Money whispers secrets. Yeah, that’s right—those crumpled bills in your wallet aren’t just paper; they’re gatekeepers to potential fortunes, if you know how to listen. But here’s the kicker: while everyone dreams of turning a few bucks into a mansion, calculating potential returns in investments feels like trying to predict a cat’s next nap spot—fickle and full of surprises. I’ve been there, staring at my screen, wondering if my stock picks were genius or just lucky guesses. The problem? Most folks dive in without the math, leading to heartbreaks and missed opportunities. Stick with me, and you’ll walk away with a relaxed guide to crunching numbers that could boost your portfolio, making smarter choices that actually pay off. Let’s keep it real and breezy, shall we?

That Time I Almost Blew My Savings on a Hunch

Picture this: me, a few years back, fresh out of college, thinking I was the next Warren Buffett. I had this wild idea to invest in a tech startup because, hey, everyone was doing it. But calculating potential returns? That sounded as exciting as watching paint dry. I just threw in a couple grand without doing the math properly. Fast forward, and I’m sweating bullets as the market dips. It was a mess, let me tell you. My opinion? Overconfidence is the silent killer in investments; it’s like betting on a horse because it has a cool name, ignoring its track record.

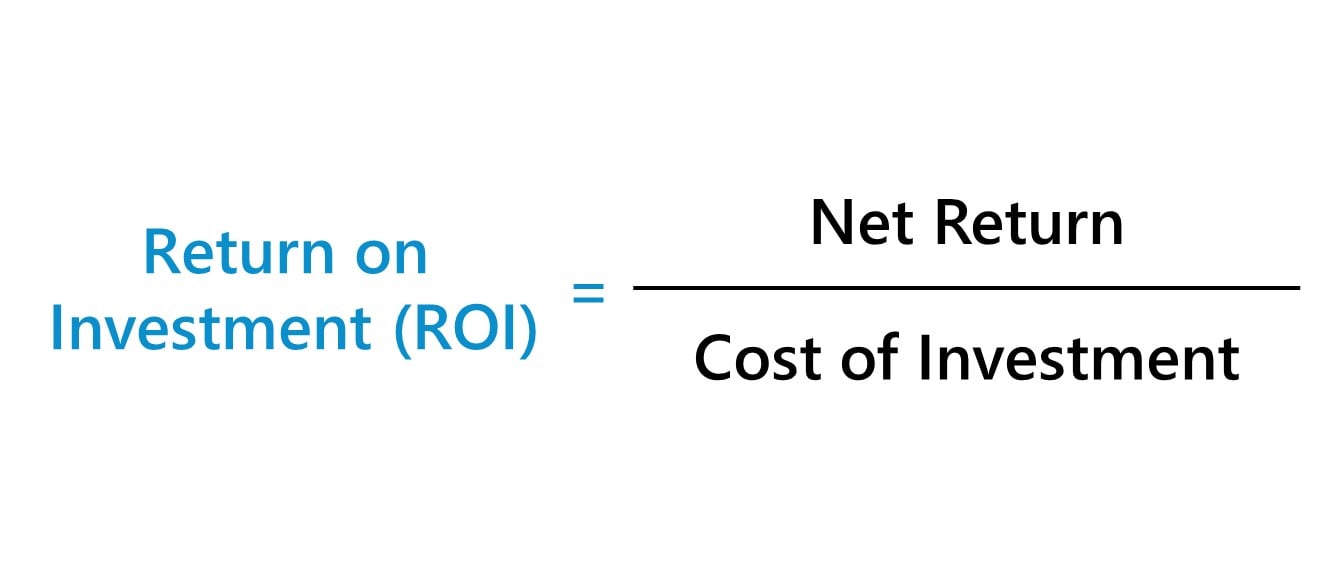

Here’s a real anecdote with the gritty details: I remember sitting in my tiny apartment, coffee stains on my laptop, calculating the return on investment (ROI) for that startup using a basic formula—(Gain from Investment minus Cost of Investment) divided by Cost of Investment. But I skimped on the details, like factoring in inflation or market volatility. The lesson? Always dig deeper. For instance, if you’re eyeing stocks, don’t just look at the price; consider the potential returns over time with tools like compound interest calculators. It’s not just about the numbers; it’s about that gut check that says, «Wait, is this sustainable?» And just like in The Wolf of Wall Street, where Jordan Belfort’s wild rides ended in chaos, my near-loss taught me to blend emotion with logic. Don’t put all your eggs in one basket, as they say—diversify and verify.

Investing Wisdom from Unexpected Eras

Ever thought about how ancient traders in Mesopotamia handled their investment returns? Okay, maybe that’s a stretch, but hear me out—comparing modern calculations to historical practices adds a fun twist. Back in the day, folks like the Medici family in Renaissance Italy weren’t crunching spreadsheets, but they sure knew about compound growth. They’d lend money and expect returns that grew over time, much like today’s mutual funds. The irony? In our hyper-digital world, we overcomplicate things with algorithms, when the core idea is pretty straightforward.

Let’s get specific: calculating potential returns for bonds versus stocks is like pitting a reliable old jalopy against a flashy sports car. Bonds offer steady, predictable yields—say, 5% annually—but stocks can soar or crash, turning a modest investment into a windfall or a wipeout. For example, if you invest $1,000 in a stock with a projected 10% annual return, after 10 years with compounding, you’re looking at about $2,594. That’s no myth; it’s basic math using the formula A = P(1 + r/n)^(nt), where P is principal, r is rate, n is compounding frequency, and t is time. But here’s a truth that’s uncomfortable: many investors ignore taxes and fees, which can eat into those gains like termites in wood. In American culture, we love a good rags-to-riches story, but remember, it’s not always as glamorous as Hollywood makes it out to be.

Why Guessing Returns is Like Betting on Rain: A Lighthearted Fix

Alright, let’s address the elephant in the room—most people treat calculating potential returns like it’s rocket science, when it’s really just a matter of getting organized. Irony alert: we’ve got apps for everything from ordering pizza to dating, yet we fumble with financial projections. Take my buddy Joe, who once projected a 20% return on crypto without considering market crashes. Spoiler: it didn’t pan out. The fix? Start with simple steps to make it a piece of cake.

First off, grab a notebook or that fancy app on your phone. Begin by identifying your investment type—equities, real estate, or even crypto—and estimate the annual return rate based on historical data. For equities, look at the S&P 500’s average 10% return over decades. Then, factor in risks: what’s the volatility? And that’s when it hits me—overlooking diversification can turn potential profits into losses. To counter that, run scenarios using online calculators; input different rates and see how they play out. For a comparison, here’s a quick table to clarify:

| Investment Type | Potential Annual Return | Advantages | Disadvantages |

|---|---|---|---|

| Stocks | 7-10% | High growth potential | High volatility |

| Bonds | 3-5% | Stable and predictable | Lower growth |

| Real Estate | 8-12% | Tangible asset with appreciation | Maintenance costs and illiquidity |

This isn’t just theory; applying it to your portfolio can reveal hidden opportunities. And hey, if you’re skeptical, try this mini experiment: pick one investment, calculate its ROI for the next five years, then adjust for inflation. You’ll see how those numbers shift, making you rethink your strategy.

Wrapping this up with a twist: what if calculating potential returns isn’t just about money, but about crafting a life you love? It’s easy to get lost in the figures, but remember, every calculation is a step toward freedom. So, here’s your call to action—grab that calculator right now and run the numbers on your current investments. What if your next big win is hiding in plain sight? Leave a comment: how has misjudging returns affected your investment journey? Let’s chat; I’m all ears.