Money whispers secrets. Wait, hear me out—it’s not the cash talking, but the way it grows (or shrinks) in your portfolio that tells tales of triumph and regret. I’ve seen folks chase investment returns like they’re hunting for buried treasure, only to dig up fool’s gold because they didn’t know how to properly evaluate what they’ve got. Here’s the uncomfortable truth: in a world obsessed with get-rich-quick schemes, many investors overlook the nitty-gritty of assessing returns, leaving money on the table or, worse, losing it. But stick with me, and you’ll walk away with practical tools to measure your investments smarter, turning those whispers into a roaring success story. Let’s dive in, shall we?

That Time I Lost It All (Almost)

Picture this: back in 2015, I jumped into tech stocks with the enthusiasm of a kid in a candy store, convinced that evaluar investment returns was as simple as checking the stock price. Y justo ahí fue cuando… I poured cash into a hot startup, only to watch it plummet faster than a character in a Marvel movie falling off a building. It was my first real lesson in investment returns analysis—turns out, raw numbers don’t tell the whole story. I remember sitting at my desk, calculator in hand, realizing I’d forgotten to factor in fees, taxes, and inflation. That slip-up cost me, but it taught me a valuable lesson: always look beyond the surface.

In my opinion, ignoring these elements is like baking a cake without tasting the batter—it’s bound to flop. Think about it; what good is a 10% gain if inflation eats away half of it? That’s why I now swear by using metrics like the real rate of return, which adjusts for inflation. It’s not just about the profit; it’s about what that profit means in real life. And hey, if you’re from the States like me, remember that «Uncle Sam» always wants his cut through taxes, so factoring that in early can save you headaches. This personal fiasco turned into a win because it pushed me to dig deeper, and you can do the same by starting with a simple audit of your own investments.

Investing Like the Pharaohs? Not Quite

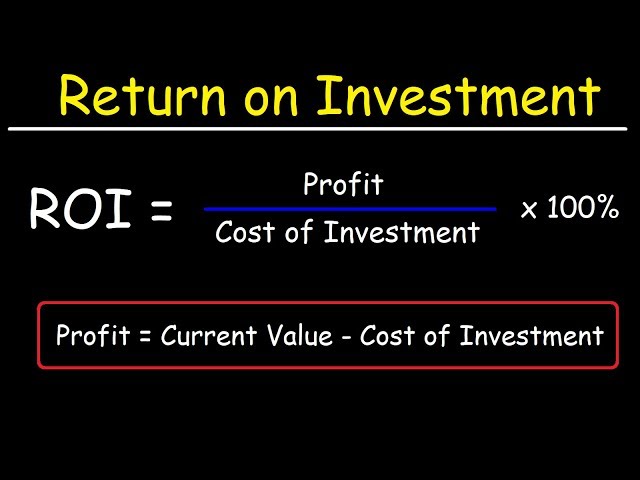

Ever wondered how ancient Egyptians handled their wealth? They hoarded gold and grain, but let’s compare that to modern how to evaluate investment returns. Back then, a Pharaoh might measure success by pyramid size, but today, it’s all about metrics like CAGR (Compound Annual Growth Rate) and ROI (Return on Investment). Here’s an unexpected twist: just as the Nile’s floods were unpredictable, so are market swings, making assessing ROI crucial for weathering storms.

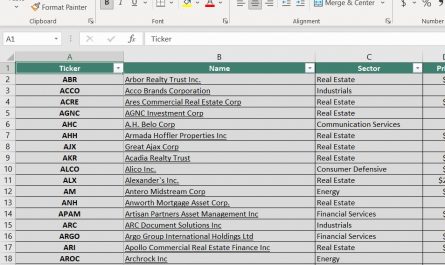

Culturally, in the U.S., we often idolize rags-to-riches stories like those in «The Wolf of Wall Street,» but that film’s chaos reminds us that blind faith in hype can lead to disaster. A historical nugget: during the Dutch Tulip Mania of the 1630s, people overvalued bulbs like they were gold, only to crash hard. Sound familiar with crypto bubbles? The truth is, evaluating returns isn’t about chasing fads; it’s about using tools like the Sharpe Ratio to measure risk-adjusted performance. For instance, comparing a safe bond to a volatile stock shows that while stocks might hit the jackpot, bonds offer steady gains without the rollercoaster. Here’s a quick table to break it down:

| Investment Type | Average Return | Risk Level | Best For |

|---|---|---|---|

| Stocks | 7-10% annually | High | Growth seekers |

| Bonds | 3-5% annually | Low | Conservative investors |

This comparison isn’t just numbers; it’s a reality check. As an American investor, I’ve learned that diversification is key, like mixing spices in a gumbo—too much of one thing ruins the pot.

Why Your Returns Might Be Playing Hide and Seek

Okay, let’s get ironic: you think tracking investment evaluation tips is a piece of cake? Well, it’s more like trying to catch smoke with your bare hands—elusive and frustrating. Many folks overlook opportunity costs, thinking, «Hey, my stocks are up, I’m golden!» But what if that money could’ve earned more elsewhere? It’s like skipping dessert for veggies, only to find out the cake was calorie-free.

To solve this, start by calculating your total return, including dividends and capital gains. Here’s a mini experiment for you: grab your latest portfolio statement and subtract all costs—fees, taxes, the works. What do you get? Probably less than you thought. In a relaxed tone, I’d say, don’t sweat it; this is your chance to refine. For example, if you’re dealing with mutual funds, use the time-weighted return to iron out cash flow impacts. And remember, in the land of investments, timing is everything—it’s not just about the end result but the journey, much like binge-watching a series where the plot twists keep you hooked.

Wrapping up this section with a dash of humor: if your returns are hiding, maybe they’re pulling a «Where’s Waldo?» on you. The fix? Employ software tools for accurate tracking, turning guesswork into solid data. It’s that simple step that can turn your investment game from amateur to pro.

A Fresh Twist on Your Wallet’s Future

Alright, let’s flip the script: what if evaluating investment returns isn’t just about numbers, but about crafting a legacy? You’ve journeyed through my mishaps, historical insights, and practical tweaks, and now it’s clear that calculating returns on investment empowers you to build wealth wisely, not wildly. In a world of financial fads, this knowledge is your secret weapon.

So, here’s my call to action: right now, pull up your investment app and run a quick return calculation using the methods we discussed. It’ll take five minutes, and you might uncover hidden gems or pitfalls. And to leave you pondering: are you truly investing for tomorrow, or just reacting to today? Drop your thoughts in the comments—let’s chat about how these strategies play out in real life. After all, in investments, the real return is the wisdom you gain along the way.