Whispers of wealth echo. Wait, hold on—most folks think capital gains are just a fancy term for the rich getting richer, but here’s the twist: everyday investors like you and me are missing out on simple strategies that could turn modest investments into something substantial. Did you know that in 2023, the average investor could have boosted their returns by up to 20% just by timing their sales right? That’s not hype; it’s a wake-up call. In this article, we’re diving into strategies for capital gains optimization, cutting through the jargon to show how you can minimize taxes, maximize profits, and build a portfolio that works for your life. Stick around, and you’ll walk away with actionable insights to make your investments smarter, not harder.

My Accidental Fortune Lesson: A Rollercoaster Tale

Okay, picture this: back in 2015, I was a newbie investor, staring at my screen as my first stock pick—a tech darling—shot up like a rocket. I remember thinking, «This is it, I’ve hit the jackpot!» But then, in a panic over market jitters, I sold too soon and watched it climb even higher without me. Yikes, right? That blunder taught me the hard way about long-term capital gains strategies. See, holding onto assets for over a year can slash your tax rate from a whopping 15-20% to just 0-15%, depending on your income bracket. In my opinion, it’s like planting a garden; you don’t yank out the seeds the moment they sprout—you wait for the harvest.

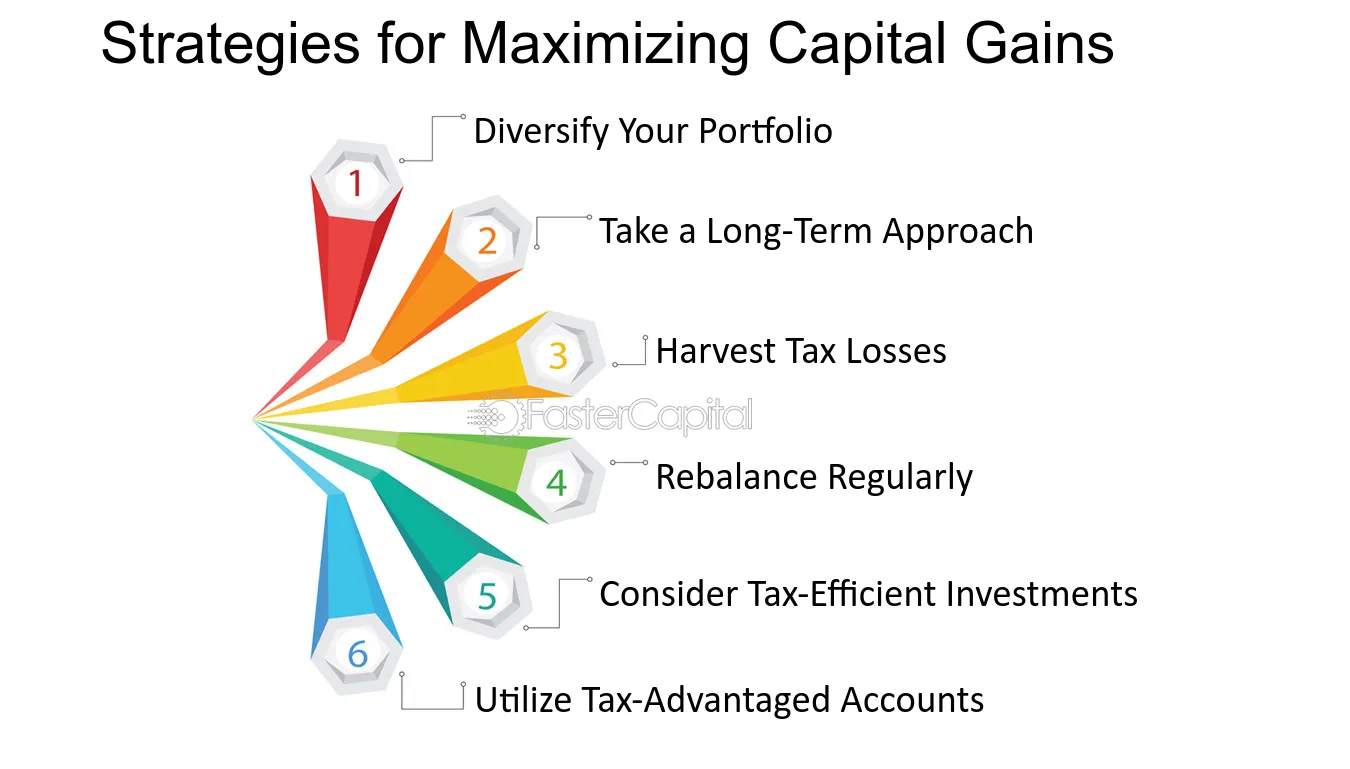

Fast-forward to today, and I’ve turned that mistake into a ritual. Every quarter, I review my portfolio, focusing on assets that have appreciated significantly. It’s not just about greed; it’s about smart timing. For instance, using tax-loss harvesting—selling losers to offset winners—saved me a bundle last year. And hey, if you’re in the US like I am, remember that «don’t count your chickens before they hatch» applies here; always consult a pro to avoid pitfalls. This personal anecdote isn’t to brag, but to show that even with screw-ups, capital gains optimization is achievable through patience and planning. What’s my lesson? Start small, learn from stumbles, and watch your investments grow organically.

From Wall Street to Ancient Empires: Unlikely Investment Parallels

Ever watched «The Wolf of Wall Street» and thought, «That guy’s life is a mess, but his hustle is real»? Well, Jordan Belfort’s wild ride mirrors something deeper in investment history—like how Roman merchants optimized their gains by holding onto spices during trade routes. Sounds random, I know, but hear me out: just as those ancients waited for the right market in distant lands to maximize profits, modern investors can use strategies for capital gains optimization by diversifying across asset classes. It’s like comparing a high-stakes poker game to a steady chess match; one gives quick thrills, the other builds lasting wealth.

In the US, we’ve got our own cultural quirks—think of it as «Yankee ingenuity» applied to investments. For example, while short-term trading might feel like chasing the next big meme stock, long-term holding is the quiet winner, much like how early railroad barons amassed fortunes by playing the long game. A key truth: myths about high-risk stocks being the only path to gains are bunk. Instead, consider index funds, which offer broad exposure and lower taxes on gains. To put it in perspective, here’s a quick table comparing two approaches:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Short-term Trading | Potential for quick profits, excitement factor | Higher taxes (up to 37%), increased stress and fees |

| Long-term Holding | Lower tax rates, compounded growth, less monitoring | Slower returns, requires patience and market faith |

This comparison isn’t exhaustive, but it highlights how investment strategies evolve from historical lessons. So, next time you’re tempted by a hot tip, channel those ancient traders and think twice.

Imagining Your Skeptical Self: Debunking Gains Myths with a Chuckle

Alright, let’s get real—imagine you’re sitting across from me at a coffee shop, sipping that overpriced latte, and you say, «Come on, optimizing capital gains sounds too good to be true. Isn’t it just for Wall Street wizards?» I’d laugh and reply, «Well, if it were that simple, we’d all be lounging on yachts, but here’s the irony: it’s often the everyday moves that make the difference.» Take the problem of overlooking qualified dividends; many folks do, thinking it’s minor, but it can boost your after-tax returns by 10-15%. And just there, when you least expect it, a small tweak like reinvesting dividends can compound your gains over time.

To solve this, let’s try a mini experiment: grab your investment app right now and check how long you’ve held your top assets. If it’s under a year, consider extending that hold period—it’s like upgrading from a flip phone to a smartphone, suddenly everything’s smoother. In a relaxed tone, I’ll add my subjective take: as an investor who’s been burned, I swear by using tools like Roth IRAs for tax-free growth; it’s not flashy, but it’s effective. Bob’s your uncle, as they say in the UK, and you’ve got a strategy that fits. This chat-style debunking shows that capital gains optimization isn’t mythical—it’s practical, with a dash of humor to keep things light.

As we wrap this up, here’s the twist: while we’ve chatted about strategies, the real game-changer is realizing that optimization isn’t about perfection; it’s about progress in your financial journey. So, take action—rebalance that portfolio today and track your gains for the next month. And here’s a reflective question: what’s one investment habit you’re ready to change, and how might it reshape your future? Share in the comments; I’m all ears.