Spilled coffee mornings, that’s how my investing days often start—chaotic, unexpected, and sometimes messy. But here’s the kicker: in the world of investments, a sudden market drop can feel a lot like that coffee stain on your favorite shirt, irreversible and annoying. You’d think controlling losses is straightforward, but nah, it’s not. Statistics show that over 70% of individual investors ignore stop-loss orders, only to watch their portfolios plunge faster than a bad superhero landing. This article dives into when to use stop-loss orders in investments, not as some rigid rulebook, but as a savvy strategy to protect your hard-earned cash and sleep better at night. By the end, you’ll grasp how these simple tools can turn potential disasters into manageable hiccups, giving you that edge in the unpredictable stock market game.

My Wild Ride with a Stock That Tanked – And the Harsh Wake-Up Call

Picture this: back in 2018, I was riding high on tech stocks, convinced that my picks were untouchable. I remember buying shares in a hot startup, thinking, «This one’s a winner, no question.» But oh boy, was I wrong. The market shifted overnight—trade wars escalated, and suddenly, my «sure bet» plummeted 30% in a week. I froze, staring at my screen, heart racing. And that’s when it hit me… no safety net in place. No stop-loss orders to automatically sell and cut my losses. It cost me thousands, teaching me a brutal lesson: emotions can wreck your portfolio faster than a viral meme goes wrong.

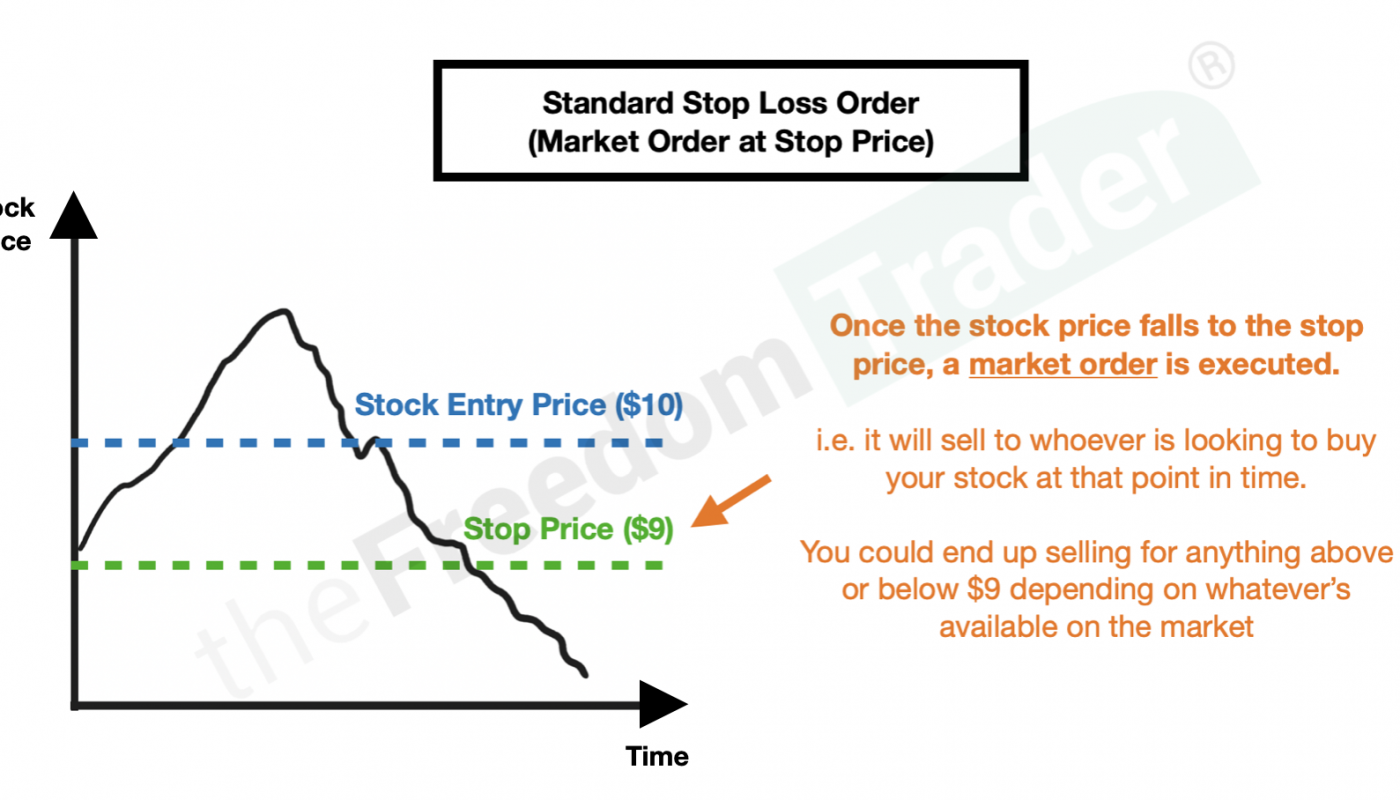

In my opinion, based on that fiasco, stop-loss orders are like that friend who drags you away from a bad party—annoying at first, but lifesaving. They set a specific price to sell an asset, preventing bigger falls. Sure, it’s subjective, but in the U.S., where we’re all about that hustle culture, ignoring them feels like kicking the can down the road. Here’s an unexpected analogy: think of stop-losses as your portfolio’s personal bouncer, keeping out the riffraff of market volatility. This real story isn’t just venting; it’s a nudge to use them during volatile times, like earnings seasons or economic uncertainty, to avoid repeating my mistake.

A Twist on Personal Finance Folklore

Fast-forward, and I’ve turned that loss into a habit of checking charts obsessively. But let’s not gloss over the human element—losses sting, especially when you’re emotionally invested, pun intended.

Lessons from Wall Street Legends – But with a Modern, Ironic Spin

Okay, imagine chatting with Warren Buffett over coffee—he’d probably chuckle and say, «Rule No. 1: Don’t lose money.» But here’s the irony: even legends like him use strategies akin to stop-loss orders in their risk management toolkit, though they’d never call it that. Historically, during the 1929 crash, traders who set mental sell points fared better than those who didn’t, drawing parallels to how ancient traders in Rome hedged bets on grain prices. Yet, in today’s meme-fueled markets, we often myth-bust the idea that stop-losses are only for novices.

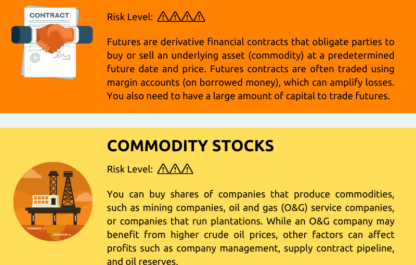

The uncomfortable truth? Many investors believe stop-losses guarantee losses, like triggering a sale at the worst time. But that’s a myth wrapped in outdated advice. In reality, for long-term investments, they act as a buffer, much like how Netflix binges keep you from real-life drama—occasionally interrupting, but preserving your sanity. Referencing pop culture, it’s like Tony Stark’s Iron Man suit: flashy protection that kicks in when things get hairy. Across cultures, from Wall Street’s aggressive trading to the cautious approaches in European markets, when to use stop-loss orders often aligns with high-risk scenarios, such as entering volatile stocks or crypto trades.

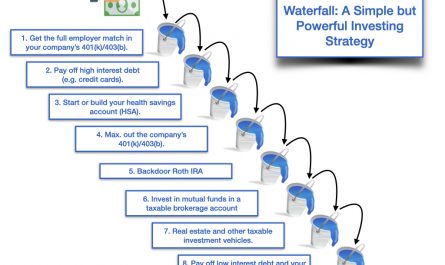

Don’t put all your eggs in one basket, as the old American saying goes; diversify and set those orders to mitigate risks. This comparison highlights how risk management strategies evolve, blending historical wisdom with modern tools for better outcomes.

| Aspect | Without Stop-Loss | With Stop-Loss |

|---|---|---|

| Risk Exposure | High – Potential for large losses | Controlled – Limits downside |

| Emotional Impact | Stressful, reactive decisions | Calmer, proactive approach |

| Best For | High-confidence, stable investments | Volatile or uncertain markets |

What If Your Portfolio Was a Bad Date? Time to Bail Out with Humor

Alright, let’s get real and a bit sarcastic: investing without stop-loss orders is like staying in a terrible date just because you don’t want to look rude. «Oh, the market’s dipping? Maybe it’ll rebound!» Yeah, right— and that’s how you end up with a portfolio hangover. The problem? Many folks hold onto losing positions out of sheer stubbornness, watching their investments tank like that infamous Titanic scene in the movie. But here’s the solution, with a dash of irony: set a trailing stop-loss, which adjusts as prices rise, so you’re not selling too early but still protecting gains.

For instance, if you’re dabbling in investing strategies for growth stocks, use stop-losses during earnings reports to avoid surprises. It’s like proposing a quick exit plan on that bad date—simple, effective, and saves you from regret. And just for fun, try this mini experiment: pick a current holding, set a hypothetical stop-loss at 10% below its current price, and track it for a week. You’ll see how it forces discipline without the drama.

An Unexpected Curveball in Trading Tactics

This approach isn’t foolproof, mind you, but it adds that layer of smarts to your game.

In wrapping this up, here’s a twist: what if I told you that stop-loss orders aren’t just about avoiding pain, but about freeing you to chase bigger wins without the fear? So, take action right now—review your portfolio and add a stop-loss to at least one position today. It might just be the game-changer you need. Ever wondered how a single tool could transform your entire investing mindset, turning anxiety into confidence? Share your thoughts in the comments; I’d love to hear if you’ve had your own «aha» moment with these orders.