Forex Trading Fundamentals: the wild ride that could make or break your wallet. Wait, hear me out—while everyone’s chasing the next big crypto hype, forex quietly moves trillions daily, yet it’s often misunderstood as just another gamble. Picture this: in 2023, the forex market hit over $7.5 trillion in daily trades, but 70% of traders still lose money due to basic oversights. That’s a harsh truth, right? This guide isn’t about getting rich quick; it’s your relaxed roadmap to grasping the essentials, helping you navigate currency trading with confidence and maybe even turn a profit without the stress. Stick around, and you’ll learn how to spot opportunities, avoid pitfalls, and build a solid foundation in investments that actually work for you.

My Bumpy Start in the Forex Jungle: A Tale of Triumph and Facepalms

Okay, let’s kick things off with a story that’s all too real for me. Back in 2018, I dove into forex trading thinking it was as straightforward as ordering coffee—simple, right? Spoiler: it wasn’t. I remember staying up late, staring at charts like they were ancient runes, and betting on the EUR/USD pair because, hey, Europe and the US are buddies. Forex trading fundamentals hit me hard when I ignored basic risk management and lost a chunk of my savings in one volatile session. Y justo ahí, everything flipped upside down. But here’s the lesson I clung to: treating forex like a high-stakes video game taught me patience. It’s not about predicting every move; it’s about understanding currency pairs as living, breathing entities influenced by global events. In my opinion, that’s where the magic happens—if you adapt like a chameleon in a rainforest. Think of it as surfing: you ride the waves, not fight them. And yeah, I threw in a local twist—being from the States, I likened it to dodging New York traffic; one wrong turn, and you’re honking mad. Fast forward, that facepalm moment turned into a win when I finally grasped how economic indicators sway markets. If you’re new, start small; it’s not as intimidating as it seems.

Forex Through the Lens of History: Like That Time Wall Street Went Bananas

Ever compare forex to a historical drama? Stick with me here—it’s like watching «The Wolf of Wall Street» but with less excess and more education. Back in 1929, the stock market crash showed us how interconnected finances can be, much like today’s forex where a sneeze in Beijing affects the yen. But here’s a truth bomb: unlike stocks, currency trading is a 24/7 beast, influenced by everything from interest rates to political shake-ups. I mean, who knew that Brexit in 2016 would send the pound plummeting like a character exiting «Game of Thrones» mid-season? That’s no exaggeration; it highlighted how geopolitical events are the unsung heroes (or villains) in forex. In a relaxed chat with a skeptical friend once, I said, «Look, mate, if you think stocks are volatile, try forex—it’s like comparing a casual jog to a marathon in a storm.» Their response? «But isn’t it all luck?» Nah, that’s a myth. The real deal is mastering fundamentals like leverage and margins, which can amplify gains or losses faster than a viral meme. For clarity, let’s break it down in this simple table:

| Aspect | Forex Trading | Stock Trading |

|---|---|---|

| Market Hours | 24/5, global access | Typically 9-5, exchange-based |

| Risk Level | High due to leverage | Variable, often company-specific |

| Key Influencers | Economic data, currencies | Company earnings, sectors |

This comparison isn’t just filler; it shows why forex demands a different mindset. Dive into it, and you’ll see how understanding these basics can be your edge in investments.

Spotting Forex Traps with a Chuckle: Your Mini Experiment for Smarter Trading

Alright, let’s get real—forex can feel like trying to catch fog with your hands, especially when overconfidence creeps in. Imagine this: you’re eyeing a trade, thinking, «This is a piece of cake,» only for the market to swing like a pendulum on caffeine. That’s the problem with ignoring forex basics: emotional decisions lead to losses quicker than a bad joke at a party. But hey, with a dash of irony, I say it’s like binge-watching a series and spoiling the ending for yourself. In my experience, the solution starts with a simple experiment: track a currency pair for a week without trading. Note how news events—like US Fed announcements—affect it, and you’ll uncover patterns that aren’t obvious at first glance. It’s not rocket science; it’s about building intuition. For instance, I once used this approach and realized that how to start forex trading isn’t about fancy tools but about consistent analysis. Throw in a local modism like «keeping your ducks in a row,» and you’ve got a strategy that works. This hands-on tweak turned my trading from haphazard to calculated, and it could do the same for you if you give it a shot.

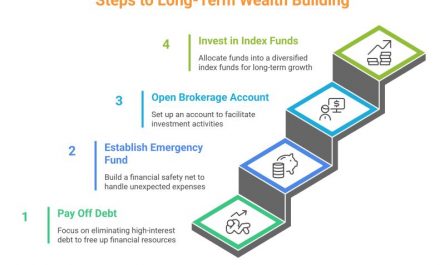

Wrapping It Up with a Fresh Spin: Your Next Move in the Investment Game

Here’s the twist: while forex might seem like just another investment fad, it’s actually a gateway to financial independence if you master the fundamentals without the hype. Think of it as planting seeds in a garden—you nurture them, and they grow, but ignore the basics, and weeds take over. So, here’s a specific CTA: grab a demo account right now and practice a single trade based on today’s economic news; it’s that straightforward. And to leave you pondering, what’s one risk you’re overlooking in your current investments that could change everything? Share in the comments; let’s chat about it. After all, in the world of forex, the real win is in the learning.