Bonds aren’t boring. Seriously, they aren’t – especially when your stock portfolio is acting like a caffeinated squirrel on Wall Street. Picture this: I’ve lost count of the times my investments have swung wildly, leaving me questioning when to diversify into bonds. It’s a real headache, right? But here’s the twist – ignoring bonds could be the mistake that keeps you up at night, while weaving them into your strategy offers a buffer against market madness. In this chat, we’ll unpack how and why to make that move, saving you from the rollercoaster ride and building a more stable financial future. Stick around; it’ll be as easy as pie.

My Accidental Bond Awakening – A Story from My Wallet’s Low Point

Okay, let’s kick things off with a slice of my life that still makes me chuckle – and wince. Back in 2018, I was all in on tech stocks, thinking I was the next Warren Buffett. «This is it,» I told myself, pouring cash into shares like they were lottery tickets. And then, bam – the market dipped, and I watched my savings evaporate faster than ice cream on a summer day in Texas. Yikes. That’s when I stumbled upon bonds, almost by accident, while nursing my losses over coffee with a buddy who swore by them. He said, «Man, bonds are like that reliable old truck in your garage; they might not win races, but they’ll get you to work every day.»

This personal fiasco taught me a hard lesson: investment diversification isn’t just smart; it’s survival. Bonds, with their fixed interest and lower volatility, became my anchor. I started small, allocating about 20% to government bonds, and watched as they cushioned the blow during the next downturn. It’s not about ditching stocks – far from it – but about balance. Think of it as mixing a cocktail: too much whiskey (stocks) and you’re hungover; add some soda (bonds), and it’s a party you can handle. My opinion? If you’re under 40 and feeling invincible, wait until life’s curveballs hit, like they did for me, before you regret not diversifying earlier.

Bonds vs. the Great Stock Hype – Unpacking the Real Deal

Ever heard the myth that bonds are for retirees only, like a dusty relic from your grandparents’ era? Well, hold on – that’s a load of baloney. In truth, bonds have been a stealthy powerhouse in portfolios for decades, from the post-WWII boom to today’s volatile markets. Compare that to stocks, which can promise big wins but deliver gut punches, as seen in the 2022 crypto crash that left folks meme-ing about «to the moon» turning into «to the basement.»

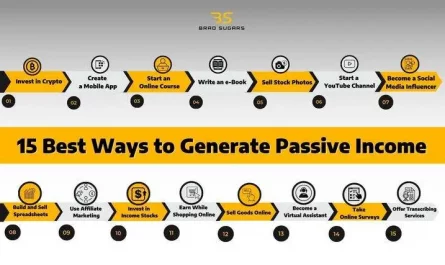

Let’s break it down with a quick, no-fuss table to show why bonds deserve a spot in your mix:

| Aspect | Stocks | Bonds |

|---|---|---|

| Risk Level | High – Like betting on a reality TV show winner. | Lower – More like a steady paycheck from a trusted job. |

| Potential Returns | High rewards, but ouch, the losses. | Modest, reliable gains to weather storms. |

| Best For | Growth chasers with a strong stomach. | Anyone wanting diversify into bonds for stability. |

The uncomfortable truth? Many investors overlook bonds until it’s too late, chasing the next big stock fad instead. But in a world where inflation sneaks up like that uninvited guest at a barbecue, bonds can hedge your bets. And just like in «The Office,» where Michael Scott’s wild ideas flop, a diversified approach – mixing in bonds – keeps your financial story from ending in chaos.

Imagine Skipping Bonds Entirely – Could You Handle the Heat?

What if you just said, «Nah, I’ll stick with stocks forever?» Sounds bold, doesn’t it? But let’s get real for a second – that choice might leave you exposed when the market flips. Picture a chat with your skeptical self: «Me, why bother with bonds? They’re so… predictable.» And I’d reply, «Exactly, that’s the point, buddy. In a market that’s as unpredictable as a plot twist in ‘Game of Thrones,’ bonds provide that predictable shield.»

Here’s a mini experiment to try right now: Grab your current portfolio breakdown. Jot down the percentage in stocks versus other assets. Now, imagine slashing your stock allocation by 10% and plugging that into bonds. Run a quick simulation using a free online tool – you’ll see how it smooths out your returns over 10 years. And that’s when it hits you… diversification isn’t about playing it safe; it’s about smart, strategic growth. For folks in their 30s or 40s, when to diversify into bonds is often when your life gets busier – kids, mortgages, you know the drill. It’s like adding shock absorbers to your car; suddenly, those bumps don’t feel so jarring.

In wrapping this up, here’s the twist: Bonds aren’t the enemy of excitement; they’re the wise sidekick that lets you enjoy the adventure without the constant fear. So, take action – audit your portfolio today and consider bumping up your bond allocation to 15-20% if you’re feeling the market’s heat. What’s your biggest «oops» moment in investments, the one that made you rethink everything? Share in the comments; let’s keep this conversation real and relaxed.