Money whispers secrets. Wait, hear me out—it’s not every day you think of your bank account as a chatty neighbor, but stick around. In a world where investments can make or break your future, diving into ethical portfolio diversification feels like ignoring the elephant in the room: profits at any cost versus doing good. Here’s the twist—by weaving ethics into your investment strategy, you’re not just growing wealth; you’re sleeping better at night, dodging scandals, and maybe even outperforming the market. That’s the real benefit, folks: a portfolio that aligns with your values and actually works. Let’s kick back and explore the steps, sharing some personal tales along the way, because who knew finance could feel this human?

That Time My Wallet Woke Up

Picture this: a few years back, I was knee-deep in stocks that sounded flashy but left a sour taste. Ethical portfolio diversification wasn’t on my radar; I was all about the quick bucks. Then came that wake-up call—remember the headlines about companies exploiting workers? Yeah, one of my holdings was right in the mix. It hit hard, like realizing your favorite superhero has feet of clay. I lost sleep, questioning every dividend. That personal mess taught me a lesson: diversification isn’t just about spreading risks; it’s about spreading goodness.

From that debacle, I learned to start small. Begin with researching companies that prioritize sustainability. Think solar energy firms or fair-trade suppliers. It’s like planting a garden; you wouldn’t just throw seeds anywhere—you pick spots that nurture growth. And hey, in my case, swapping out those shady stocks for ethical ones? My portfolio didn’t tank; it thrived. Sustainable investments aren’t a fad; they’re a smart, long-game play. If you’re skeptical, imagine chatting with your future self: «Why didn’t I diversify ethically sooner?» Exactly.

A Sneaky Analogy from the Kitchen

Speaking of chats, let’s flip it—ever tried juggling too many hot pans? That’s undiversified investing for you, burning your fingers with market swings. But add ethical layers, like choosing organic ingredients, and suddenly you’re cooking up a storm without the guilt. Weird metaphor, I know, but it fits.

Lessons from Ancient Traders to Modern Markets

Fast-forward from my wallet woes to history’s stage. Ever heard how medieval merchants in Venice diversified their spice routes to avoid pirates? It’s not just a dusty fact; it’s a blueprint for ethical diversification strategies. Back then, spreading investments across seas meant hedging bets ethically—supporting fair trade over exploitation. Fast-forward to today, and it’s eerily similar: companies like Patagonia aren’t just selling gear; they’re pioneering sustainable practices that echo those old-school smarts.

But here’s a truth that stings: many folks still chase high-yield funds without peeking under the hood. That’s like admiring a sports car without checking the emissions—sure, it’s fast, but at what cost to the planet? In the U.S., where I’m from, we’ve got this cultural obsession with «bigger, faster,» à la Wall Street wolves. Yet, studies show ethical funds often hold their own, sometimes beating traditional ones. How to diversify portfolio ethically? Mix in bonds from green energy or stocks in gender-equal firms. It’s not rocket science; it’s evolution, drawing from those Venetian traders who knew a balanced ship sails longer.

And just when you think it’s all smooth sailing… enter the modern twist. Remember that episode of «The Office» where Michael Scott bungles a investment seminar? Hilarious, but it mirrors how we sometimes overlook ethics for laughs. Don’t be that guy; blend history’s wisdom with today’s tools.

Why Your Portfolio Might Be a Bad Date – And How to Fix It

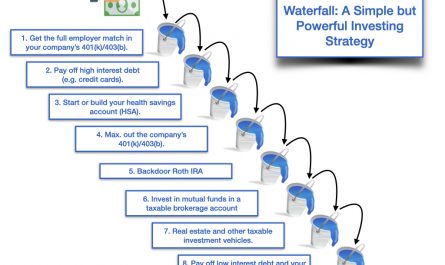

Alright, let’s get real with some irony: your current investments could be that unreliable date who ghosts you during downturns. Picture this problem—stuck in volatile sectors without an ethical backbone, and boom, a scandal hits. «Yikes, there goes my retirement fund.» But here’s the fix, served with a side of humor: treat diversification like swiping right on the right matches. Step one, audit your holdings; step two, add ethical alternatives; and step three, monitor like you’re binge-watching a series—no spoilers allowed.

To make it concrete, let’s compare two paths in a simple table. On one side, the old-school approach: high-risk, high-reward but ethically murky. On the other, ethical diversification: steady growth with a conscience.

| Aspect | Traditional Diversification | Ethical Diversification |

|---|---|---|

| Risk Level | High volatility, potential scandals | Balanced, with ESG filters |

| Returns | Short-term gains, long-term uncertainty | Often comparable, plus moral wins |

| Personal Impact | Sleepless nights, «what ifs» | Peace of mind, aligned values |

See? It’s a piece of cake once you tweak it. And boy, was that eye-opener for me—swapping a bad date of a portfolio for one that sticks around. If you’re in the U.S., toss in some local flavor like community-focused mutual funds; they’re as American as apple pie.

A Final Twist on Your Money Journey

Wrapping this up with a curveball: what if ethical diversification isn’t just about money—it’s about legacy? Yeah, think beyond the numbers; you’re building a world your grandkids can inherit. So, here’s a specific CTA: grab that investment app right now and run a quick ethical scan on your portfolio. It’ll take five minutes, I promise.

And one last question to ponder: if your investments could talk, what stories would they tell about your choices? Drop your thoughts in the comments; let’s keep this conversation going. After all, in the investing game, it’s not just about winning—it’s about winning right.