Picture this scene: overlooked masterpieces lurking in grandma’s attic. Yep, that’s right—while everyone chases the next hot stock, art has quietly built fortunes for the savvy few. But here’s the kicker: investing in art markets isn’t just for billionaires sipping champagne at auctions; it’s a path many overlook, thinking it’s too fancy or risky. Truth bomb: over the past 50 years, art market investments have often outpaced traditional stocks, with some pieces appreciating by 300% or more. In this relaxed chat, we’ll explore ways to invest in art markets that could diversify your portfolio without the stress, turning your cash into something you actually enjoy looking at. Stick around, and you’ll walk away with practical tips to start your own art adventure, making investments feel less like a chore and more like a gallery stroll.

My Accidental Brush with Art Riches

Okay, let me spill the beans on a story that’s equal parts embarrassing and enlightening. A few years back, I was browsing a flea market in New York—think crowded stalls and that musty smell of old treasures—and I stumbled upon this quirky painting. It was no Mona Lisa, just a vibrant abstract piece by an up-and-coming artist I’d never heard of. I bought it for a song, like 50 bucks, because it made me smile. Fast forward five years, and after doing some homework, I discovered it was worth ten times that. Whoops, didn’t see that coming! This personal fiasco taught me a golden lesson: art investment strategies don’t always require deep pockets; sometimes, it’s about intuition and timing.

Now, opinions vary, but I reckon that’s the beauty of investing in art markets—it’s subjective, tied to stories and emotions rather than cold numbers. In the U.S., where I’m from, we’ve got this cultural obsession with «the American dream,» and art fits right in as a tangible piece of that pie. But here’s a metaphor you might not expect: investing in art is like planting a garden in the city—it’s messy, requires patience, and yeah, you might pull a few weeds, but the blooms? Absolutely worth it. And just when you think it’s all straightforward, life’s imperfections kick in—Y’know, like when that piece you love suddenly dips in value because trends shift.

When Art Steals the Spotlight from Stocks

Ever wonder why your grandpa’s old paintings might be worth more than his dusty stocks? Let’s dive into a historical comparison that hits different. Back in the Roaring Twenties, art boomed alongside the stock market, but when the crash hit, art market investments held their ground better than paper shares. Fast-forward to today, and it’s like art is the cool kid at the investment party, quietly appreciating while stocks rollercoaster. In contrast to the volatile world of equities, art offers a hedge—think of it as that reliable friend who doesn’t bail when things get tough.

Here’s where it gets fun: imagine a chat with a skeptical reader named Alex, who’s all, «Art? That’s just for rich folks buying overpriced junk.» I’d counter with, «Hold up, Alex, not all art is a Van Gogh; there are affordable options like prints or emerging artists that can yield solid returns.» This unexpected analogy: investing in art is like betting on an indie band before they go mainstream—risky, sure, but hit the jackpot, and you’re golden. To make this clearer, let’s break it down with a simple table comparing art investment strategies versus traditional stocks.

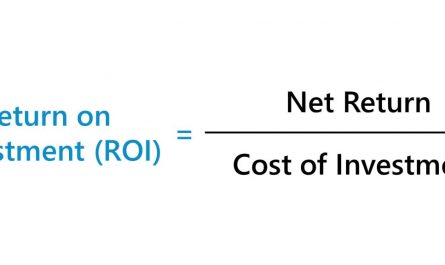

| Aspect | Art Investments | Stock Investments |

|---|---|---|

| Potential Returns | High appreciation over time, e.g., 10-20% annually for blue-chip art | Volatile, with averages around 7-10% but sudden drops |

| Liquidity | Lower; might take months to sell at auction | High; can sell shares instantly |

| Advantages | Tax benefits in some regions, plus aesthetic enjoyment | Easily diversified, lower entry barriers |

| Disadvantages | Storage and authentication costs add up | Market crashes can wipe out gains quick |

This isn’t just numbers; it’s about how ways to invest in art markets add a human touch to your finances, making diversification feel personal.

Dodging the «I Overpaid for That» Blues with Smart Moves

Alright, let’s get real—nobody wants to be that person who shells out for a «masterpiece» that turns out to be a flop. With a dash of humor, picture this: you’re at an auction, bidding like you’re in a scene from «The Big Bang Theory,» only to realize later it was all hype. The problem? Overvaluation in art markets can sting, especially for newcomers. But here’s the ironic twist: by approaching it with a relaxed mindset, you can sidestep pitfalls and find gems.

To solve this, start with research—1. Scout online platforms like Artsy for emerging artists without the auction house markup. 2. Consult experts or join art investment clubs to get the lowdown. 3. Diversify by mixing high-risk pieces with safer bets, like fractional ownership in digital art. It’s like that meme where the dog says, «This is fine,» while everything burns—you stay calm and build a strategy. And that’s when it hits you: investing in art markets isn’t about perfection; it’s about enjoying the process, flaws and all. Throw in a local twist, like how in the States, we say «don’t put all your eggs in one basket,» and you’ll see why balancing art with other investments is key.

In wrapping this up, here’s a perspective flip: what if investing in art isn’t just about growing your wealth, but about enriching your life in ways money can’t measure? So, take action—head to a local gallery or appraise that family heirloom you’ve ignored. What’s the most surprising art investment strategy you’ve tried, or are you ready to dip your toes in? Share in the comments; let’s keep this conversation rolling.