Scams lurk everywhere. You’d think with all the apps and advisors at our fingertips, investing would be a breeze, but nope—billions vanish into thin air each year from clever cons. Did you know that in 2023 alone, the FTC reported over $10 billion lost to investment fraud? That’s not just numbers; that’s real people’s dreams crumbling. Look, I’m no financial guru, but sharing these tips on avoiding investment scams could save you headaches and keep your portfolio intact. By the end, you’ll walk away with practical steps to spot red flags and protect your hard-earned cash, all while keeping things light-hearted.

That Time I Almost Handed Over My Life Savings – A Wake-Up Call

Okay, picture this: a few years back, I was scrolling through my inbox, coffee in hand, when an email popped up promising «guaranteed returns» on some hot stock tip. Sounded like a dream, right? But wait, I’m from the States, and we’ve all heard that old saying, «If it seems too good to be true, it probably is.» I nearly fell for it, though. You know, that moment when curiosity gets the better of you, and you’re clicking links before your brain catches up.

This wasn’t just any scam; it was a classic phishing scheme disguised as an investment opportunity. I remember thinking, «What’s the harm in checking it out?» But then, I paused—thankfully—and recalled a friend who lost big in a similar setup. He got sucked into what turned out to be a pyramid scheme, losing thousands. My lelesson? Always verify sources. I dug deeper, checked the sender’s domain, and realized it was a fake. It’s like navigating a stormy sea; one wrong wave, and you’re overboard. Personally, I think the best defense is skepticism with a side of research—don’t just dive in because it feels exciting.

The Subtle Art of Spotting Fakes

In that experience, I learned that scam prevention in investments starts with small habits. For instance, always cross-reference with reputable sites like the SEC. And just to keep it real, I’ll admit, it’s not always straightforward—sometimes you second-guess yourself. But hey, that’s life.

From Wild West Gold Rushes to Crypto Hype – A Twisted History Lesson

Ever compare today’s investment scams to those old-timey gold rush frauds? Back in the 1800s, folks flocked to California, only to get swindled by fake maps and salted mines. Fast forward to now, and it’s like the digital version of that—think Bitcoin booms where promises of easy riches lure in the unsuspecting. Here’s a truth that’s uncomfortable: many believe crypto is the Wild West of finance, but the myths around it, like «it’s foolproof,» are what get people burned.

In my opinion, this evolution shows how scams adapt. Take the Ponzi scheme, named after Charles Ponzi in the 1920s; it promised massive returns from nothing but recycled investor money. Today, it’s repackaged as high-yield investment programs (HYIPs) online. A common myth? That these are «innovative opportunities.» The hard truth: they collapse when new investors dry up, leaving early birds to fly away with the loot. It’s like that episode in «The Wolf of Wall Street» where Jordan Belfort spins tales of wealth, but in reality, it’s all smoke and mirrors. If you’re from the U.S., you might relate to how Hollywood glamorizes this stuff, making it harder to see the dangers.

To make this clearer, let’s break it down with a simple comparison. Here’s a table of how historical scams stack up against modern ones:

| Aspect | Historical Example (e.g., Ponzi Scheme) | Modern Twist (e.g., Crypto Scams) |

|---|---|---|

| Promise | Quick, effortless profits from postal replies | Overnight gains from «decentralized» tokens |

| Risk | High, with no real assets backing it | Even higher, due to volatility and regulation gaps |

| Advantage | Few could verify claims back then | Easy access via apps, but tools like blockchain can expose fakes |

| Disadvantage | Ruined lives and reputations publicly | Faster spread via social media, affecting more people |

This isn’t just history; it’s a reminder to keep your eyes peeled for patterns.

Spotting the Sneaky Ones with a Chuckle – Irony and Easy Fixes

Alright, let’s get ironic here: investing scams are like that uninvited guest at a party—they show up with flashy stories but leave you broke. Imagine a scammer as a bad date on a app, promising the world but delivering nada. The problem? People overlook red flags, thinking, «This time it’s different.» But here’s the fix, and it’s a piece of cake if you break it down.

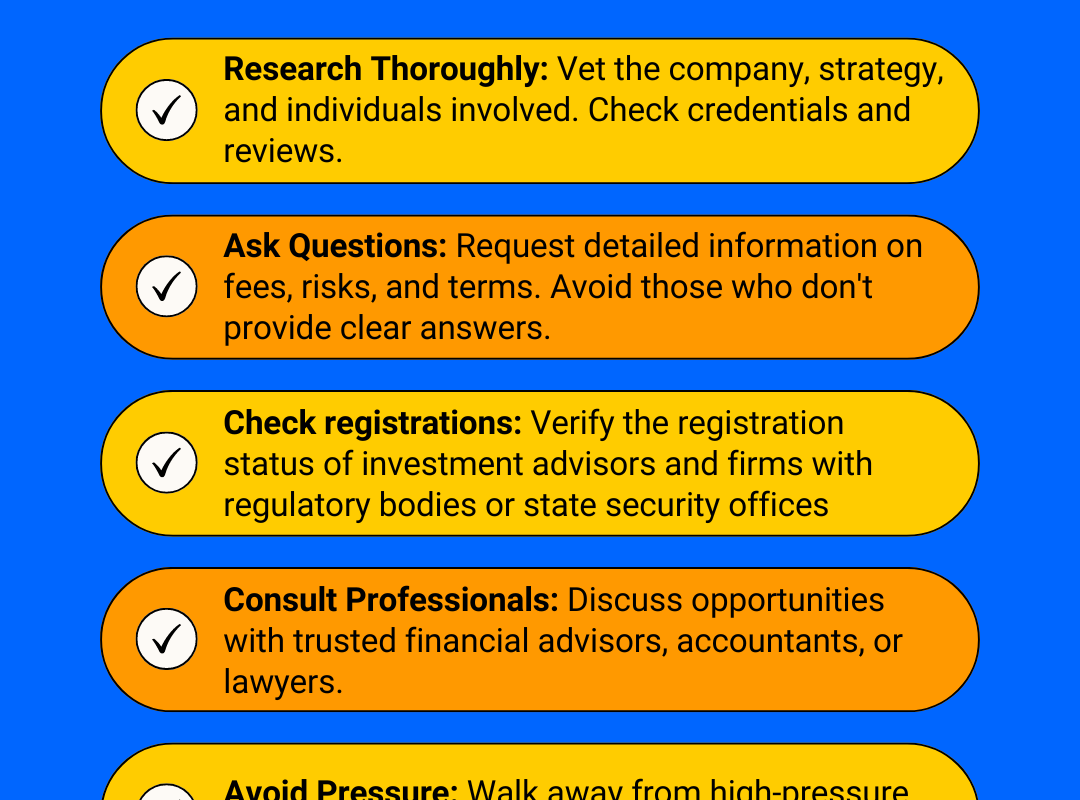

First off, watch for pressure tactics—scammers love to say, «Act now or miss out!» That’s their way of rushing you, like in those infomercials that scream «But wait, there’s more!» Instead, step back and verify. Number one: Check for investment tips from certified advisors. Two: Use tools like FINRA’s BrokerCheck to screen firms. Three: And if something feels off, walk away—it’s that simple. I once avoided a scam by just saying, «Nah, I’ll pass,» and boy, was that the right call. Y’know, that feeling when you dodge a bullet?

To make it fun, try this mini experiment: Next time you see an ad for a «miracle investment,» jot down the promises and fact-check one. You’ll probably laugh at how obvious it is. Plus, incorporating diverse sources, like forums or news, adds layers to your defense. It’s not about being paranoid; it’s about being smart in a world that’s, well, full of tricks.

And just when you think you’ve got it all figured out… wait, no, that’s not the end. In wrapping this up, investing doesn’t have to be a nerve-wracking game. At the end of the day, it’s about flipping the script: instead of fearing scams, use them as a chance to grow wiser. So, here’s a specific call to action—grab your phone right now and audit one investment account for suspicious activity. What’s the wildest avoiding investment scams story you’ve encountered? Share in the comments; let’s learn from each other and keep our money safe. After all, in the words of a certain meme, «Keep calm and invest on,» but smarter.