Bulls charge wildly into digital goldmines, but let’s face it—crypto investing isn’t always the thrill ride it’s cracked up to be. Picture this: while everyone’s chasing the next Bitcoin boom, a staggering 90% of new investors see their portfolios dip faster than a stone in a pond. That’s the uncomfortable truth. You’re probably here because the crypto rollercoaster has you hooked yet terrified, right? This guide dives into smart cryptocurrency investing strategies that can turn your risky bets into steady gains, without the constant stomach flips. Stick around, and you’ll walk away with actionable tips to build a portfolio that’s as resilient as it is rewarding. Let’s keep it real and relaxed—no hype, just honest advice from someone who’s been burned and learned.

My Wild Ride into Crypto Waters: A Personal Tale of Triumph and Facepalms

Okay, so back in 2017, I jumped headfirst into the crypto pool with all the grace of a newbie surfer. I’d just heard about Ethereum from a buddy at a barbecue—yeah, that casual—and thought, «Why not throw in a few hundred bucks?» Fast forward a month, and my investment had doubled. I was on top of the world, picturing early retirement like some character in «The Wolf of Wall Street.» But oh boy, that high didn’t last. A market crash hit, and I watched my gains evaporate quicker than ice cream on a summer day. And that’s when it hit me—raw emotion can wreck your strategy.

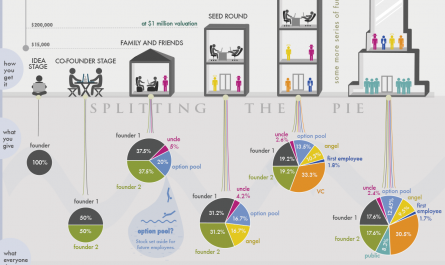

This isn’t just my story; it’s a lesson wrapped in regret. The key takeaway? **Emotional discipline in cryptocurrency investing** is non-negotiable. I learned to treat crypto like a marathon, not a sprint. Start small, research deep, and diversify your holdings. For instance, instead of betting everything on one coin, spread out to include stablecoins or altcoins. It’s like not putting all your eggs in one basket—a classic American saying that rings true here. Opinions vary, but mine? Based on that facepalm moment, I’d say ignoring diversification is like ignoring a storm warning; it’s asking for trouble.

Crypto vs. Traditional Investments: When Digital Coins Meet Old-School Gold

Ever compare crypto investing to panning for gold in the Wild West? Both promise riches, but one involves pickaxes and the other, lines of code. Historically, gold has been the safe haven during economic turmoil, holding value for centuries, whereas cryptocurrency is the upstart rebel—volatile, innovative, and full of surprises. Think about it: in the 1849 Gold Rush, folks risked everything for a nugget, much like today’s investors chasing the latest NFT boom. But here’s the twist—unlike gold, crypto doesn’t have a central bank backing it, which means it’s more like a high-stakes poker game than a reliable savings account.

This comparison highlights a **core strategy for cryptocurrency investing**: blending the best of both worlds. For example, pair your crypto plays with traditional assets for balance. Say you’re eyeing Bitcoin for its growth potential; offset that with bonds or stocks for stability. It’s not about choosing sides—it’s about creating a hybrid approach that minimizes risks. In U.S. culture, we often say «don’t hit the jackpot if you can’t handle the bust,» and that fits perfectly. Plus, if you’re skeptical, imagine a chat with your grandma: she’d probably scoff at crypto’s wild swings but admit that, hey, it’s the future. The truth is, while myths paint crypto as a get-rich-quick scheme, the reality is more nuanced—it’s a tool for long-term wealth if you’re strategic.

A Mini Experiment to Test Your Tolerance

Want to dip your toes in? Try this: pick a small amount, say $100, and allocate it across three cryptos—one established like Bitcoin, one emerging like Solana, and one stable like USDT. Track it for a week. You’ll see firsthand how volatility plays out, forcing you to confront your risk appetite. It’s eye-opening, trust me.

Dodging the Crypto Hype Train: Irony-Laced Strategies for the Win

Oh, the irony—everyone’s yelling «To the moon!» with crypto memes flying around, but half the time, it’s just a rocket to nowhere. I’ve seen friends get swept up in the FOMO (fear of missing out), buying into the next big thing only to watch it crash and burn. It’s like chasing a viral TikTok trend; exciting at first, but what happens when the algorithm changes? The problem? Overhyping leads to poor decisions, turning potential profits into losses faster than you can say «hodl.»

But let’s solve this with a dash of humor: imagine crypto as that unreliable friend who promises adventure but shows up late. Your strategy? Build a plan that’s more like a trusty old pickup truck—reliable and ready for bumps. First off, **focus on long-term cryptocurrency investing strategies** by ignoring short-term hype. Research fundamentals, like a project’s real-world utility, not just Twitter buzz. Second, set stop-loss orders to cut losses automatically—it’s like having a safety net at a circus. And third, keep learning; join communities or read up on market trends without getting sucked into the echo chamber. In American lingo, «Keep your cool under pressure,» because that’s what separates winners from the hype victims. Y just when you think you’ve got it figured out…

Wrapping this up with a fresh spin: while crypto can feel like the wild west of finance, it’s really just another chapter in the investment saga. Don’t let the glitter blind you—smart strategies make it sustainable. So, here’s your call to action: pick one coin, dive into its whitepaper today, and start building your portfolio. What’s your biggest crypto regret or dream? Share in the comments; let’s keep the conversation real and relaxed.