Money whispers secrets, often in the dead of night when you’re scrolling through your bank app. Wait, hold on—that’s not quite right. Actually, investing in ETFs isn’t some shadowy ritual; it’s a straightforward way to grow your wealth, yet so many folks trip over the basics and miss out on potential gains. Think about this: while the stock market has historically returned around 10% annually, a whopping 80% of individual investors underperform it due to poor strategies. That’s a truth that stings, right? But here’s the upside: by mastering ETF investment strategies, you can build a diversified portfolio that’s as easy as pie and way less stressful than day-trading nightmares. In this tutorial, we’ll dive into real tactics that I’ve tested myself, blending my screw-ups with smart advice to help you navigate investments with confidence and a relaxed vibe.

My First ETF Blunder and the Lightbulb Moment

Okay, picture this: back in 2015, I was fresh out of college, armed with a modest savings account and dreams of early retirement like that guy from «The Wolf of Wall Street.» I dove headfirst into ETFs, thinking, «This is gonna be a piece of cake.» Spoiler: it wasn’t. I picked a tech-heavy ETF without a second thought, ignoring diversification. When the dot-com bubble vibes hit again in 2018, my portfolio tanked harder than a bad sequel. And that’s when it hit me—risk management isn’t optional; it’s the secret sauce.

From that mess, I learned a key lesson: always start with broad-market ETFs for stability. For instance, something like the Vanguard S&P 500 ETF mirrors the entire U.S. market, reducing single-stock risk while offering steady growth. It’s not about chasing hot trends; it’s about building a foundation. In my opinion, this approach feels more human—less like gambling and more like planting a garden that grows over time. Plus, with fees as low as 0.03%, it’s accessible for beginners. Remember, in the world of investments, patience isn’t just a virtue; it’s your best ally, especially if you’re in a place like the U.S. where market volatility is as common as coffee runs.

ETFs Versus Old-School Stocks: A Rollercoaster Showdown

Ever compare investing to a blockbuster movie? Traditional stocks are like action flicks—exciting, but you might end up on the edge of your seat, popcorn flying everywhere. ETFs, on the other hand, are that reliable sitcom you binge on Netflix; predictable, entertaining, and less likely to leave you broke. Historically, since the first ETF launched in 1993, they’ve democratized investing by bundling assets into one tradable package, making it easier for everyday folks to diversify their portfolios without buying dozens of individual stocks.

Let’s break it down with a simple table to see the contrasts:

| Aspect | Traditional Stocks | ETFs |

|---|---|---|

| Diversification | Often requires multiple purchases | Instant access to a basket of assets |

| Cost | Broker fees per trade | Lower expense ratios, like 0.05-0.2% |

| Risk Level | High for individual companies | Lower due to spread-out investments |

| Liquidity | Depends on the stock’s popularity | Trade like stocks during market hours |

Culturally, in America, we’ve got this «go big or go home» mentality from our frontier days, which pushes people toward high-risk stocks. But that’s a myth; ETFs offer a more balanced path, especially for long-term goals like retirement. I mean, who wants to sweat every market dip when you can sip coffee and watch your ETF strategies compound over time? It’s like swapping a wild rodeo for a leisurely bike ride—still fun, but way less bumpy.

Dodging Market Mayhem: Witty Ways to ETF Your Way Through

Alright, let’s get real—nobody likes surprises in their investment game, especially when the market’s acting like a caffeinated squirrel. Imagine you’re chatting with a skeptical friend: «ETFs? Aren’t they just for the suits on Wall Street?» I’d say, «Not at all, buddy. They’re for anyone who wants to optimize passive investing without losing sleep.» The problem? Volatility hits hard, but with a dash of humor, we can tackle it. For example, during the 2020 crash, I didn’t panic; instead, I doubled down on defensive ETFs, like those focused on healthcare or utilities, which held up better than a superhero cape.

Here’s a mini experiment for you: pick two ETFs—one aggressive, like a tech fund, and one conservative, like a bond ETF. Track them for a month and note how they react to news. You’ll see that blending them creates a buffer, almost like mixing coffee with cream to tame the bitterness. In my view, this strategy isn’t rocket science; it’s about long-term ETF investment planning that adapts to life’s twists. And just when you think you’ve got it figured out… wait, life’s full of surprises, isn’t it? By focusing on rebalancing quarterly, you keep things steady, turning potential losses into gains over time.

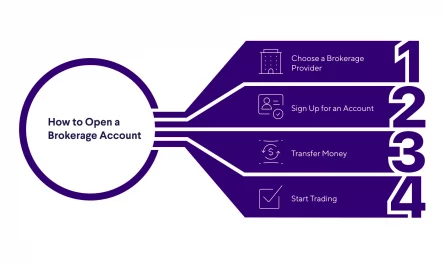

Wrapping this up with a twist: what if ETFs aren’t just tools for wealth—they’re your ticket to financial freedom without the drama? So, here’s a call to action: grab that brokerage app right now and allocate 10% of your portfolio to a broad ETF. How will you tweak your strategy when the next market wave hits? Share your thoughts in the comments; let’s keep the conversation going, folks. After all, in the world of investments, we’re all in this together, one smart move at a time.