Money’s sneaky game. Yep, that’s right—everyone dreams of that effortless cash flow, but here’s the kicker: building passive income through investments isn’t a magic trick; it’s more like planting a garden that demands some upfront sweat. I’ve been there, staring at my bank account, wishing for those dividend checks to just appear. The problem? We often romanticize passive income as «set it and forget it,» when in reality, it’s about smart, ongoing choices that can turn your finances from a leaky boat into a sturdy ship. Stick with me, and I’ll walk you through practical steps to get there, drawing from my own blunders and wins, so you can start generating that sweet, steady revenue without losing your sanity.

My Accidental Dive into Stocks and the Lesson That Stuck

Let me take you back to 2015, when I was fresh out of college and thought investing was for Wall Street wizards. Picture this: I’m sitting in my cramped apartment, scrolling through finance blogs, and I decide to throw a few hundred bucks into some blue-chip stocks. Building passive income through investments sounded glamorous, like hitting the jackpot without the casino. But oh boy, was I wrong. My first pick? A tech stock that plummeted faster than my enthusiasm. I lost a couple hundred, and let’s just say it stung more than that time I burned my tongue on hot coffee.

That mess taught me a core lesson: education is your best friend. Before diving in, I wish I’d spent time learning about passive income investments like dividend-paying stocks or index funds. It’s not just about picking winners; it’s about understanding market basics and your risk tolerance. Here’s where it gets personal—I started small, reading books like «The Intelligent Investor» and tracking my portfolio like a hawk. Fast forward a few years, and those initial stumbles led to a diversified setup that’s now spitting out dividends quarterly. My opinion? If you’re serious about this, treat it like dating: take it slow, do your research, and don’t rush into commitments. And hey, in true American fashion, remember that «don’t put all your eggs in one basket» isn’t just a saying—it’s a lifesaver for your wallet.

From Ancient Empires to Your Investment Portfolio: A Surprising Parallel

Ever thought about how the Romans built their wealth? Those guys were masters at creating passive income streams through conquered lands and taxes—talk about an early version of real estate investment trusts. Fast-forward to today, and it’s wild how similar principles apply to modern steps for building passive income. While the Romans diversified their assets across provinces, you can do the same with a mix of stocks, bonds, and maybe even peer-to-peer lending. It’s like comparing a blockbuster like «The Godfather» to a Netflix binge; both tell stories of power and strategy, but one requires more effort upfront.

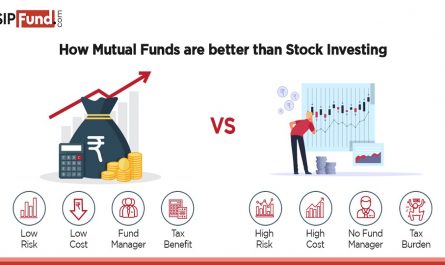

This historical nod isn’t just trivia—it’s a reminder that passive income isn’t new. In fact, the truth is uncomfortable: many overlook how diversification, a key strategy for passive income investments, mirrors ancient success. For instance, while the Pharaohs hoarded gold, savvy investors today spread out to real estate for rental yields or ETFs for steady growth. Think about it—would you bet everything on one gladiator fight? Probably not. So, why do it with your money? This comparison shows that, just as empires fell from poor planning, your portfolio could suffer without balance. And if you’re skeptical, imagine chatting with Julius Caesar: «Et tu, Brute? Why not add some bonds to that stock pile?» Yeah, it sounds ridiculous, but it drives home the point—mix it up for longevity.

| Investment Type | Pros | Cons |

|---|---|---|

| Dividend Stocks | Regular payouts, potential for growth | Market volatility can cut returns |

| Real Estate | Appreciation and rental income | High entry costs and maintenance |

| Index Funds | Low fees, broad diversification | Slower growth compared to individual stocks |

The Hilarious Hurdles of Investing and How to Sidestep Them

Okay, let’s get real for a second—investing for passive income can feel like trying to assemble IKEA furniture blindfolded. You know, that moment when you’re halfway through and realize you’ve got pieces left over? That’s the irony: everyone talks about the easy money, but the pitfalls are what trip you up. Take my friend who jumped into crypto thinking it was a «piece of cake» only to watch his investment tank. And me? I once overlooked fees that ate into my returns, leaving me muttering, «Y just when I thought I was ahead…»

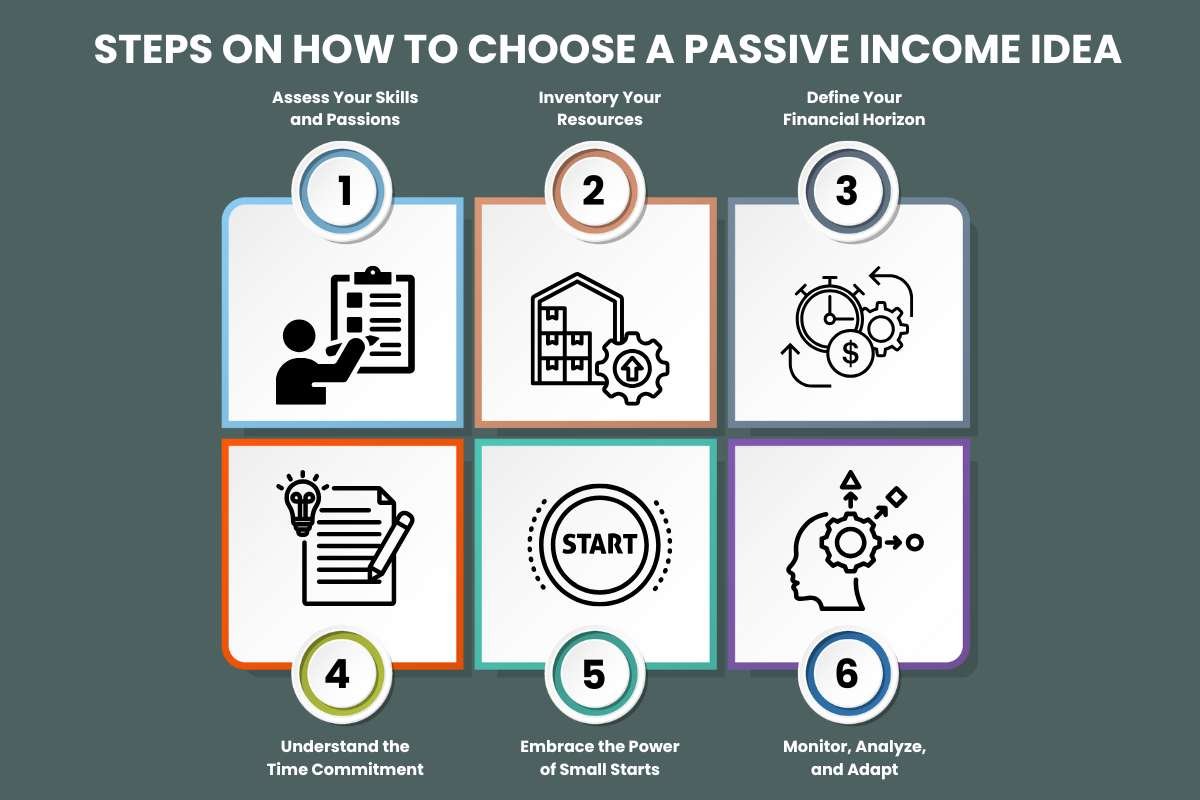

But here’s the fix, wrapped in a bit of sarcasm: start by assessing your goals and automating contributions, like setting up a robo-advisor that’s smarter than your average bear. Number one, build a budget that includes investment allocations—think of it as feeding a pet that grows over time. Number two, monitor but don’t obsess; checking your portfolio daily is like stalking an ex on social media—unhealthy and unproductive. And number three, consult a pro if needed, because let’s face it, we’re not all Warren Buffett. This approach turns the headache into a laughable memory, especially when you reference that «Office» meme where Michael Scott says, «That’s what she said,» about his failed ideas—investing mishaps can be just as comical if you learn from them. In the end, with a relaxed mindset, you’ll navigate these bumps and watch your passive income flourish.

What if passive income isn’t just about the money, but the freedom it buys you to live life on your terms? That’s the twist—it’s a gateway to more than cash; it’s peace of mind. So, take action right now: pull up your investment app and review one holding for potential tweaks. And here’s a question that might keep you up thinking: what’s the one investment risk you’re ignoring that could change your financial story? Share in the comments; I’m all ears.