Whiskey barrels whispering. Ever thought that your next big investment might not be in stocks or bonds, but in something as quirky as aging oak casks? Yeah, it’s a contradiction: while traditional markets like the S&P 500 promise steady growth, they can also leave you tossing and turning over volatility. But alternative asset classes? They’re the underrated heroes offering diversification and potential high returns, especially when inflation’s biting. In this guide, we’ll dive into these often-overlooked investments, sharing real stories and insights to help you build a portfolio that’s as unique as you are. Stick around, and you might just discover how to safeguard your wealth without the usual market rollercoaster.

My Wild Ride with Whiskey Barrels

Okay, picture this: a few years back, I was at a dead end with my regular investments. The stock market felt like a bad blind date – unpredictable and draining my energy. So, I decided to get creative. I poured (pun intended) some cash into whiskey barrels, those aging containers that turn booze into liquid gold. And boy, was I in for a surprise. Not only did that investment mature nicely, yielding a solid 15% return, but it also taught me a lesson about alternative asset classes like commodities and collectibles: they’re not just assets; they’re stories waiting to happen.

In my case, it started with a trip to Scotland, where I chatted with a distiller who swore by barrel investments. He said, «Lad, it’s like planting a tree – you wait, and it grows.» That personal anecdote hit home, showing how these assets can hedge against inflation better than your average savings account. Of course, it’s not all smooth; I dealt with storage fees and market fluctuations, which made me question my sanity at times. But here’s my subjective take: if you’re tired of the Wall Street grind, exploring investments in alternative assets feels like unlocking a secret level in a video game – rewarding, if you’re patient. And just like in that episode of «The Office» where Michael Scott tries day trading, rushing in without research can lead to hilarious mishaps. So, take it from me: start small, research thoroughly, and remember, not every barrel turns to gold.

From Gold Rushes to Modern Treasures

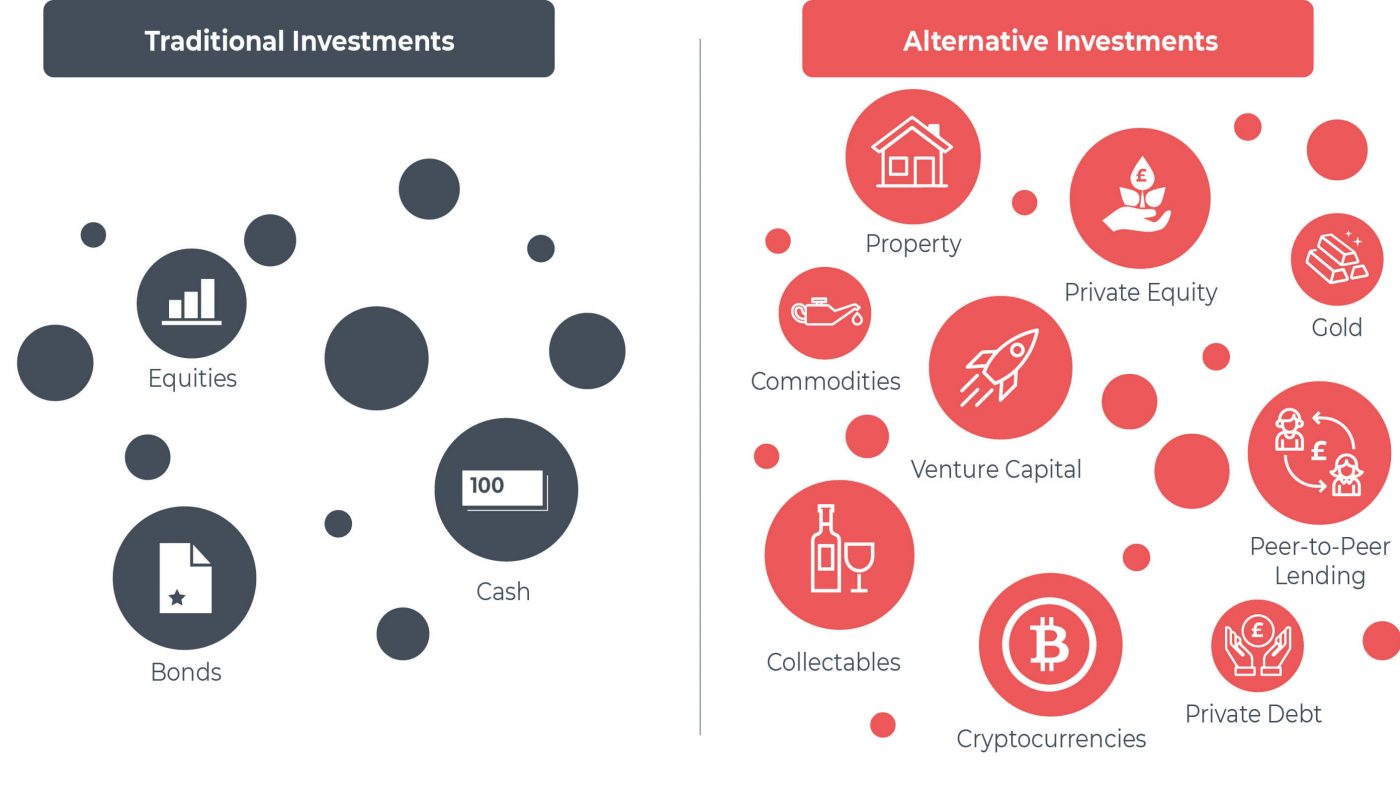

Let’s flip the script and compare this to history’s wildest bets. Back in the 1840s, the California Gold Rush had folks ditching farms for picks and pans, chasing alternative investments in the form of shiny metals. Fast-forward to today, and commodities like gold still hold sway, but now they’re rubbing shoulders with private equity and real estate crowdfunding. It’s a cultural shift – what was once a frontier gamble is now a savvy portfolio play. In the UK, for instance, where I hail from, investing in property has always been a «piece of cake» for the landed gentry, but alternative twists like peer-to-peer lending add a modern edge.

Here’s a quick table to chew on, comparing traditional versus alternative paths, because sometimes a visual helps cut through the fog:

| Aspect | Traditional Investments (e.g., Stocks) | Alternative Asset Classes |

|---|---|---|

| Liquidity | Easy to sell, like flipping a switch | Often slower, but can be worth the wait |

| Risk Level | Market swings that keep you up at night | More stable in downturns, like a hidden bunker |

| Potential Returns | Consistent, but capped | High upside, à la rare art pieces skyrocketing |

This comparison isn’t just numbers; it’s about evolving with the times. Think of alternative assets as the indie bands of the investment world – they might not top the charts right away, but when they do, it’s epic. My opinion? In a world obsessed with quick wins, these options force a deeper connection, much like how British tea culture values a slow brew over instant coffee.

Why Your Portfolio Might Be Yawning – And How to Wake It Up

Alright, let’s get real for a second: if your investment strategy is as exciting as watching paint dry, it’s probably because you’re stuck in the traditional rut. Imagine a conversation with a skeptical friend: «You mean I should dump money into hedge funds or vintage cars? Sounds dodgy, mate.» I’d counter with, «Exactly, but hear me out – it’s like upgrading from a beat-up bicycle to a sleek motorcycle.» The problem? Many folks overlook alternative asset classes due to their complexity, missing out on diversification that could shield against economic storms.

With a dash of humor, let’s call this the «yawning portfolio syndrome» – it’s safe, but oh so boring. Solution? Start by exploring options like real estate investment trusts (REITs) or even cryptocurrency derivatives, which blend tech with tangibles. For a mini experiment, grab a notebook and jot down three alternative ideas that intrigue you – say, investing in farmland or rare collectibles. Do it now, and you’ll see how it sparks creativity. And just when you think it’s all risk, remember that meme about the doge coin millionaire? It shows how these assets can turn heads, but always with eyes wide open. In the end, it’s about balance – don’t go all in, but don’t ignore the potential either.

Wrapping this up with a twist: while alternative assets might seem like the wild child of investments, they could be the steady companion your portfolio needs in turbulent times. So, here’s a specific call to action: pick one alternative class, like commodities, and research a small investment opportunity today – it might just be the spark you need. And finally, what’s one alternative investment that’s changed your financial game? Share in the comments; let’s keep the conversation real and unfiltered.