Whispers of Wealth. Wait, that sounds too mystical for investments, doesn’t it? But here’s the truth that stings: while stocks can turn your portfolio into a high-stakes gamble, mutual funds offer a safer path to growth without the constant heart palpitations. As someone who’s juggled both in my own financial journey, I’m here to unpack why swapping individual stocks for these pooled investments might just be the smart move for your peace of mind and wallet. By the end, you’ll see how mutual funds can simplify your investing strategy and potentially boost your returns with less risk – all while keeping things as relaxed as a Sunday brunch.

My Wild Ride with Stocks – And Why I Switched Gears

Picture this: back in 2015, I dove headfirst into stocks, thinking I was the next Warren Buffett. I poured cash into a handful of tech darlings, convinced that picking winners was a piece of cake. Spoiler alert – it wasn’t. One bad quarter, and my portfolio plummeted faster than a character in a Marvel movie cliffhanger. That loss? Over 20% in a month. It was a wake-up call, teaching me that individual stock investing demands constant monitoring and nerves of steel. Fast forward to mutual funds, and suddenly, diversification hit like a breath of fresh air. Instead of betting on single companies, I was spreading bets across dozens, managed by pros. My personal lesson? Mutual funds aren’t just about growth; they’re about reclaiming your weekends from market obsessions. And just like that, my stress levels dropped while my returns stabilized.

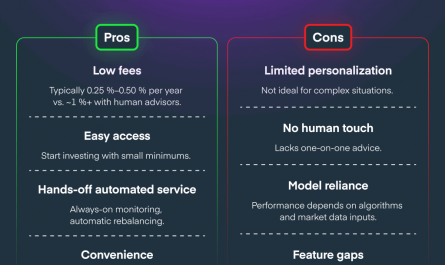

Opinions vary, but I’ll admit, as a fan of hands-off approaches, mutual funds feel like a no-brainer for beginners. They’re like hiring a team instead of going solo – sure, you might miss the thrill, but who needs adrenaline when you’re building real wealth? Drawing from my U.S.-based experiences, where stock culture is as American as apple pie, I’ve seen friends chase meme stocks only to regret it. Mutual funds, on the other hand, align with that practical, community-driven ethos we often overlook.

From Wall Street Frenzy to Mutual Fund Sanity: A Historical Twist

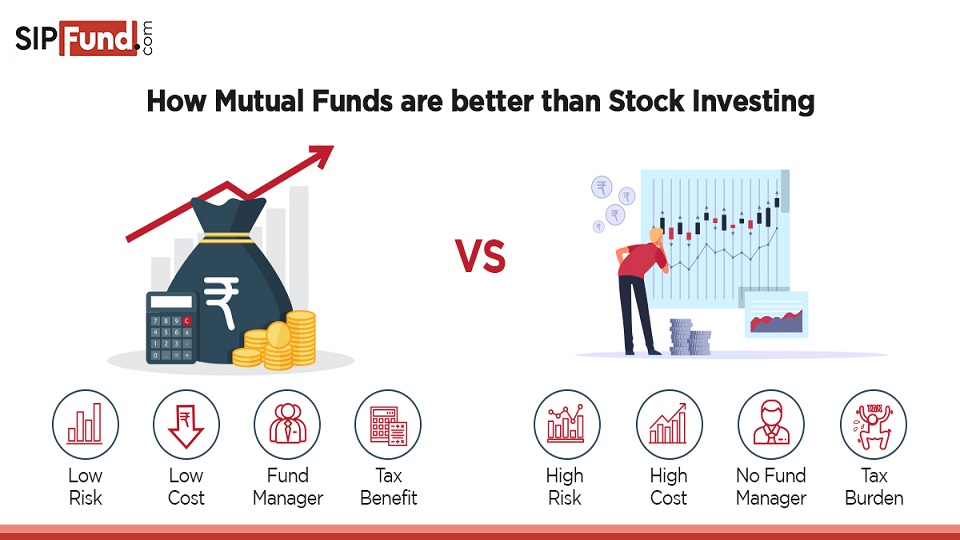

Ever compare stocks to that chaotic scene in «The Wolf of Wall Street»? It’s all glitz, risk, and Jordan Belfort-style drama. But let’s pivot to history: back in the 1920s, the stock market crash exposed how individual stocks could wreck economies, paving the way for mutual funds in the 1930s as a more regulated, collective option. This isn’t just trivia; it’s a cultural shift from rugged individualism to shared prosperity, much like how cooperatives transformed rural America. Stocks demand you play fortune-teller, predicting market moves, whereas mutual funds let you ride the wave with a safety net.

Here’s an unexpected analogy: imagine stocks as trying to catch a single fish in a stormy ocean – exciting, but exhausting and unpredictable. Mutual funds? More like casting a wide net in calm waters, gathering a variety of catches without the constant battle. This diversification benefit means you’re not wiped out by one bad performer, a key advantage in volatile times. In my view, rooted in everyday investor realities, this approach echoes how communities band together during tough spots, like in those old Western films where the town unites against outlaws.

The Overlooked Perk: Cost-Effective Growth

Dig deeper, and you’ll find mutual funds often come with lower entry barriers. No need to be a stock-picking savant; just contribute regularly and watch compounding work its magic.

Stocks’ Wild Swings: Why I Chuckled and Chose Stability Instead

Okay, let’s get ironic – stocks are like that friend who promises adventure but leaves you stranded. «Buy low, sell high,» they say, but what if you’re terrible at timing? I remember laughing at my own missteps, like holding onto a fading stock because «it’ll bounce back.» Spoiler: it didn’t, and I ate ramen for weeks. The problem? High volatility in stocks can erode gains through emotional decisions. Mutual funds counter this with professional management and automatic rebalancing, making them a smoother ride for the average Joe.

But here’s the fix, wrapped in humor: treat mutual funds as your financial wingman. They handle the grunt work – diversification, risk assessment – while you sip coffee. For instance, if stocks are a rollercoaster (fun for some, nausea-inducing for others), mutual funds are a scenic train – steady progress with views of potential profits. In a world obsessed with get-rich-quick schemes, like those TikTok trading tips that often flop, mutual funds remind us that slow and steady wins the race. And boy, does it feel good to laugh at the market’s mood swings from the sidelines.

| Feature | Stocks | Mutual Funds |

|---|---|---|

| Risk Level | High (single company exposure) | Lower (diversified portfolio) |

| Management | Self-directed | Professional oversight |

| Accessibility | Requires research and time | Easy entry for all levels |

| Potential Returns | High rewards, but unpredictable | Consistent growth over time |

That table sums it up – no fluff, just clear pros that might sway your choice.

Wrapping It Up with a Fresh Angle

Twist time: while stocks might seem like the hero of every investment story, mutual funds are the unsung sidekick that actually saves the day for most folks. They’ve got your back when life gets messy, offering that long-term investing stability without the drama. So, here’s a specific call to action: pull up a mutual fund calculator online right now and plug in your numbers – you’ll see how even small investments can grow steadily. And what’s your deepest investment regret, the one that keeps you up at night? Share it in the comments; let’s turn those lessons into collective wisdom.