Whispers of wealth, those shiny lures. Yeah, investing in precious metals like gold and silver isn’t just for the ultra-rich or conspiracy theorists—it’s a real strategy that can hedge against economic storms. But here’s the kicker: while everyone’s chasing stocks that might crash like a bad party, metals have quietly outperformed inflation for decades. Picture this—gold’s value has skyrocketed over 500% in the last 20 years, yet many folks miss out because they think it’s too complicated or outdated. In this article, we’re diving into tips for investing in precious metals to help you build a more secure portfolio, without the hype. Stick around, and you’ll walk away with practical advice that could save your savings from the next market meltdown.

My Wild Ride with Gold Bars: A Personal Tale of Triumph and Oops Moments

Okay, let’s get real for a second. Back in 2010, I was that guy staring at his dwindling 401(k), thinking, «What if I just buy some gold coins?» It started innocently enough—gold investment tips from a buddy who swore by it. I remember buying my first ounce online, feeling like I’d hit the jackpot, only to watch prices dip right after. Yikes. But here’s the lesson I learned the hard way: investing in precious metals isn’t a get-rich-quick scheme; it’s more like planting a sturdy oak in your backyard that weathers hurricanes. In my opinion, gold acts as that reliable backup, especially when stocks go haywire, as they did in 2008.

Fast forward, and I’ve turned a small stash into a decent nest egg by diversifying beyond just gold. Think silver for everyday affordability or platinum for industrial vibes. And just to add a twist, remember that episode in «The Simpsons» where Mr. Burns hoards gold? It’s funny, but it mirrors how metals can be a hedge against chaos. Don’t go full Burns, though—balance is key. If you’re skeptical, imagine chatting with your doubtful self: «Sure, it’s volatile, but when inflation hits like it did post-COVID, precious metals investment doesn’t lose value overnight.» That personal nudge kept me in the game, and it might for you too.

From Pharaohs to Modern Vaults: How Ancient Bling Shapes Today’s Strategies

Ever think about how Egyptian pharaohs buried themselves with gold, basically saying, «This stuff lasts forever»? Fast-forward to now, and we’re still obsessed, but with a modern spin. In the U.S., where I hail from, gold has been a cultural staple—think of the Gold Rush era, where folks chased dreams across California, only to learn that patience pays off more than frenzy. It’s a stark comparison to today’s crypto craze, which can vanish like smoke, while silver investing strategies offer tangible stability.

Here’s an unexpected analogy: investing in metals is like brewing the perfect cup of coffee—it’s simple on the surface, but get the beans wrong, and it’s a mess. For instance, unlike stocks that rely on company performance, precious metals thrive on scarcity and global demand. Take silver, which is not just for jewelry but crucial in tech like solar panels. A truth that’s often ignored: while gold shines in economic downturns, silver can offer higher returns during booms, making it a piece of cake for beginners. And if you’re from the States, you know how we love our «all-American» investments—metals feel like that, reliable as apple pie amidst global uncertainty.

Dodging the Bullet: Laughing at Common Traps and Smart Fixes in Metal Investing

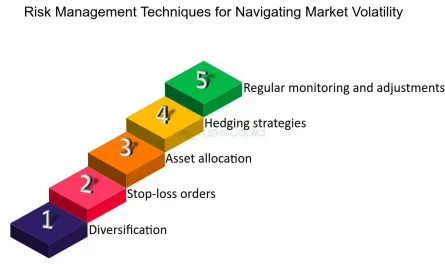

Alright, let’s address the elephant in the room—or should I say, the shiny bar in the safe. Many people dive into how to invest in metals without a plan, thinking it’s straightforward, and then bam, fees eat them alive. Picture this: you’re excited about buying physical gold, but storage costs and taxes turn it into a headache. Irony alert—it’s like ordering a fancy meal and forgetting the tip doubles the price. But here’s how to fix it with a relaxed approach: start small, say with ETFs instead of physical bars, to avoid the storage hassle.

Y justo ahí fue cuando I realized diversification is your best friend. For example, mix in some platinum for variety, as it’s less correlated with gold prices. If you’re game, try this mini experiment: track metal prices for a week using free apps, then compare to your current investments. You’ll see how they stabilize your portfolio. And for a quick overview, here’s a simple table to chew on:

| Metal | Advantages | Disadvantages |

|---|---|---|

| Gold | Strong hedge against inflation; easy to sell | High upfront costs; price volatility |

| Silver | Affordable entry; industrial demand boosts value | More sensitive to economic swings; storage needs |

This isn’t just theory—it’s backed by my own slip-ups, like overbuying silver during a hype cycle. The key? Educate yourself on market trends and consult pros, making tips for investing in precious metals feel less intimidating and more empowering.

Wrapping It Up with a Golden Twist: Your Next Move

Here’s the twist: while precious metals might seem old-school in our digital world, they’re the unsung heroes that could outlast fleeting trends like NFTs. So, don’t just sit there—take action now by researching a small investment in gold or silver ETFs. It’s easier than you think, and who knows, it might just be the smart bet you’ve been overlooking. One last question to ponder: If gold has protected wealth for centuries, why not let it guard yours today? Share your thoughts in the comments; I’m curious what shiny surprises you’ve encountered. And remember, in investing, it’s not about timing the market—it’s about time in the market.