Whispers of wealth echo in unexpected places. Yeah, you heard that right—it’s not just about Wall Street’s glitz or crypto’s wild rides. Here’s a shocker: peer investing networks have turned the investment world upside down, letting everyday folks like you and me lend money directly to others, cutting out the middlemen. But here’s the catch—while traditional investing can feel like a gated club, these networks fling the doors wide open. In this guide, we’ll dive into peer investing, exploring how it builds real connections, minimizes risks, and boosts your portfolio. Stick around, and you’ll walk away with practical tips to start peer-to-peer investing without the usual headaches.

My Accidental Dive into Peer Investing

Okay, picture this: I’m sitting in my cramped apartment, scrolling through apps like it’s Netflix, and suddenly, I stumble upon a peer investing platform. It was one of those rainy Seattle afternoons—think gray skies and endless coffee—when I thought, «Why not try lending a few bucks?» Fast forward, and that impulsive move turned into a steady stream of returns. I remember the first time I saw my investment grow; it felt like discovering a hidden gem in my backyard, you know, the kind that makes you say, «Wait, is this real?»

In my opinion, peer investing isn’t just about the money—it’s about that human touch. I once lent to a small business owner who used the funds to expand their organic farm. Talk about a feel-good factor; it’s like being part of a community potluck where everyone brings a dish, but instead of food, it’s financial support. And just when you think it’s all smooth sailing, there are lessons learned the hard way. For instance, I diversified my loans across a few borrowers, which saved me from a potential loss when one defaulted. If you’re dipping your toes in, remember: peer-to-peer investing networks thrive on trust, so start small and build from there. Y justo ahí fue when I realized diversification isn’t just smart—it’s essential.

From Village Loans to Digital High-Fives

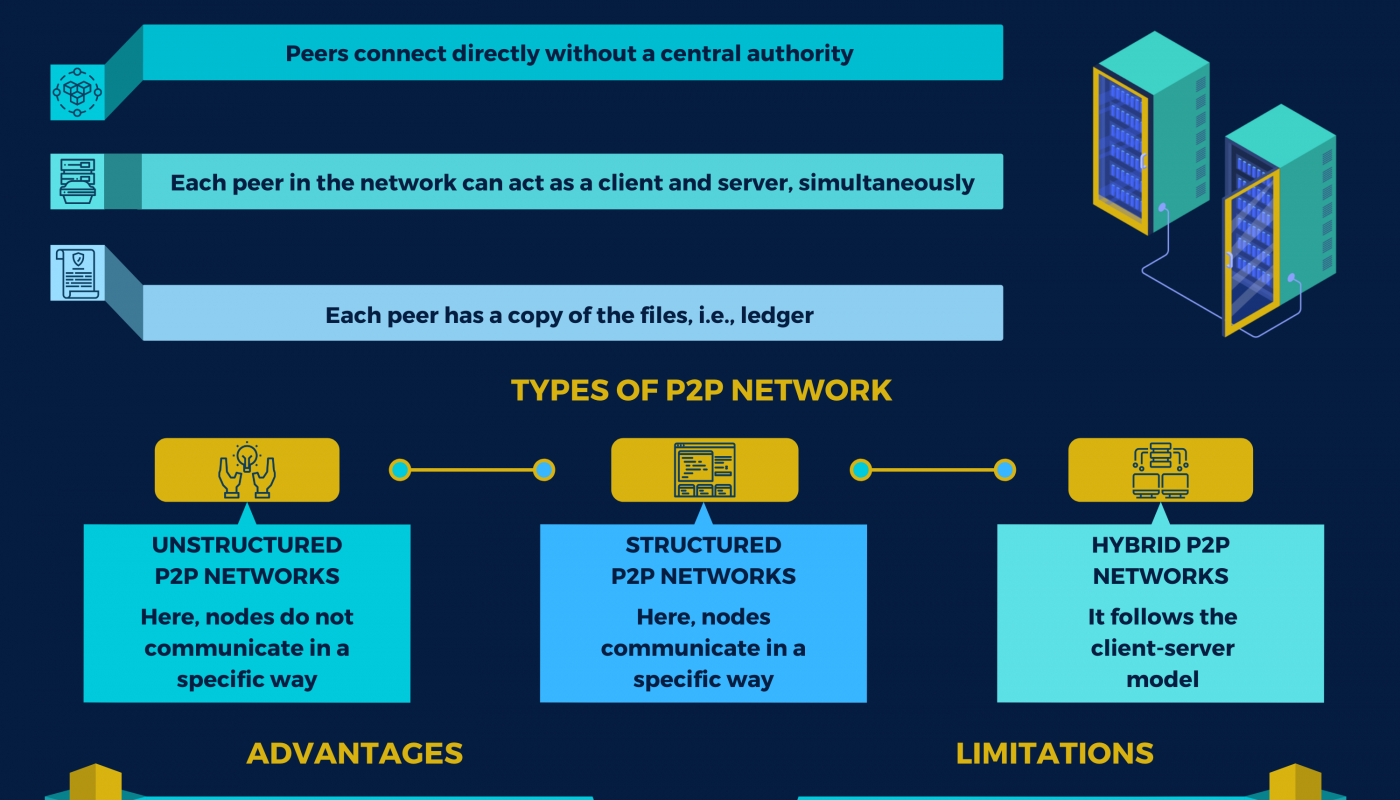

Ever think about how our ancestors handled money? Back in the day, in places like rural England, villagers would pool resources for loans, a system as old as time. Fast forward to today, and peer investing networks are basically that tradition on steroids, powered by apps and algorithms. It’s like comparing a handwritten letter to a Snapchat—both connect people, but one feels more immediate, more alive.

Here’s a twist: in modern America, where everything’s about speed, these networks flip the script by emphasizing community over cold transactions. Take LendingClub or Prosper; they’re not just platforms, they’re digital town squares. I mean, it’s reminiscent of that episode in «The Office» where Michael Scott tries to start a business—chaotic but full of heart. The key difference? Today’s networks use credit scoring and data analytics to make it safer, reducing the risks that plagued old-school loans. If you’re skeptical, imagine chatting with a friend: «Hey, why trust a bank when you can back a neighbor’s dream?» That’s the beauty—it’s accessible, with lower barriers than traditional investing, letting you earn interest rates that beat inflation. But don’t get me wrong, it’s not a free-for-all; regulations like those from the SEC add a layer of protection, making it feel less like a gamble and more like a calculated handshake.

The Pitfalls That Had Me in Stitches—And Smart Ways to Sidestep Them

Alright, let’s get real for a second: peer investing isn’t all rainbows. I once lost sleep over a loan that went south, thinking, «Great, there goes my vacation fund.» But here’s the ironic part—those slip-ups taught me more than any textbook. For example, not all platforms are created equal; some charge hidden fees that sneak up on you like a plot twist in a thriller movie.

To tackle this, I started comparing options head-on. Here’s a quick table to break it down, because who doesn’t love a clear picture?

| Platform | Pros | Cons |

|---|---|---|

| LendingClub | High returns and user-friendly interface | Potential for borrower defaults |

| Prosper | Diverse loan options and community feel | Fees can add up quickly |

| Funding Circle | Focus on small businesses, steady growth | Requires more research upfront |

See, the humor in it? It’s like dating—sometimes you pick the wrong match, but with due diligence, you find a keeper. My advice: always check the peer investing risks, like interest rate fluctuations or economic downturns, and mitigate them by spreading your investments. It’s a piece of cake once you get the hang of it, and before you know it, you’re not just investing; you’re building a network that pays off in more ways than one.

Wrapping It Up with a Fresh Spin

Who’d have thought that peer investing could turn strangers into allies? It’s not just about growing your wallet; it’s about fostering connections in a world that’s increasingly isolated. So, here’s your nudge: dive into a platform like LendingClub today and start with a modest investment—say, $100—to see the magic unfold. And think about this: what’s your biggest hesitation with mixing money and community? Drop a comment below; let’s chat about how peer networks are reshaping investments for the better.