatsby’s parties masked deeper woes, modern investors often overlook how tax laws evolve. In the 1920s, the top tax rate soared to 25% post-crash, forcing the elite to rethink their strategies, much like we’re doing with today’s fluctuating rates.

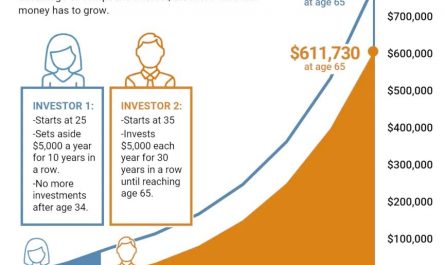

This historical nod shows that tax strategies for investments aren’t new; they’re just more sophisticated. For instance, while Gatsby might have dodged scrutiny with his bootlegger bucks, you can legally use Roth IRAs or 401(k)s to shield growth from taxes. It’s an unexpected analogy, right? Like comparing a speakeasy to a diversified ETF. But here’s the truth: Ignoring this could leave you as exposed as those flappers in the stock market crash. By blending historical insights with current practices, you avoid the pitfalls—don’t put all your eggs in one basket, as they say—and maximize long-term gains through vehicles that defer or eliminate taxes altogether.

Why the IRS Feels Like That Annoying Party Crasher (And How to Show It the Door)

Imagine you’re at a barbecue, grilling up your investment steaks, when suddenly the IRS crashes in, demanding a cut of the meat. Irony alert: It’s not that taxes are evil; it’s how we handle them that turns them into a buzzkill. A common gripe? Folks overpay on dividends without realizing qualified ones get special treatment. And just like that overzealous neighbor who shows up unannounced, poor planning can eat into your returns faster than you can say «capital gains tax.»

But let’s flip this with some humor—think of optimizing as teaching that crasher some manners. First off, consider holding investments longer for long-term capital gains rates, which are often lower than short-term ones. It’s like letting wine age; wait a bit, and it tastes better (or in this case, costs less). Step 1: Review your portfolio annually to rebalance and identify tax-efficient assets. Step 2: Explore municipal bonds, which offer tax-free interest—a real game-changer for investment tax optimization. And Step 3: Don’t forget about the wash sale rule to avoid disallowing losses. By tackling these with a relaxed approach, you’re not just surviving taxes; you’re thriving, much like how characters in «The Wolf of Wall Street» navigated markets, minus the illegal antics.

A Quick Side-by-Side on Investment Tools

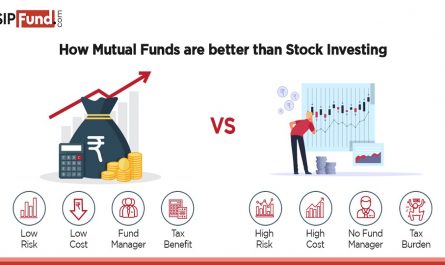

For a clearer picture, here’s a simple table comparing two popular tax-advantaged accounts:

| Feature | Roth IRA | Traditional 401(k) |

|---|---|---|

| Tax Treatment | Growth tax-free; withdrawals tax-free after age 59½ | Contributions pre-tax; withdrawals taxed as income |

| Best For | Younger investors expecting higher future taxes | Those in higher tax brackets now |

| Advantages | No required minimum distributions | Immediate tax deduction on contributions |

| Disadvantages | No upfront tax break | Taxes on withdrawals can surprise you |

Wrapping this up with a twist: What if taxes weren’t the villain, but your secret ally in building wealth? By optimizing tax strategies for your investments, you’re not just saving money—you’re crafting a legacy. So, here’s your call to action: Grab that investment statement right now and jot down one change, like shifting to tax-efficient funds. And think about this: What’s the one tax oversight that’s cost you the most in your financial journey? Share in the comments; let’s keep the conversation real and helpful.