Money whispers, tech shouts. Wait, actually, in the world of investments, tech often screams for attention while your wallet quietly panics. Here’s the twist: everyone wants to dive into technology sectors for that sweet return, but with markets as unpredictable as a plot twist in a Marvel movie, where do you even start? This article cuts through the noise, offering you, the everyday investor, a relaxed guide to spotting golden opportunities without losing your shirt. By the end, you’ll grasp not just where to invest in technology sectors, but how to do it with a bit of savvy and a lot less stress—think of it as upgrading your portfolio from basic to blockchain badass.

My Wild Ride in Silicon Valley Stocks: A Personal Tale with Surprises

Let me take you back to 2018, when I, a wide-eyed investor from the Midwest, decided to throw some cash at tech stocks because, hey, everyone’s doing it. Picture this: I bought into a promising AI startup, lured by promises of automation revolutionizing everything. But oh boy, was I in for a jolt. The stock dipped faster than a caffeine crash after a Red Bull binge. That experience taught me a hard lesson—tech investments aren’t just about hype; they’re about timing and research. Fast forward to today, and I’ve turned things around by focusing on stable sectors like cloud computing, which has been a steady climber. My opinion? Diversify early, folks. It’s like dating; don’t put all your eggs in one basket, as we say in the States. And just when you think you’ve got it figured out, tech investment opportunities throw a curveball, reminding you that patience pays off.

To add some depth, let’s chat about an unexpected analogy: investing in tech is like planting a garden in a storm. You nurture the seeds (your picks), but you’ve got to weather the tempests (market volatility). I remember chatting with a buddy over coffee—him skeptical as ever—saying, «Why bother with tech when it’s all bubbles waiting to pop?» My response: «Because, mate, the next Google could be around the corner, and missing out is like skipping the lottery when you’ve got the numbers.» That conversation pushed me to dig deeper, blending personal anecdotes with real-world checks. In this sector, best tech sectors to invest in often include AI and machine learning, but only if you’re ready for the long game.

Tech Investments: From the Gold Rush to Crypto Boom—A Cultural Throwback

Ever notice how investing in technology echoes history’s wildest chases? Take the California Gold Rush of 1849, where folks flocked for fortune, only to find that the real winners were the tool sellers. Fast-forward to today, and investing in technology sectors feels eerily similar—everyone’s after the next big digital gold, like blockchain or EVs. But here’s a cultural nugget: in the UK, we might call it a «right proper gamble,» whereas in the US, it’s «hitting the jackpot.» The truth? Tech booms aren’t new; they’ve evolved from steam engines to silicon chips, and understanding this helps you spot patterns.

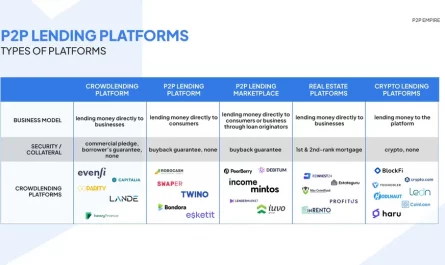

Comparatively, think about how the dot-com bubble burst in the early 2000s versus the crypto surge now. Back then, investors overlooked fundamentals, much like ignoring the weather before a picnic. Today, with tech investment opportunities in renewable tech, you’re better off if you research green energy stocks, which are as reliable as that cup of tea on a rainy day. And that’s not just me talking; it’s backed by trends showing sustainable tech leading the charge. This historical lens adds a layer of wisdom, making your decisions less about luck and more about strategy. Oh, and for a pop culture tie-in, it’s like Neo in The Matrix choosing the red pill—once you see the patterns, there’s no going back.

Why Your Portfolio Might Be a Tech Mess (And a Lighthearted Fix)

Alright, let’s get real with some irony: you’ve probably got a portfolio that’s as balanced as a unicyclist on a tightrope, especially if tech is your main squeeze. The problem? Overloading on flashy sectors like fintech without considering risks, which can leave you scratching your head when the market dips. But here’s the fun part—fixing it doesn’t have to be a chore. Imagine this: you’re at a party, and tech investments are that charismatic guest who steals the show, but you need to mingle with others to keep things steady.

To break it down without getting too preachy, let’s propose a mini experiment: grab a notebook and list your current tech holdings. Now, rate them on a scale of 1-10 for stability—1 being as shaky as Jenga tower, 10 rock-solid. What do you find? Probably a bunch of 5s and 6s, right? The solution: shift towards top tech sectors to invest in, like cybersecurity, which is booming with remote work. It’s like upgrading from a flip phone to a smartphone—suddenly, everything clicks. And just when you think it’s sorted, remember, markets are unpredictable, so keep an eye out. Y’know, that whole «don’t count your chickens» vibe.

For a quick compare, here’s a simple table to weigh options:

| Sector | Pros | Cons |

|---|---|---|

| AI and Machine Learning | High growth potential, innovative edge | Volatile, regulatory hurdles |

| Cloud Computing | Stable demand, recurring revenue | Competitive market, saturation risks |

| Blockchain | Decentralized security, emerging applications | Speculative, energy concerns |

Wrapping It Up with a Fresh Spin: Your Tech Investment Awakening

Here’s the plot twist: while we’ve chatted about where to invest in technology sectors, the real game-changer is realizing it’s not just about the money—it’s about aligning with what excites you. So, don’t just sit there; take action by auditing one tech stock in your portfolio right now and asking if it still sparks joy. And for a reflective nudge: what’s the one tech trend you’re passionate about, and how might it shape your future? Share in the comments—let’s keep the conversation rolling.